My DSO Manager is a market-leading credit management and cash collection software software. Its innovative SaaS (Software as a Service) solution allows to digitize the Order to Cash process, interconnect systems (ERP, CRM, third-party solutions) and customer relationship stakeholders (internal and external) to optimize the entire management of customer accounts. It integrates all the essential business features, concerning customer risk management, cash collection, dispute & deduction resolution, and collection forecasting.

My DSO Manager is designed entirely by credit managers for credit managers. To date, more than 2,100 companies in 89 countries have chosen to use this solution. They describe it as innovative due to its performance, rapid integration, and user-friendly, scalable interface. Whether for large international groups or mid-sized businesses, My DSO Manager adapts to the needs of each company, regardless of its sector of activity or location.

Using My DSO Manager helps to increase financial performance while increasing customer satisfaction and the image of the company, which structures and professionalizes its management thanks to the software.

Using My DSO Manager helps to increase financial performance while increasing customer satisfaction and the image of the company, which structures and professionalizes its management thanks to the software.

The objectives of My DSO Manager are:

Effective cash collections helps reduce DSO, as do effective dispute resolution and good customer risk management. This improves the company's cash flow and profitability, while ensuring improved customer satisfaction.

My DSO Manager is the tool that allows you to manage your DSO and carry out all the actions necessary to improve it.

My DSO Manager is the tool that allows you to manage your DSO and carry out all the actions necessary to improve it.

My DSO Manager contains powerful and innovative features that you will quickly learn to use.

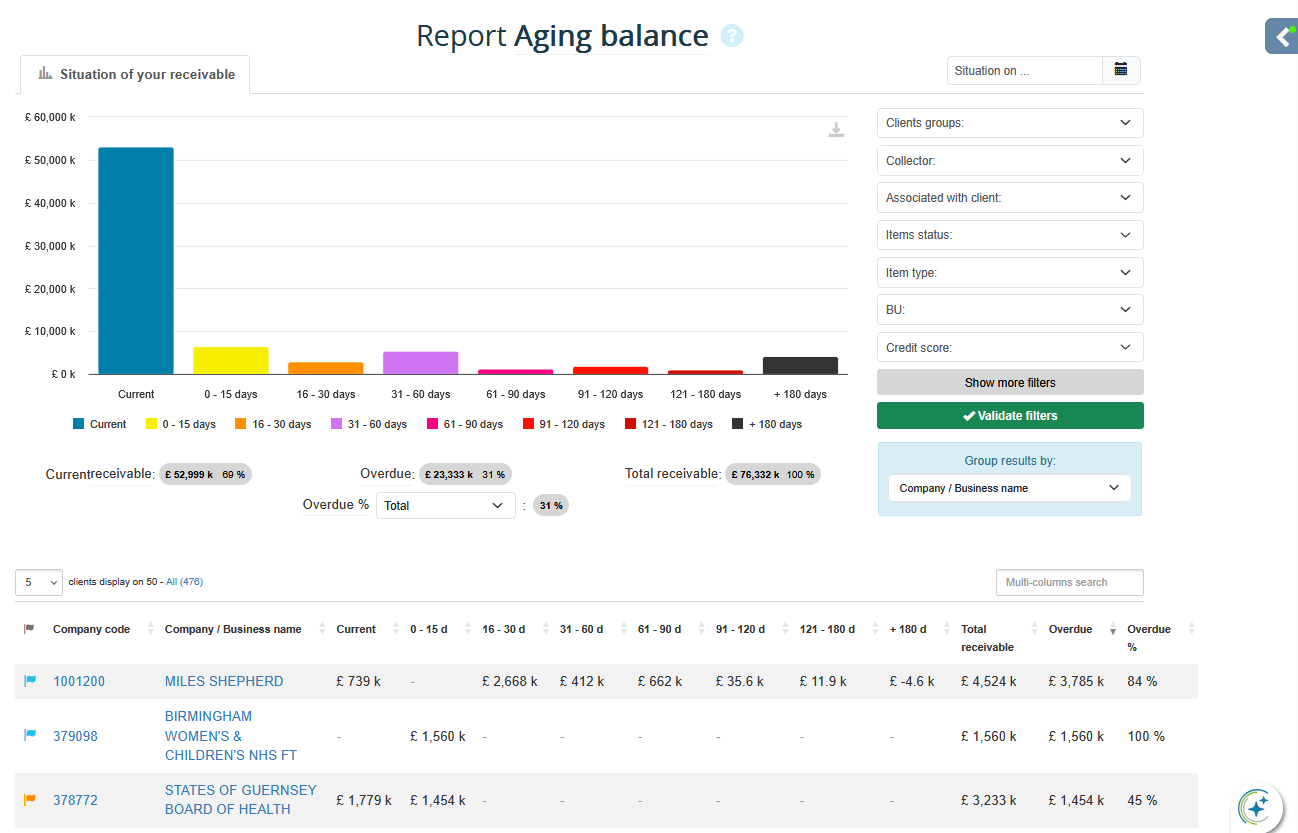

Reports are calculated in real time on all your data, by customer group, user portfolio, customer segmentation or parts, by customer. The flexibility of My DSO Manager allows you to transcribe your company's organization into the software.

