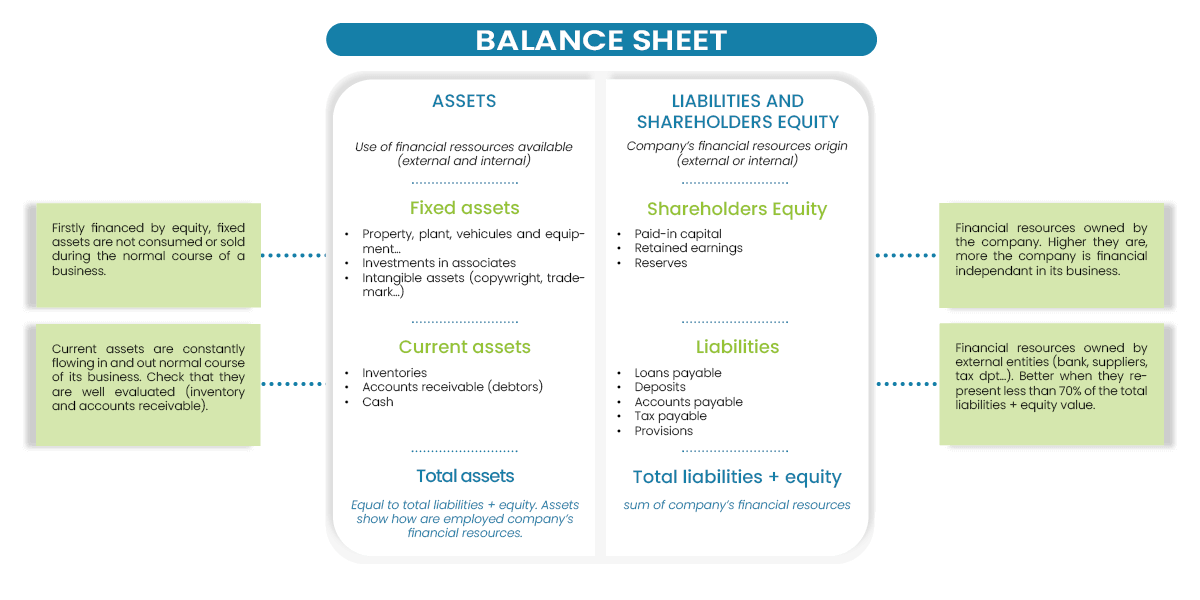

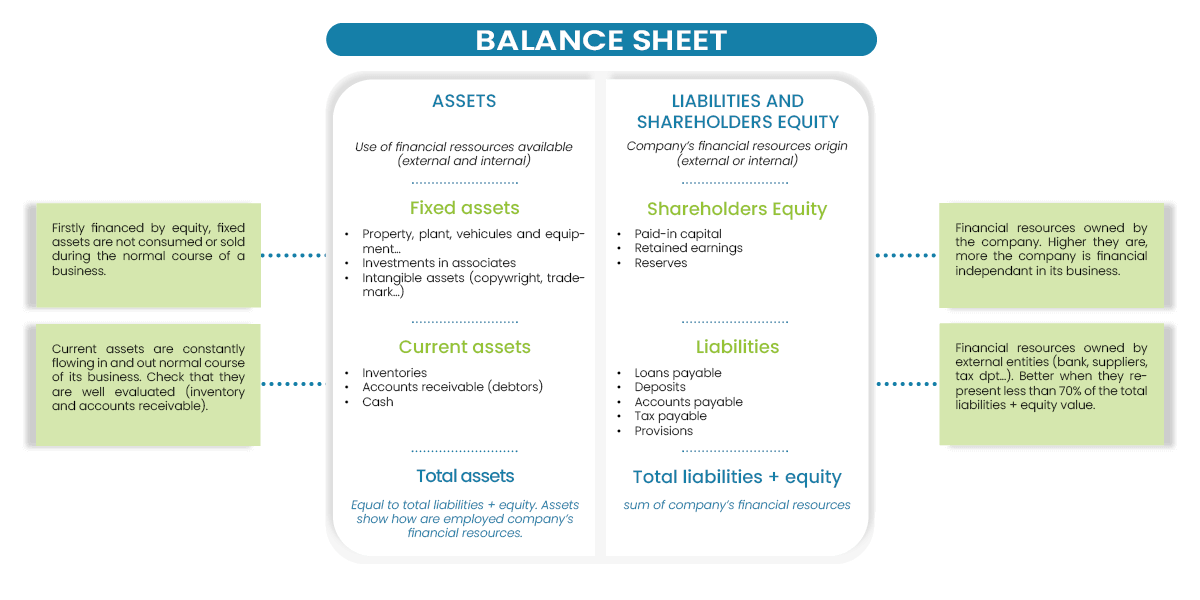

The balance sheet is a snapshot of a company's financial condition. Assets, liabilities, and ownership equity are listed as of a specific date, such as the end of its financial year. The balance sheet shows if the company's activity is mainly financed by:

In the opposite way, the higher the debt, the more the company depends on them to fund its activity, which can continue only if suppliers and banks credit lines are maintained and raised proportionately with business growth.

