Credit management function can be managed in different ways. It is very interesting to see how it is organized depending on the type of business and / or the country of the company.

Credit management function can be managed in different ways. It is very interesting to see how it is organized depending on the type of business and / or the country of the company.Commercial culture is a key element in credit management. So there may have as many credit organization as different business cultures in the world. It would be impossible to identify every one.

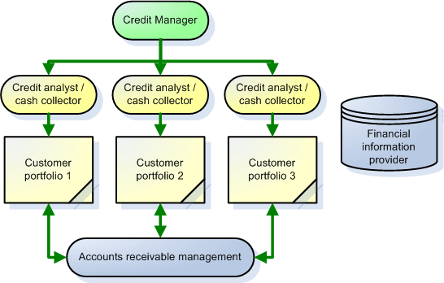

However, we could see 3 main types of organization:

- The Anglo-saxon one.

- The Taylorist one.

- The back office one.

Read the article.