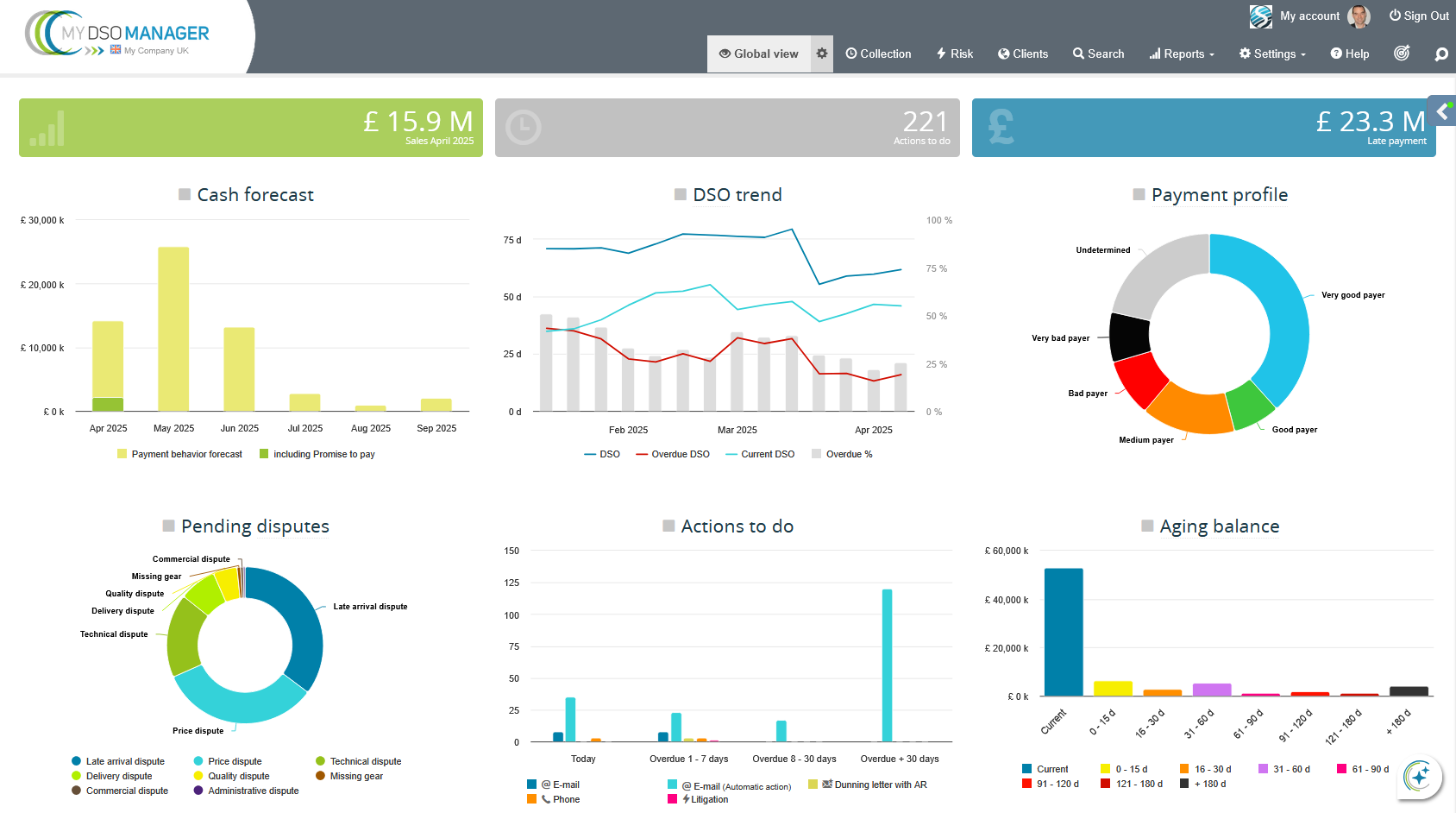

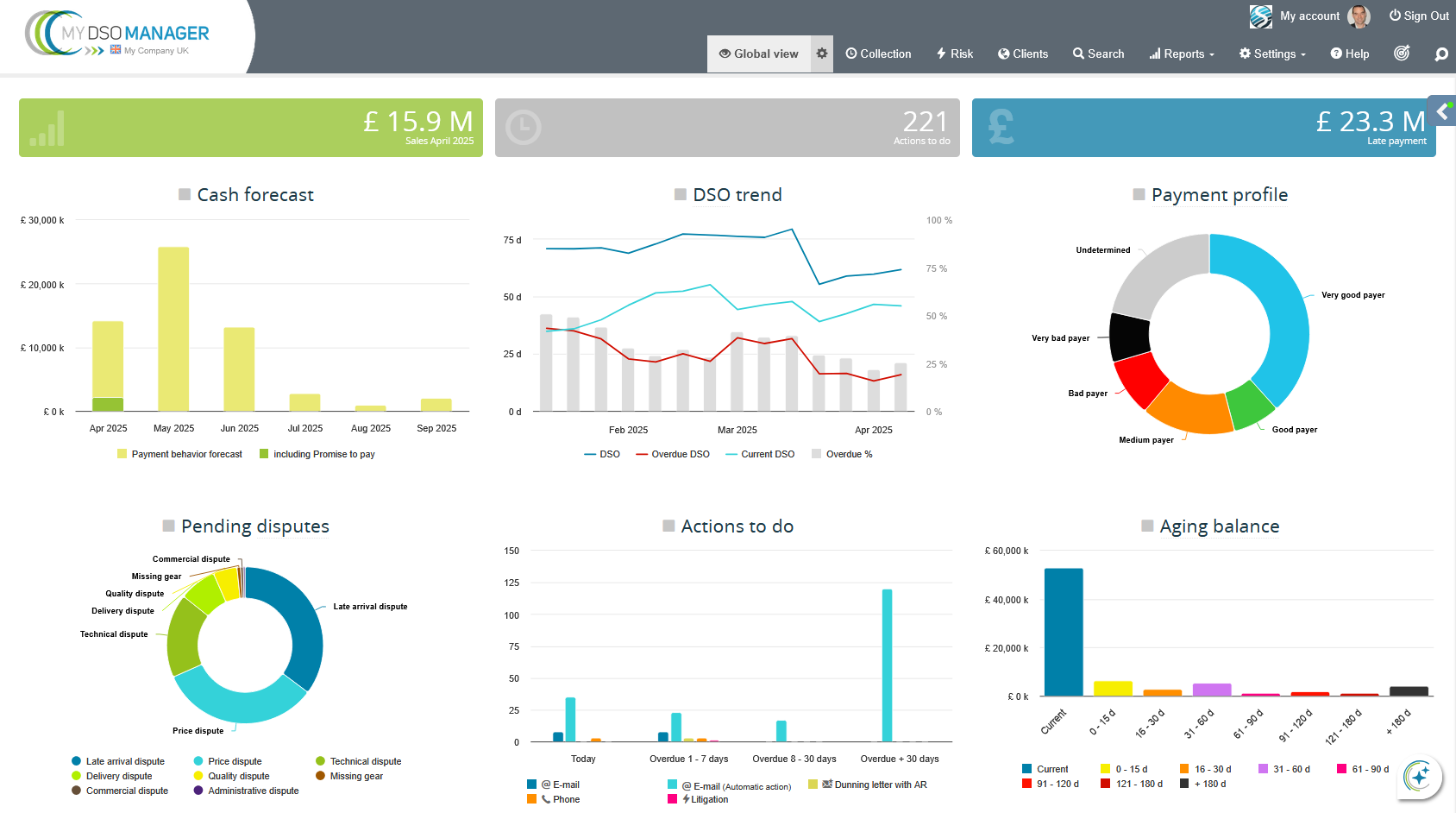

The global view allows you to display all reports globally or filtered on the desired data. Each user can customize it according to their role and wishes: choice and order of reports, viewing scope. In one click, the user can access the details of each report.

Each report can be customized and filtered according to multiple criteria: client groups, user portfolios, risk, set of analytical fields which are fields customized by client and which allow you to reproduce the client segmentation and parts of your company in My DSO Manager.

My DSO Manager is designed entirely by credit managers for credit managers. To date, more than 2,100 companies in 89 countries have chosen to use this solution. They describe it as innovative due to its performance, rapid integration, and user-friendly, scalable interface. Whether for large international groups or mid-sized businesses, My DSO Manager adapts to the needs of each company, regardless of its sector of activity or location.

A credit management software to manage major challenges

The digitalization of customer relations, cash collection, and risk management are vital challenges for businesses. Regardless of their size, they have a direct impact on their cash flow, profitability, and credibility. These are key elements for the sustainability and development of any company.The objectives of My DSO Manager are:

- To provide its clients with agile and automatable functionalities to optimize their processes and digitize their collections.

- To democratize digital practices for good Accounts Receivable management. This is achieved through a tool that allows them to be implemented collaboratively.

- To drastically simplify the constraints of implementing and using the software.

- To increase the power of the software by interconnecting it with a set of third-party solutions and exploiting the most recent technical developments such as MAIA generative AI and machine learning.

Why My DSO Manager?

