Set a credit limit for each of your buyers allows to manage your accounts receivable according to their financial capacity and their solvency.

This is a key element in the management of the risk of bad debts, which is the root cause of financial issues of many companies.

My DSO Manager proposes to set approval levels for credit limits by users and a validation workflow ensuring traceability and transparency of the decisions taken.

Steps:

To go further:

This is a key element in the management of the risk of bad debts, which is the root cause of financial issues of many companies.

My DSO Manager proposes to set approval levels for credit limits by users and a validation workflow ensuring traceability and transparency of the decisions taken.

Steps:

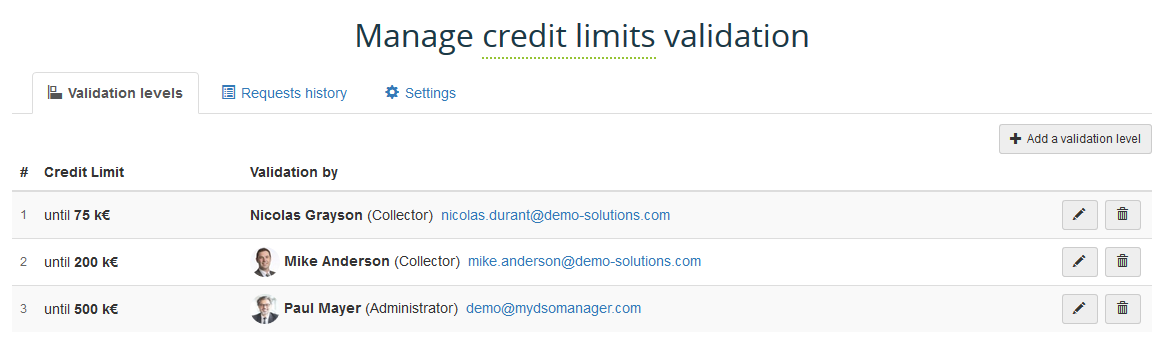

- Set in the Settings tab the validations levels and preferences.

- Manage from the customer file the risk aspects (credit insurance, financial information, payment behavior, ...) and their assessment using the analysis tools (credit rating, credit limit calculation tool...)

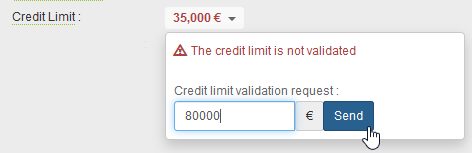

- Validate credit limit decisions according to defined validation levels

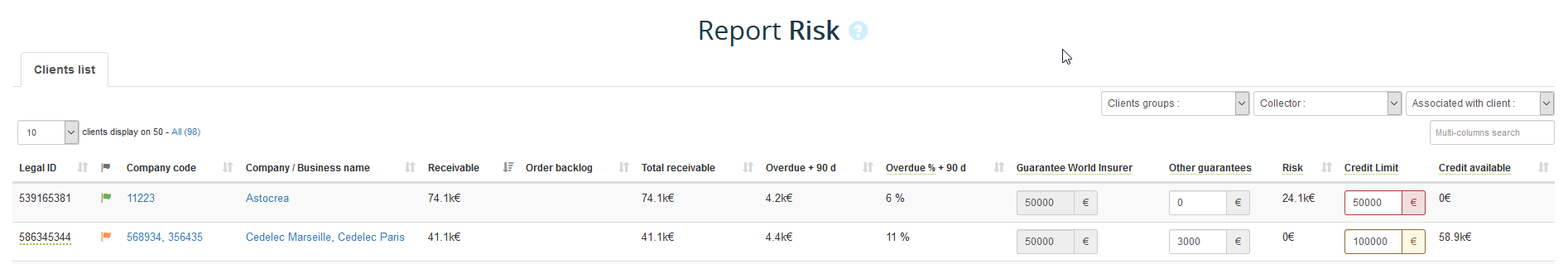

- Manage in the Risk report and / or with the alerts credit limit overruns and those that are not validated

Risk report:

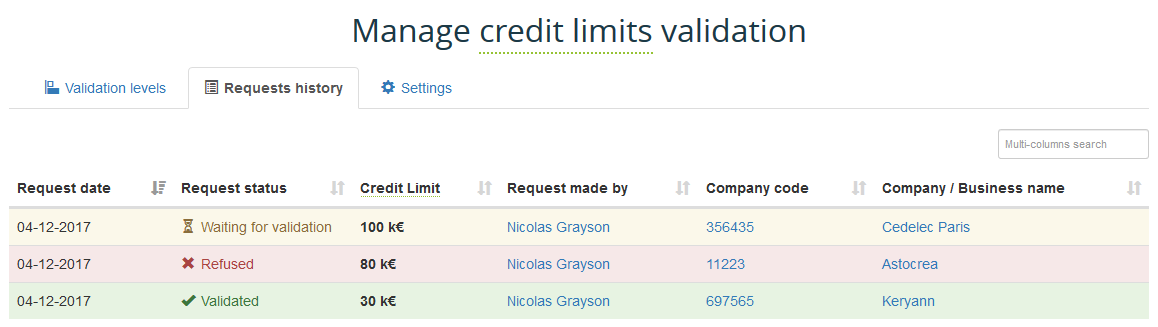

Requests history:

To go further:

- Adapt your collection strategy depending on the "risk" assessment of your clients (score, financial information, ...), for example by creating a specific scenario for risky clients

- Use the payment behavior informations (payer profile, overdue causes, ...) to identify the financial problems of your customers beforehand and adapt the credit limit accordingly

List of last topics in the online help: