The Tangible Net Worth (TNW) is a relevant indicator to assess the real value of a company based on the balance sheet. It can be used for credit analysis to validate the outstanding level that is granted to customers.

For example, it may be stipulated in the credit management policy that the credit limit granted to customers shall not exceed xx% of their tangible net worth.

Indeed, the TNW meets the obvious need, but it is not so easy to get, to know the intrinsic value of a company based on what is material, i.e., what can be converted into cash in case of termination of the activity, liquidation of assets (sale of fixed assets, inventory, and payment of receivables) and payment of debts with third parties (banks, suppliers, taxes, etc.). TNW is a concept that is very down to earth. All intangible valuations, i.e., intangible assets: patents, expenses, goodwill, licenses, and all other intellectual property that the company may have, are excluded in the calculation.

TNW is a concept that is very down to earth. All intangible valuations, i.e., intangible assets: patents, expenses, goodwill, licenses, and all other intellectual property that the company may have, are excluded in the calculation.

Please note, the TNW is not an indicator allowing the market value of a company to be calculated (the price at which it could be resold), but its monetary value at a time "T".

Please note, the TNW is not an indicator allowing the market value of a company to be calculated (the price at which it could be resold), but its monetary value at a time "T".

For example, if the value of the stock is overvalued (as shown in the balance sheet of dead stock), the tangible net worth will also be false (see the pitfalls the of the balance sheet). This principle is true for any difference in the value of balance sheet assets (fixed assets, receivables, etc.) compared to reality.

For example, a patent may have some value for a few months but become obsolete overnight. The value of goodwill may vary depending on many criteria: competitive environment, market growth, and positioning.

As a consequence of this subjectivity, the valuation of intangible assets varies with business strategy. They will swell if the executive wants to sell his company, anthey will decrease if it wants to reduce its net income.

Furthermore, the principle of a credit analysis is to determine the capabilities of a company to pay its invoices in the short term, with a horizon of a few weeks or even a few months. However, intangible assets are difficult to convert into cash and therefore do not strengthen the solvency of a company in the short term. The principle of tangible net worth is not to deny the intangible assets of a company, which are, in most cases, a reality, but to put them aside because they do not help the company meet its debts.

The principle of tangible net worth is not to deny the intangible assets of a company, which are, in most cases, a reality, but to put them aside because they do not help the company meet its debts.

First, the TNW is not enough to achieve a solid financial analysis. Many other factors must be taken into account when looking at the income statement and balance sheet.

However, TNW provides information about client's financial situation. As a lender (a deferred payment granted to the client equals a credit given), we must ask ourselves the following question: how much can I loan to this company?

TNW plays a pivotal role in the answer to this question: it does not make sense to give the customer a credit limit greater than 100% of his TNW. 80% is far too high.

Tip: Never set a credit limit exceeding 50% of the TNW, which is already very high.

Tip: Never set a credit limit exceeding 50% of the TNW, which is already very high.

This percentage varies depending on the case. For example, if the customer analyzed has serious cash flow problems, it is very risky to grant him an outstanding equal to 50% of its TNW because you may become his main creditor. You won't be able to disengage, and you will face an agonizing dilemma:

The credit analysis inherently involves subjectivity. The use of tangible net worth does not change this assumption. Nevertheless, it is a relevant indicator that together with other elements of analysis, can give a coherent and realistic business view. It provides an essential point of reference in determining the credit limit granted to his client.

The credit analysis inherently involves subjectivity. The use of tangible net worth does not change this assumption. Nevertheless, it is a relevant indicator that together with other elements of analysis, can give a coherent and realistic business view. It provides an essential point of reference in determining the credit limit granted to his client.

For example, it may be stipulated in the credit management policy that the credit limit granted to customers shall not exceed xx% of their tangible net worth.

Indeed, the TNW meets the obvious need, but it is not so easy to get, to know the intrinsic value of a company based on what is material, i.e., what can be converted into cash in case of termination of the activity, liquidation of assets (sale of fixed assets, inventory, and payment of receivables) and payment of debts with third parties (banks, suppliers, taxes, etc.).