DSO, an acronym for Days Sales Outstanding, is the key performance indicator for credit management and debt collection. It corresponds to the number of days of invoiced sales not yet paid. DSO is the main contributor to a company's working capital requirement and has a direct impact on cash flow.Effective cash collections helps reduce DSO, as do effective dispute resolution and good customer risk management. This improves the company's cash flow and profitability, while ensuring improved customer satisfaction.

Principles and features

|

Intuitive: Easy handling of My DSO Manager features in a pleasant and flexible environment, allowing to involve your teams and your customers. The ergonomics of the software is acclaimed by our 25,000 users around the world. |

|

Affordable: My DSO Manager is an attractive Credit Management and cash collection solution adapted to large international groups, mid-sized companies, and SMEs. Available in 15 languages, managing all currencies and multi-entity organizations with real-time consolidation of data at group level. ERP agnostic credit management solution with quick implementation thanks to the flexibility and agility of our Smart Upload module, allowing My DSO Manager to be adapted to your data and your organization. |

|

Innovative: offers the most innovative and scalable functionalities, whether for collection (interactive emails, personalization in automation), risk management (diary, workflow, scoring, etc.), predictive collections , AI, etc. Also benefit from access via smartphone and all frequent evolutions of the software. |

|

Efficient: My DSO Manager offers a set of intelligent and efficient features for an immediate return on investment thanks to measurable and sustainable gains, improvement of DSO, overdues and profitability, as well as other benefits: continuous improvement of internal processes, image and credibility with your customers and partners. |

My DSO Manager contains powerful and innovative features that you will quickly learn to use.

Native integrations

- Management of all existing currencies, all data formats from ERPs, CRM, accounting tools, etc.