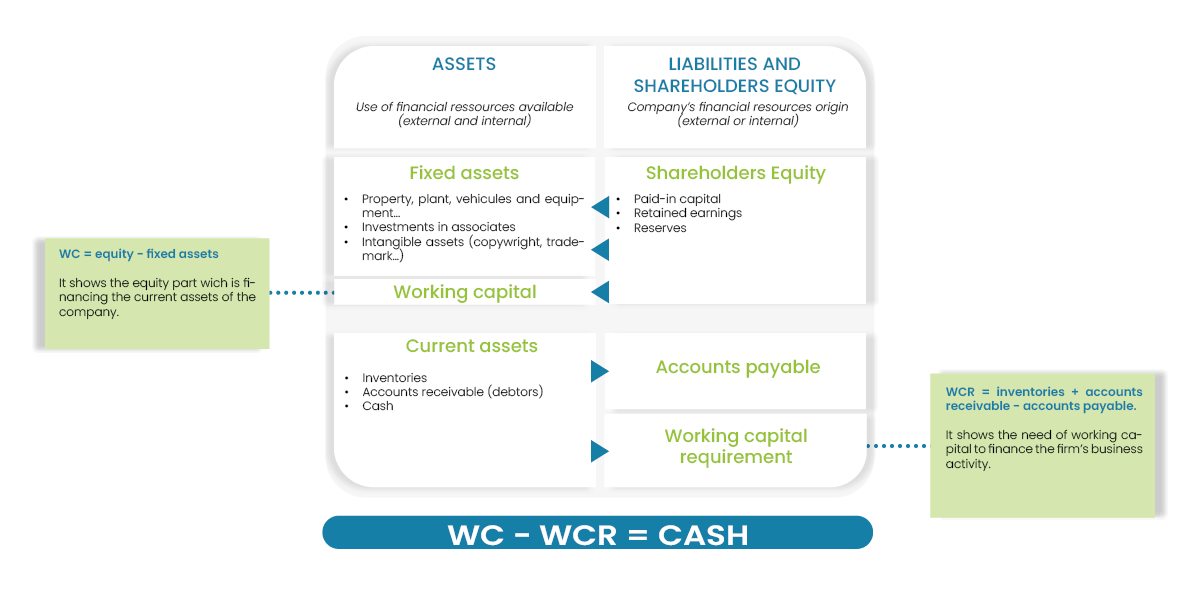

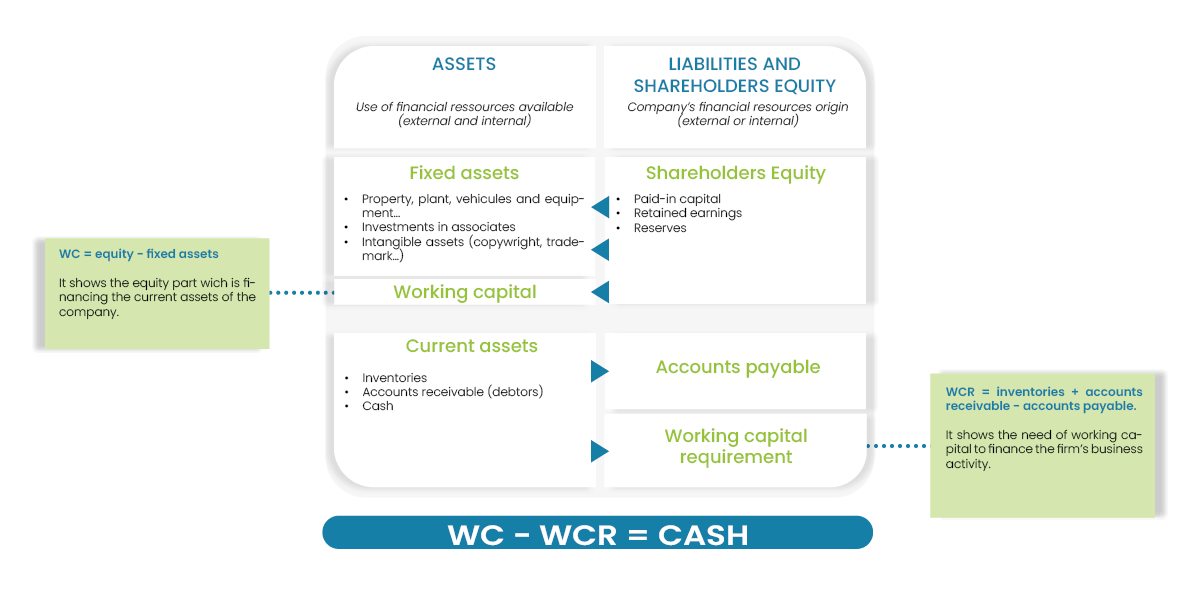

Assets are divided into two parts: If we look at the company's financial resources (owners’ equity plus liabilities) and assets, we can determine the part of the owner’s equity that finances the current assets; in other words, the business activity of the business. This is the working capital.

If working capital is weak, working capital requirements are financed by liabilities. In this case, the company is financially weak and depends on its creditors (banks, suppliers) to maintain and develop its activity.

If we look at the company's financial resources (owners’ equity plus liabilities) and assets, we can determine the part of the owner’s equity that finances the current assets; in other words, the business activity of the business. This is the working capital.

If working capital is weak, working capital requirements are financed by liabilities. In this case, the company is financially weak and depends on its creditors (banks, suppliers) to maintain and develop its activity.

This situation can be problematic because the company is dependent on short-term cash credit. The renewal of these credits is not certain. Therefore, the risk of failure increases with this dependence! It may be normal to have recourse to bank credit, but in reasonable proportions.

Be careful with companies having an unbalanced financial structure with an even negative WC and a high WCR. This is a consequence of bad management or too little financing. These situations make these companies very risky, whatever is the good will of the leaders to respect their commitments.

Be careful with companies having an unbalanced financial structure with an even negative WC and a high WCR. This is a consequence of bad management or too little financing. These situations make these companies very risky, whatever is the good will of the leaders to respect their commitments.

Tensions in the treasury are almost systematic, and the risk of delays in payment or unpaid invoices is very high. A decrease in turnover, an unpaid invoice, or a disengagement from a creditor (bank, supplier) can be fatal and lead the company to bankruptcy.

Analyze the financial structure as a whole and in a dynamic way.

Each case is particular, and the evaluation of the assessment depends intrinsically on the company's business sector and of the financial need that results from this.

Analyze the financial structure as a whole and in a dynamic way.

Each case is particular, and the evaluation of the assessment depends intrinsically on the company's business sector and of the financial need that results from this.

Thus, a simple trade has to finance mainly its stock, while an iron and steel company must finance very heavy fixed assets (equipment, grounds, etc.), stock, and credits allowed to customers.