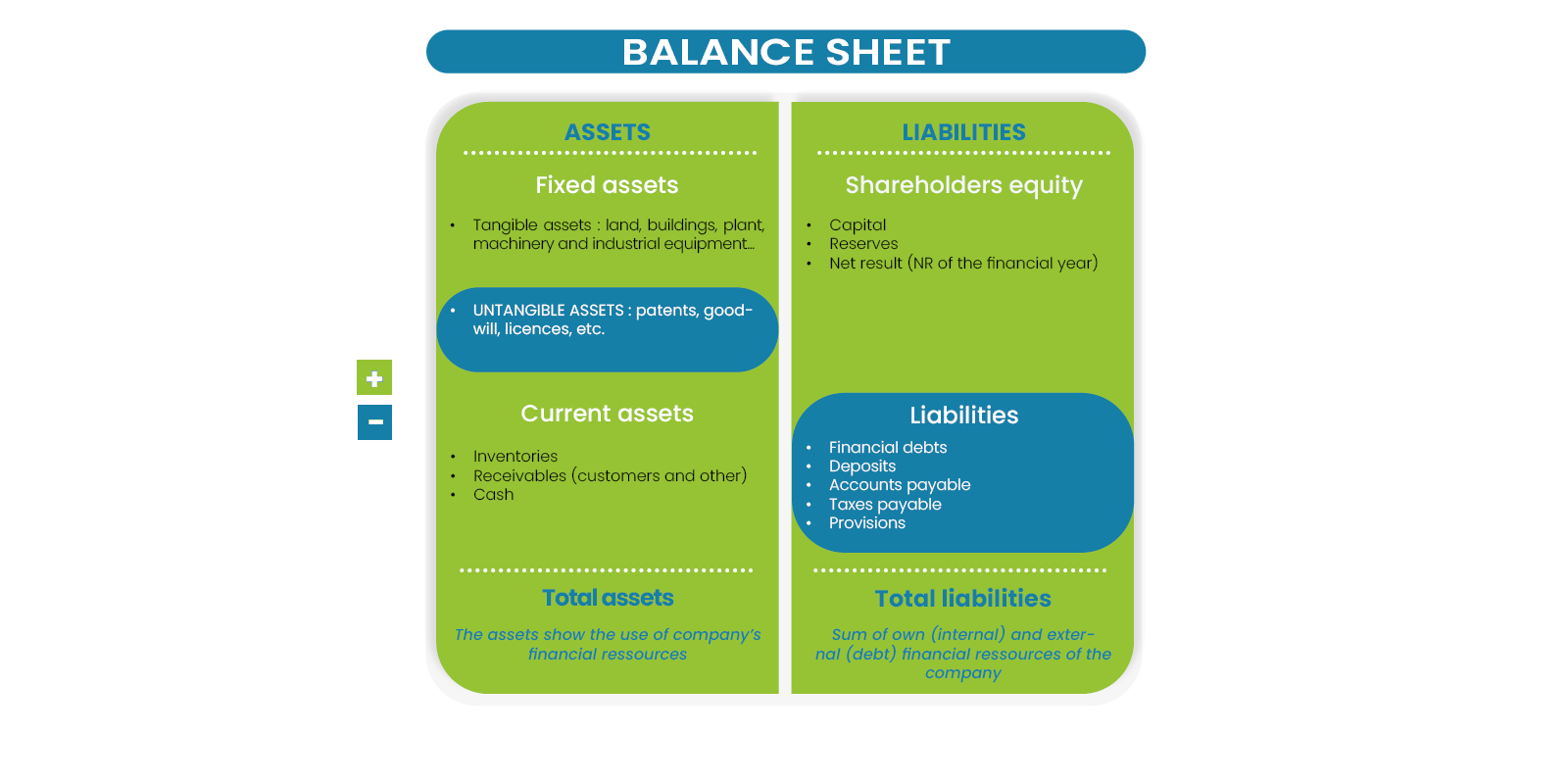

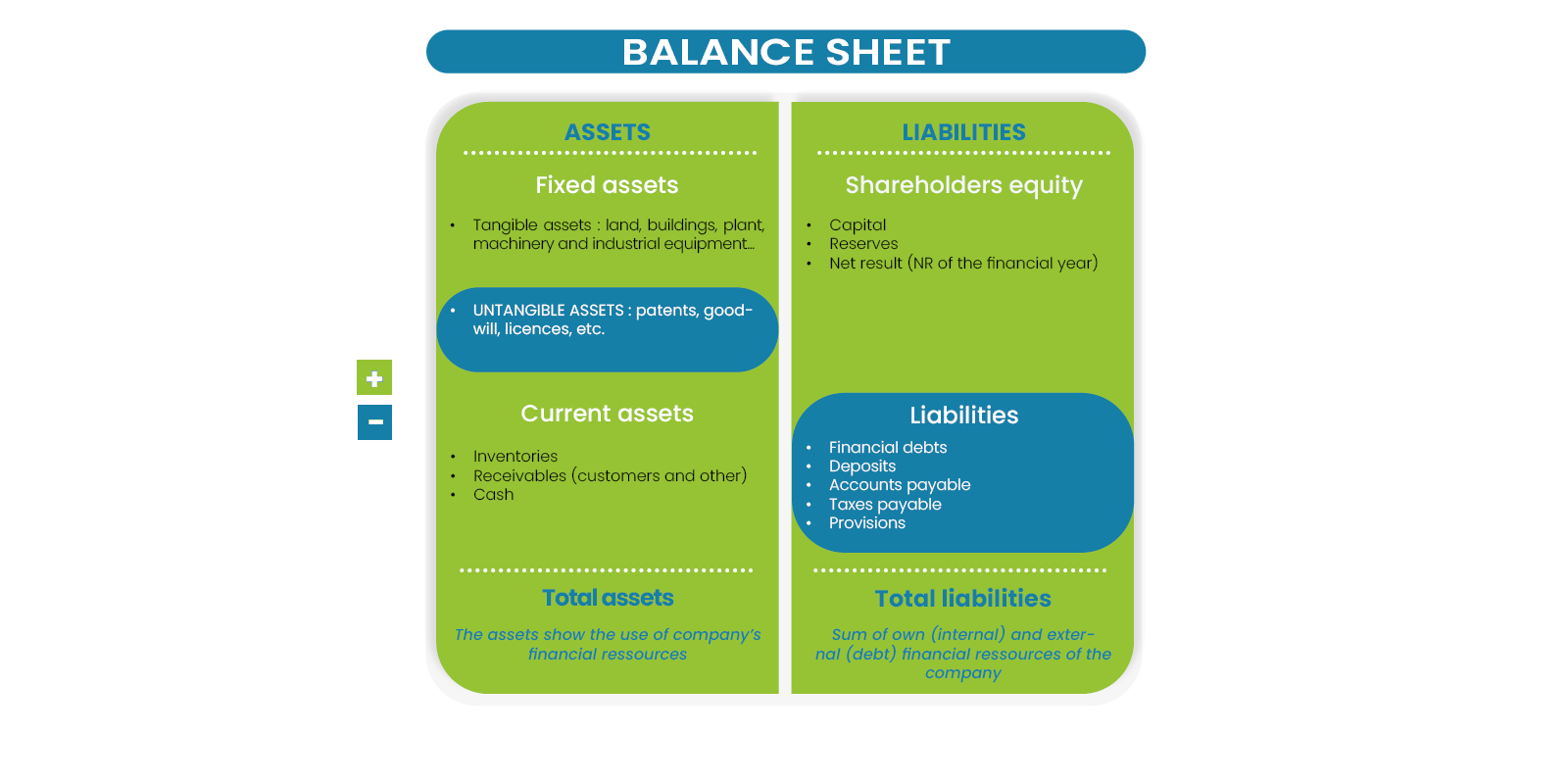

Tangible Net Worth calculation

As a key prerequisite to any assessment of TNW, it is necessary to ensure that the balance sheet is representative of the financial reality of the business. If this is not the case and the financial statements are fraudulent, the TNW will be biased and lead to a false estimate of the value of the company.For example, if the value of the stock is overvalued (as shown in the balance sheet of dead stock), the tangible net worth will also be false (see the pitfalls the of the balance sheet). This principle is true for any difference in the value of balance sheet assets (fixed assets, receivables, etc.) compared to reality.

Why exclude intangibles from credit analysis?

Intangible assets are immaterial and unquantifiable (cash is intangible but perfectly quantifiable), they are subject to subjectivity in large proportions. Indeed, how to define rationally the value of goodwill or a patent? It is extremely difficult because their actual value depends on external context, which may rapidly evolve.For example, a patent may have some value for a few months but become obsolete overnight. The value of goodwill may vary depending on many criteria: competitive environment, market growth, and positioning.

As a consequence of this subjectivity, the valuation of intangible assets varies with business strategy. They will swell if the executive wants to sell his company, anthey will decrease if it wants to reduce its net income.

Furthermore, the principle of a credit analysis is to determine the capabilities of a company to pay its invoices in the short term, with a horizon of a few weeks or even a few months. However, intangible assets are difficult to convert into cash and therefore do not strengthen the solvency of a company in the short term.