- Multi-entity platform that allows real-time consolidation of data and performance reports from international groups at the corporate level.

- Accessible on computer, tablet or smartphone, 24/7. 100% uptime.

- Flexible and scalable interface and configuration.

- Suitable for international use, thanks to 15 languages offered for the My DSO Manager interface, and 170 for the reminder languages.

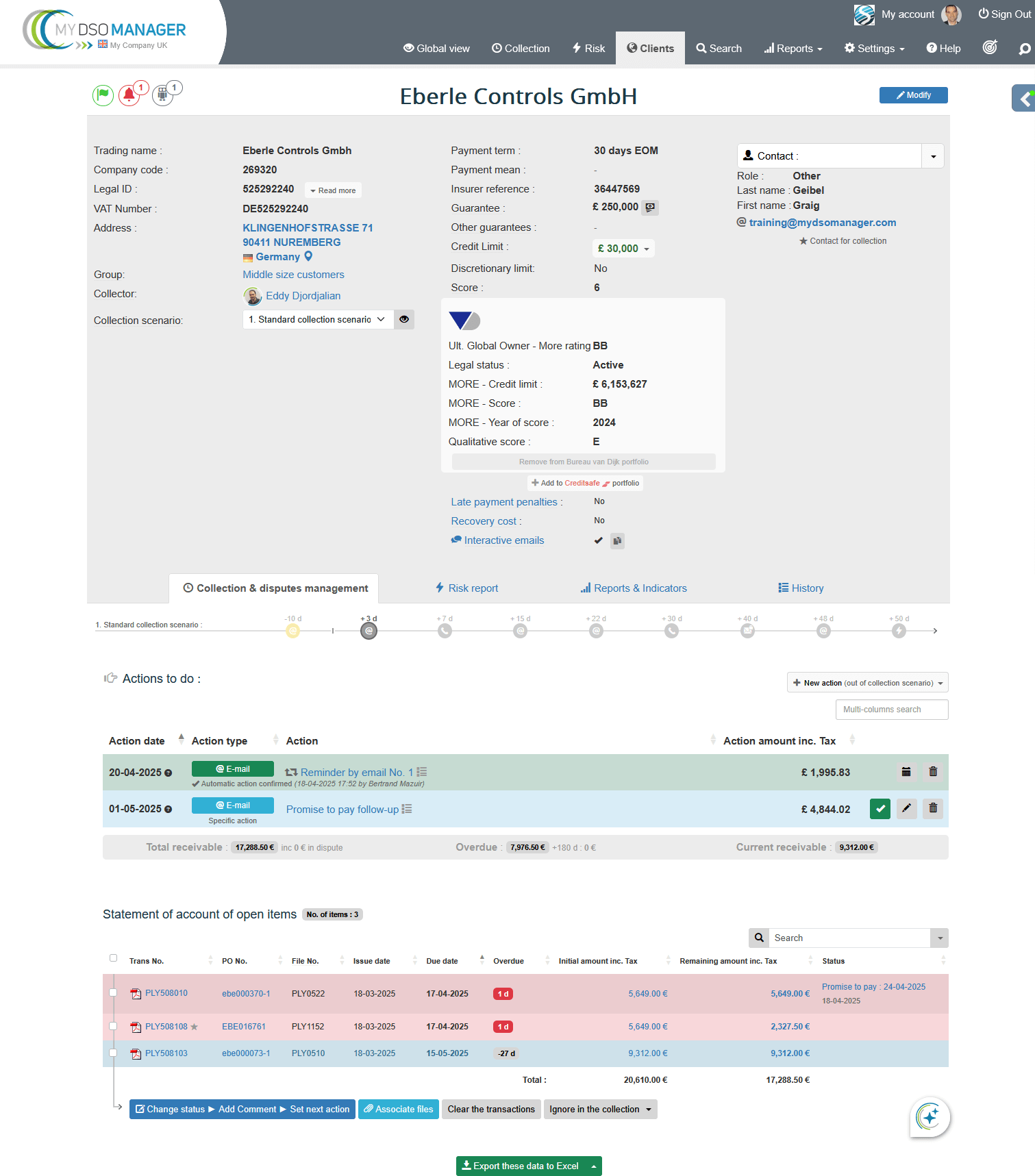

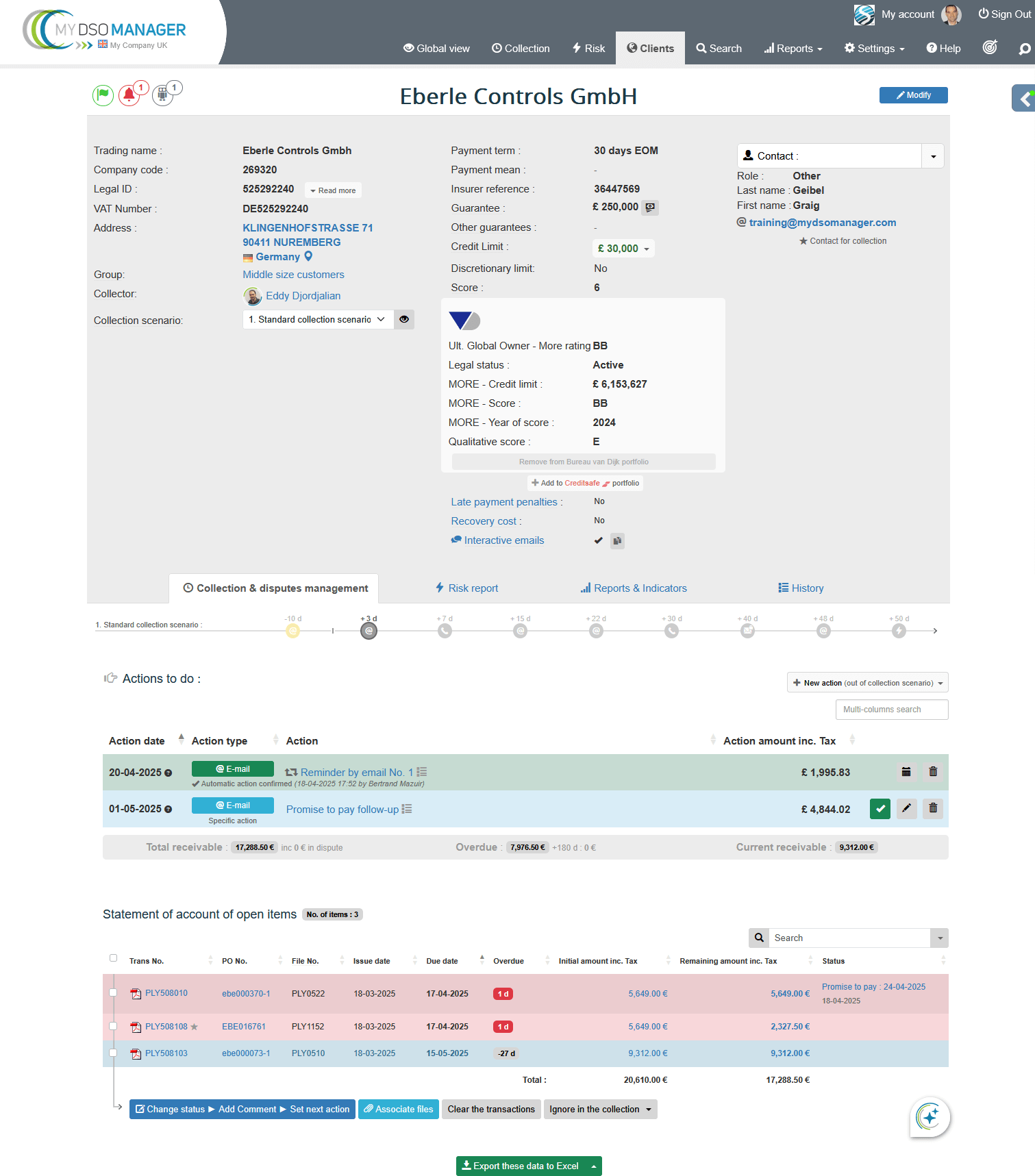

Cash collection

- Dynamically create and assign a collection scenario to each of your customers based on their typology and characteristics (risky customer, public, etc.).

- Create your reminder templates dynamically (emails, interactive emails, letters, electronic mail, SMS) while keeping the possibility of personalizing them when carrying out the action.

- Automatically insert PDF invoices, late payment penalty amounts, account status, your company's bank details and much more into your templates using balises #Hashtag.

- Add a status and comment to invoices after each customer feedback made in the software, by email or phone, allowing you to keep the history and prepare the next action, or let our generative AI

MAIA do it for you.

MAIA do it for you. - Give your customers access to their account status with interactive emails that allow them to respond directly to you in the app.

- Set up automatic reminders that will be sent if invoices are not paid by the due date. Define your strategies using our Search & Assign AI.

- Insert payment buttons allowing your customers to pay directly from their interactive page or reminder emails via multiple payment methods.

- Dematerialize the sending of your reminder letters thanks to native interconnection with numerous players such as Maileva, Cortex, AR24, etc.

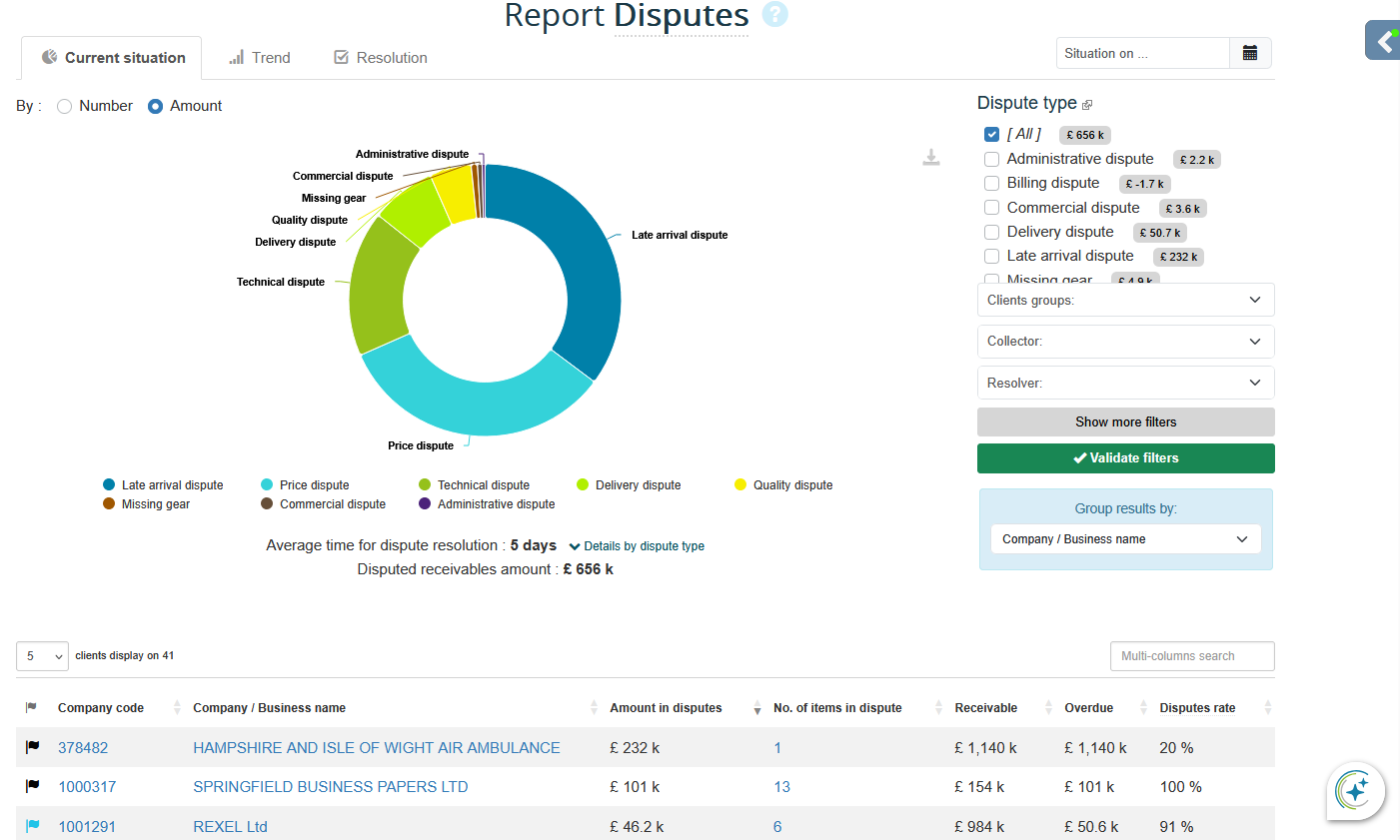

- Identify disputes and manage their resolution by involving colleagues who can resolve them.

- Manage collection by payment center and customer risk by legal entity in the event of multiple accounts for the same buyer.

- Etc.

