The order for payment is usable and similar in many different countries in Europe. You can request an order for payment with domestic and european clients.

It applies only to border disputes.

The purpose is to obtain an enforcement which allows you to mandate a bailiff to recover your claim against which your client may not object.

In order to get the order by the court, it is essential to demonstrate the soundness of your initiative and that your debt is:

No need to be an experienced lawyer to start an Order for Payment. Simply fill in a form (Form A for the EOP) together with all the necessary evidence to prove the soundness of your application (purchase orders, invoices, delivery notes, dunning letters and formal notice, email, fax) and file it with the commercial court of the jurisdiction of the defendant (your client and debtor).

No need to be an experienced lawyer to start an Order for Payment. Simply fill in a form (Form A for the EOP) together with all the necessary evidence to prove the soundness of your application (purchase orders, invoices, delivery notes, dunning letters and formal notice, email, fax) and file it with the commercial court of the jurisdiction of the defendant (your client and debtor).

More you will bring evidence of the reality of your debts and their enforceability (eg a letter acknowledging your client having to pay your bills), more the court will be obvious to issue an order for payment for the sum it considers legitimate.

Then, you have 6 months (do it just as soon as possible) to serve your debtor court's decision. In the absence of opposition from your client to the Commercial Court within one month the order becomes enforceable. Then, you can instruct a bailiff to recover your receivable. In some cases your client will pay you upon receipt of the order which has a strong psychological impact on "opportunists" bad debtors.

In some cases your client will pay you upon receipt of the order which has a strong psychological impact on "opportunists" bad debtors.

Condition of the effectiveness of the injunction to pay, your bills should not be easily contestable by your client in which case he will not hesitate to lodge a statement of opposition.

Condition of the effectiveness of the injunction to pay, your bills should not be easily contestable by your client in which case he will not hesitate to lodge a statement of opposition.

The European Order for Payment

Simpler than it seems, the European Order for Payment is very effective in case of uncontested pecuniary claims. This regulation, available since 2008, allows the free circulation of European Orders for Payment throughout European Union countries by laying down minimum standards.It applies only to border disputes.

The purpose is to obtain an enforcement which allows you to mandate a bailiff to recover your claim against which your client may not object.

In order to get the order by the court, it is essential to demonstrate the soundness of your initiative and that your debt is:

- Due ! Your claim must be for a specific amount that has fallen due at the time when the application for a EOP is submitted,

- Certain and real ! You claim corresponds to goods supplied or a service provided. You can proove it.

- Liquid: the debt can be valued in money.

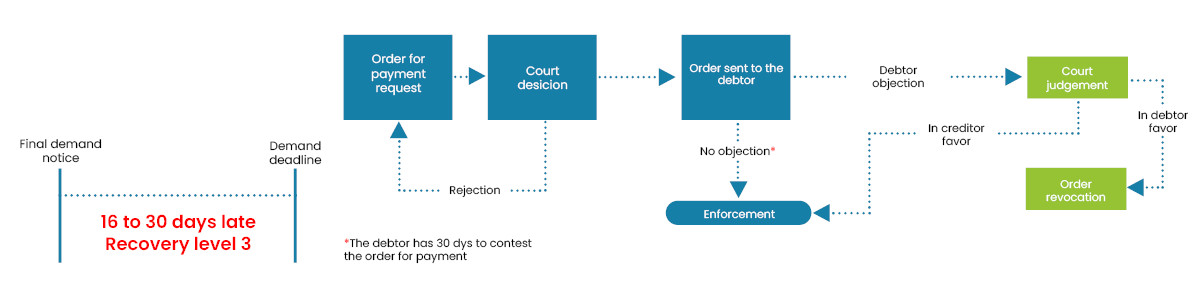

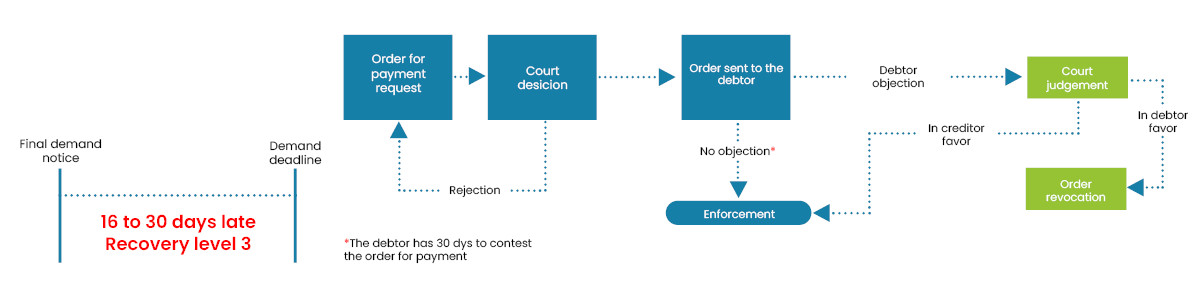

In the case of a dispute with your client, he may lodge a statement of opposition within 30 days date of the order with the court that issued the order for payment.

Therefore, the proceedings continue before the competent courts of the EU country of origin in accordance with the rules of ordinary civil procedure, unless the claimant has requested that the proceedings be terminated in that event.

The Order for Payment process

No need to be an experienced lawyer to start an Order for Payment. Simply fill in a form (Form A for the EOP) together with all the necessary evidence to prove the soundness of your application (purchase orders, invoices, delivery notes, dunning letters and formal notice, email, fax) and file it with the commercial court of the jurisdiction of the defendant (your client and debtor).

No need to be an experienced lawyer to start an Order for Payment. Simply fill in a form (Form A for the EOP) together with all the necessary evidence to prove the soundness of your application (purchase orders, invoices, delivery notes, dunning letters and formal notice, email, fax) and file it with the commercial court of the jurisdiction of the defendant (your client and debtor).More you will bring evidence of the reality of your debts and their enforceability (eg a letter acknowledging your client having to pay your bills), more the court will be obvious to issue an order for payment for the sum it considers legitimate.

Then, you have 6 months (do it just as soon as possible) to serve your debtor court's decision. In the absence of opposition from your client to the Commercial Court within one month the order becomes enforceable. Then, you can instruct a bailiff to recover your receivable.

Advantages of the order for payment:

- fast (if not opposition of the debtor), simple, effective,

- allows to obtain an enforcement,

- Cost: only the issuance of the order to the debtor generate a cost of approximately 40 euros depending on the Commercial Court.

- if the debtor lodge an objection to the order for payment, the time spent to get this order is lost.