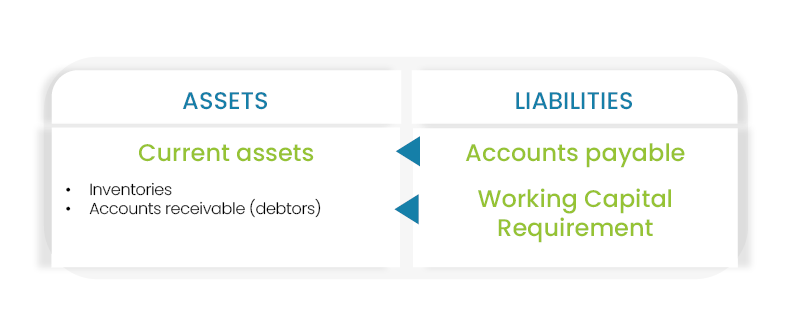

WCR is indeed the biggest source of "cash" of the company when there is a strong commitment of the business managers to challenge processes which generate WCR.

The WCR is a real trap for cash which should be avoided through an efficient business organization.

Each decision has an impact on working capital requirement. The optimization of working capital requirement potentially concerns all sectors and all stakeholders of the company.

Thus, it is necessary to control it with:

The WCR is assessed in value (quantitative aspect WCR) and number of days of sales (qualitative aspect). It must then be husked through a thorough audit to determine which internal business processes are generating WCR and to identify opportunities for improvement.

An action plan to optimize the processes involved (inventory management, purchasing, receivables management, billing ... etc.) is engaged. This plan will streamline the organization and the operating methods of the business, and will have results regarding the business’ cash and profitability.

Piloting monthly WCR reveals progress and helps to identify new priorities.

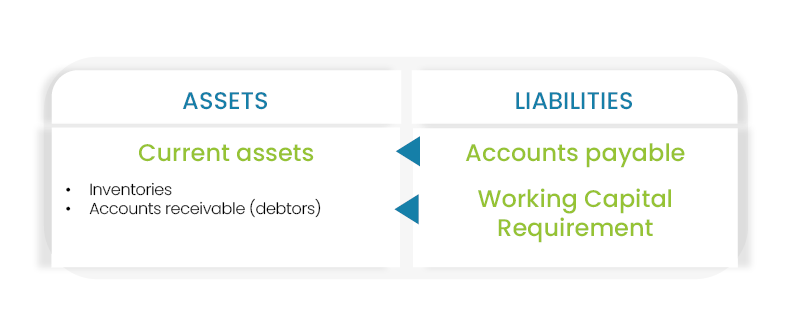

The WCR is a real trap for cash which should be avoided through an efficient business organization.

Each decision has an impact on working capital requirement. The optimization of working capital requirement potentially concerns all sectors and all stakeholders of the company.

Thus, it is necessary to control it with:

- A detailed and accurate monitoring of its main components,

- An action plan dedicated to processes which contribute to the WCR.

WRC driving tool (download it herebelow)

It is appropriate to value each month or each quarter (with a preference for the monthly frequency):- Raw material inventory,

- Outstanding amounts of production,

- Finished products inventory,

- Accounts receivalbe including VAT,

- Accounts payable including VAT.

The WCR is assessed in value (quantitative aspect WCR) and number of days of sales (qualitative aspect). It must then be husked through a thorough audit to determine which internal business processes are generating WCR and to identify opportunities for improvement.

An action plan to optimize the processes involved (inventory management, purchasing, receivables management, billing ... etc.) is engaged. This plan will streamline the organization and the operating methods of the business, and will have results regarding the business’ cash and profitability.

Piloting monthly WCR reveals progress and helps to identify new priorities.