Customer sheet in My DSO Manager

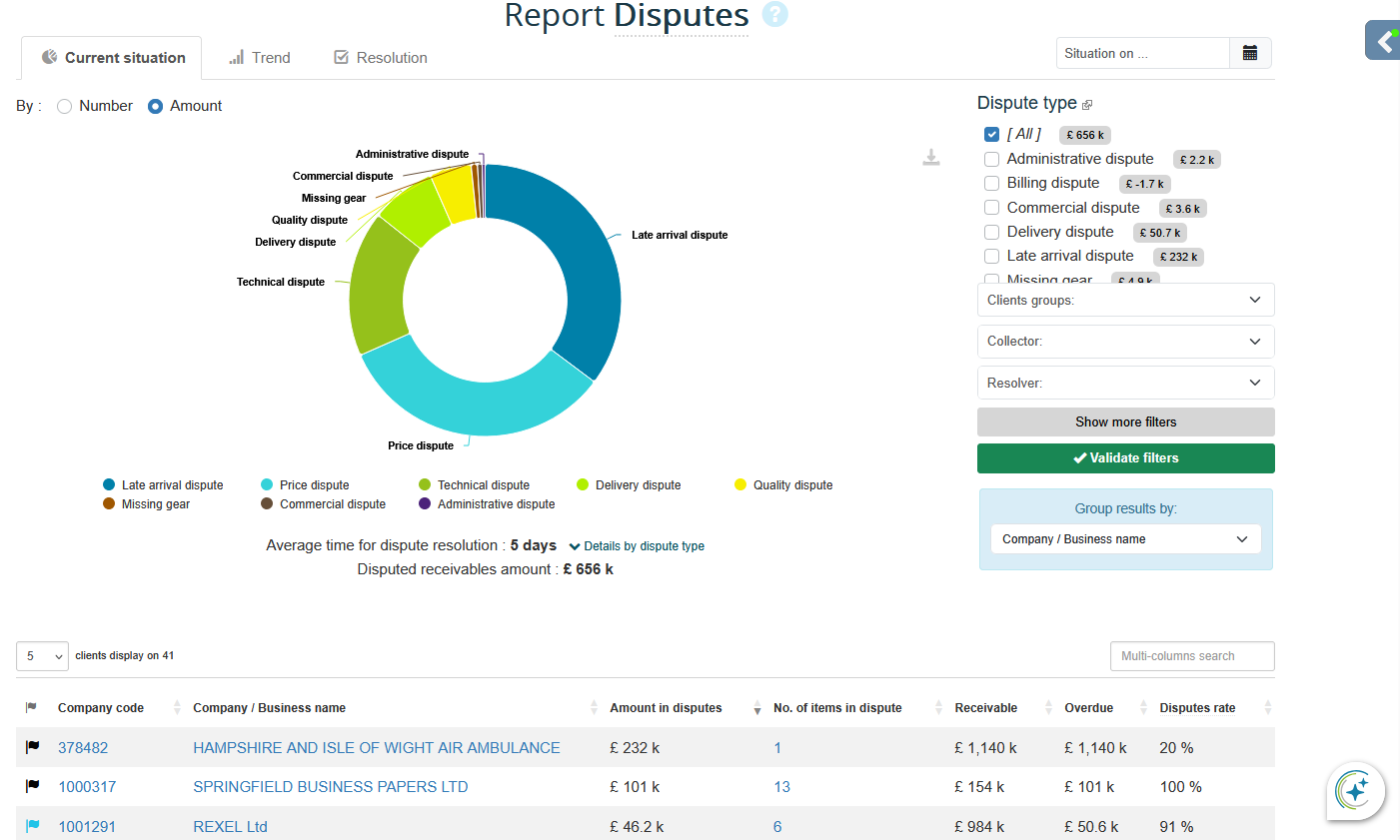

Management of disputes and special situations

- Identify disputes during your reminders or following customer feedback via their interactive page.

- Take into account the customer feedback explaining the dispute as well as any supporting document integrated and recorded in My DSO Manager.

- Qualify your items with an appropriate status (price dispute, administrative dispute, etc.) and set the next action.

- Directly involve internal stakeholders in your company in handling the dispute by assigning a resolution officer.

- Drive resolution by carrying out internal follow-up actions and using dispute reports.

- Improve your performance by tracking dispute resolution time calculated in days, overall and by dispute type and any other segmentation.

- Turn your dispute resolution process into an opportunity to improve customer satisfaction.

Dispute reports: situation, developments and resolution

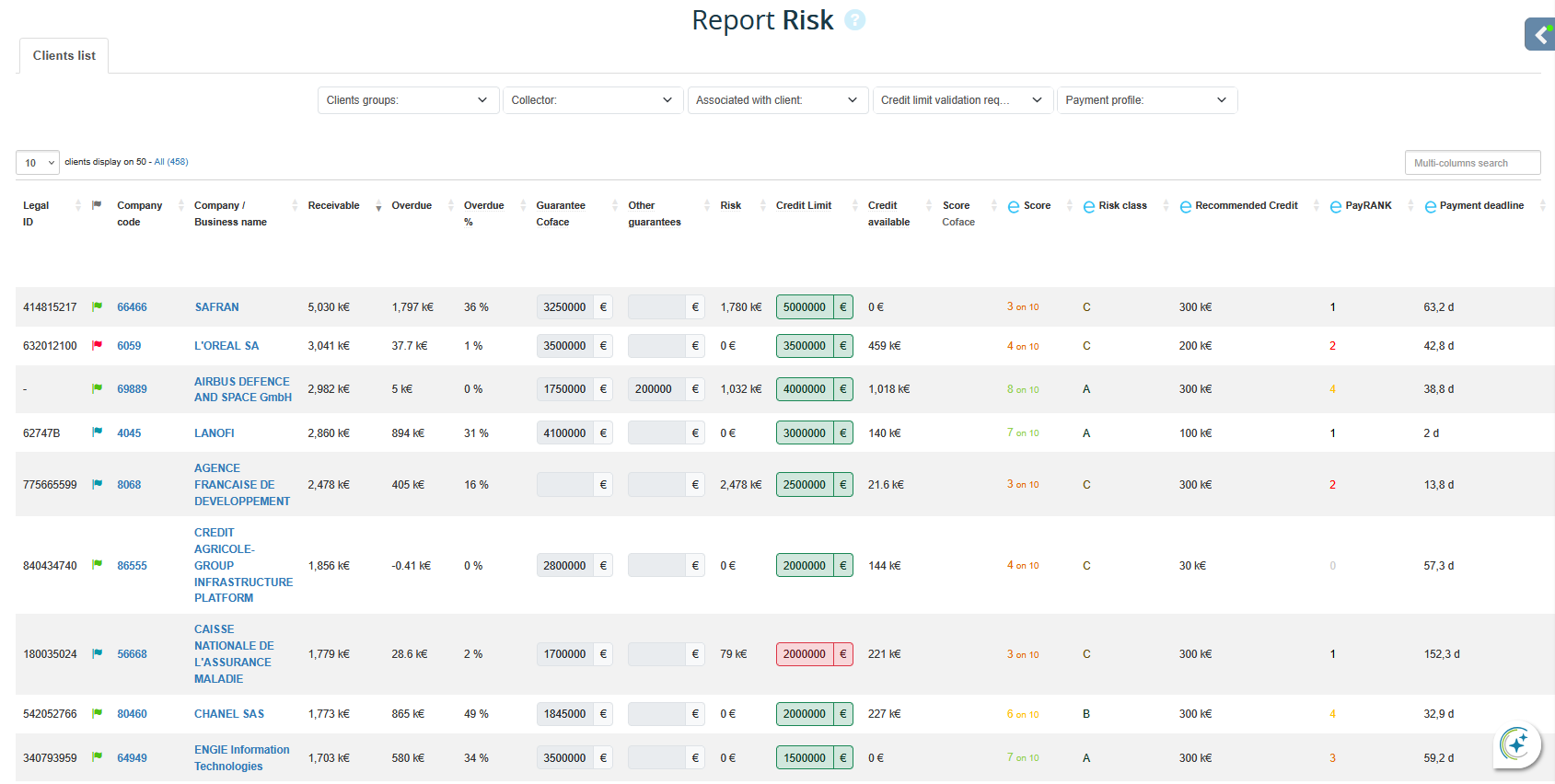

Risk management

- Score your customers and set a credit limit for each of them with dedicated and customizable tools.