The interpretation of the balance sheet must be done in parallel with an understanding of the activity of the company, its operating mode, its profitability, its operating cycle, etc. It is taking into account all of the realities of business, which makes it possible to deduce its solvency, its sustainability, and the level of credit limit that can be granted to this company. Through these numbers, you have to see the company concerned, like Keanu Reeves in the Matrix, who visualizes the world through the Matrix and its numbers. You will therefore be an expert in financial analysis when, instead of the balance sheet and the income statement, the image of the company with all of its characteristics will appear in your mind when reading them.

Through these numbers, you have to see the company concerned, like Keanu Reeves in the Matrix, who visualizes the world through the Matrix and its numbers. You will therefore be an expert in financial analysis when, instead of the balance sheet and the income statement, the image of the company with all of its characteristics will appear in your mind when reading them.

- Owners’ equity: capital stock, retained earnings, reserve,

- liabilities: accounts payable, loans payable, and tax payable.

In the opposite way, the higher the debt, the more the company depends on them to fund its activity, which can continue only if suppliers and banks credit lines are maintained and raised proportionately with business growth.

-

My DSO Manager, the innovative credit management software

My DSO Manager offers powerful features to manage credit risk and assess customers' creditworthiness. The SaaS software is used by SMEs as well as worldwide companies to improve the cash collected.

Scoring, credit analysis, connectors with financial information providers, credit limit workflows, etc. allow a full monitoring of the company's exposure and the adaptation of collection strategies accordingly.

See the online demo.

What is the balance sheet?

Assets are divided into two parts:

- current assets: accounts receivable, inventory, work in process, cash, etc., that are constantly flowing in and out of a firm in the normal course of its business, as cash is converted into goods and then back into cash,

- fixed assets: land, buildings, equipment, machinery, vehicles, leasehold improvements, and other such items. Fixed assets are not consumed or sold during the normal course of a business, but their owner uses them to carry on its operations.

This situation can be problematic because the company is dependent on short-term cash credit. The renewal of these credits is not certain. Therefore, the risk of failure increases with this dependence! It may be normal to have recourse to bank credit, but in reasonable proportions.

A dynamic view of the balance sheet: the working capital and the working capital requirements

How to calculate the working capital requirement?

Working capital: equity and fixed assets.

The WC must be positive and large enough to cover the WCR.

If the WC is negative, that means that equity is not sufficient to finance fixed assets and the company has recourse to short-term bank loan (whose renewal is not guaranteed) to finance them. The default risk is maximum!

Working capital requirement: Operating assets (inventories plus accounts receivable) minus operating liabilities (payables).

The WCR represents the need to finance the operation. It depends strongly on the sector of activity. For example, industrial companies generally have a higher WCR, while the major retailers have negative working capital (they are paid by their customers before they pay their suppliers).

Net cash: WC - WCR.

The Net cash is the remaining WC after the absorption of WCR. If the WC covers WCR, the net cash is positive. This amount is reflected in cash (excess cash on a bank account).

If the WC does not cover the WCR, net cash is negative. Stable financial resources are insufficient to finance the activity, and the company has recourse to short-term bank loan or credit suppliers to finance the operating cycle.

This situation is problematic because the company is dependent on credit given by suppliers or short term loans whose renewal is not assured. The risk of failure is high, even if many businesses are in this situation!

Tensions in the treasury are almost systematic, and the risk of delays in payment or unpaid invoices is very high. A decrease in turnover, an unpaid invoice, or a disengagement from a creditor (bank, supplier) can be fatal and lead the company to bankruptcy.

Thus, a simple trade has to finance mainly its stock, while an iron and steel company must finance very heavy fixed assets (equipment, grounds, etc.), stock, and credits allowed to customers.

The interpretation of the balance sheet must be done in parallel with an understanding of the activity of the company, its operating mode, its profitability, its operating cycle, etc. It is taking into account all of the realities of business, which makes it possible to deduce its solvency, its sustainability, and the level of credit limit that can be granted to this company.