Tangible Net Worth calculation method

Total liabilities minus debts minus untangible assets.

Credit analysis and Tangible Net Worth

What to do once TNW is calculated?First, the TNW is not enough to achieve a solid financial analysis. Many other factors must be taken into account when looking at the income statement and balance sheet.

However, TNW provides information about client's financial situation. As a lender (a deferred payment granted to the client equals a credit given), we must ask ourselves the following question: how much can I loan to this company?

TNW plays a pivotal role in the answer to this question: it does not make sense to give the customer a credit limit greater than 100% of his TNW. 80% is far too high.

-

My DSO Manager, the innovative credit management software

Easy to implement, including intuitive and powerful features, My DSO Manager allows to efficiently manage your accounts receivable.

The software helps to significantly improve cash flow (you will get paid faster by your customers), profitability (you'll have fewer bad debts), and customer satisfaction (you'll have quicker dispute resolution) thanks to intelligent digital functionalities.

See more with our online demo.

This percentage varies depending on the case. For example, if the customer analyzed has serious cash flow problems, it is very risky to grant him an outstanding equal to 50% of its TNW because you may become his main creditor. You won't be able to disengage, and you will face an agonizing dilemma:

- Cancel or reduce the credit line, which can push the customer into bankruptcy, which will result in bad debts for the supplier,

- Continue to accompany him by accepting late payments, with the risk that despite this assistance, he will fill for bankruptcy and thus generate a very large outstanding for those who have given support.