- Integrate your credit limit validation process and get them approved in My DSO Manager.

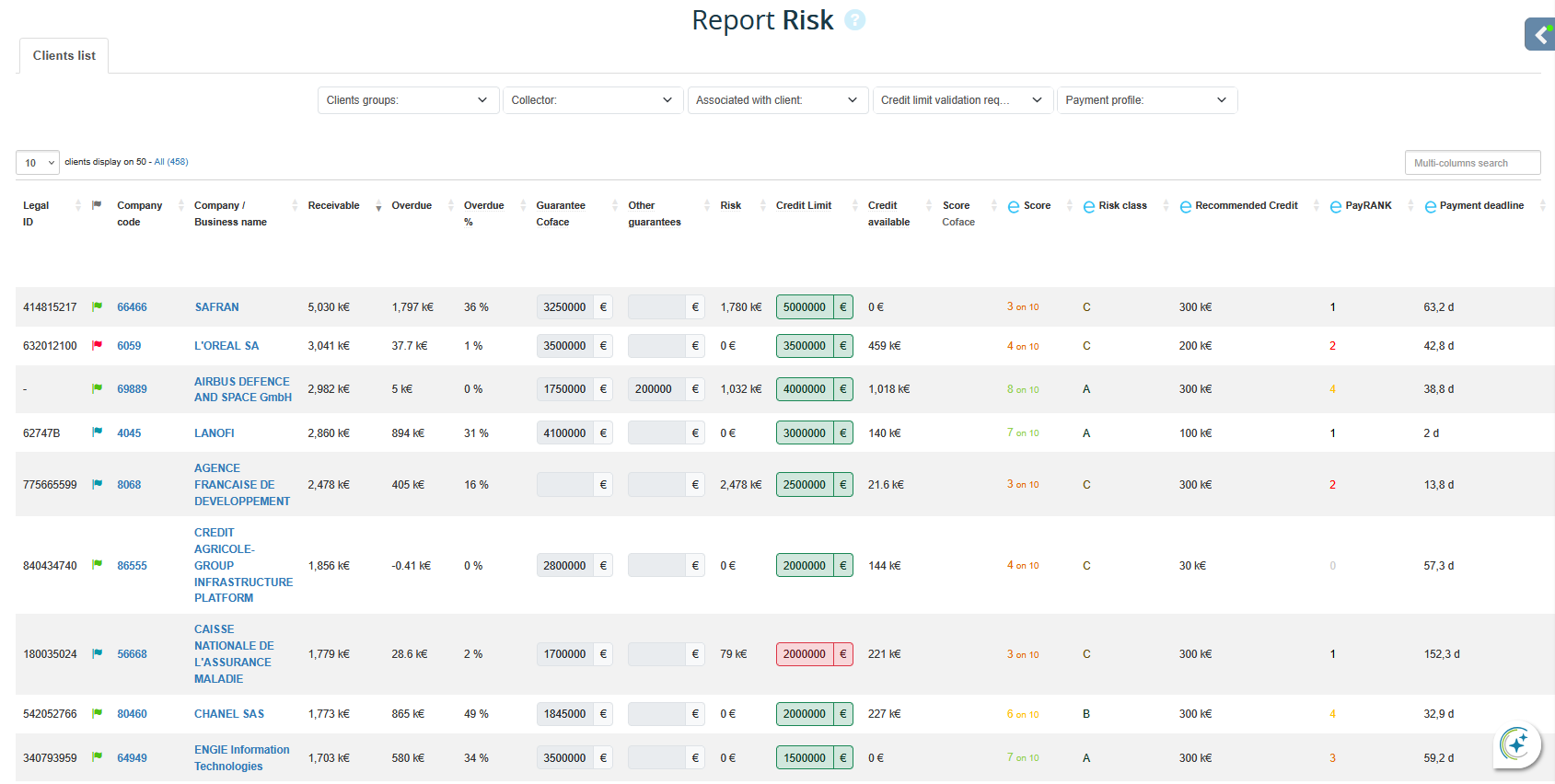

- Manage your customer risk with the risk report and by carrying out credit analyses.

- Integrate data from your service providers via our connectors: financial information providers, credit insurers, etc.

- Carry out daily monitoring of all risk actions using the Risk agenda.

- Create alerts to highlight customers with anomalies (exceeding credit limits or insurer guarantees, etc.).

- Manage your credit insurance by integrating guarantees, controlling reporting deadlines and making approval requests from My DSO Manager.

- For groups, manage your data between multiple entities to obtain a consolidated view of the outstanding and delayed payments of your key account customers.

- Manage multiple currencies with conversion rates updated daily and automatically by the software.

Risk report

Performance management

Benefit from the multiple reports natively present in the software:| DSO | Aging balance | Overdue trend |

| Risk | Items status | Disputes |

| Sales | Cash receipts | Collection efficiency |

| Cash forecast | Payment profiles | Key Management Indicators (KMI) |

Reports are calculated in real time on all your data, by customer group, user portfolio, customer segmentation or parts, by customer. The flexibility of My DSO Manager allows you to transcribe your company's organization into the software.

- Measure your buyers' actual payment behavior and average payment delays by defining your payer profile criteria and associated dynamic settings. For example, assigning tailored collection scenarios to late payers.

- All reports are action-oriented, in order to measure performance and take action to improve indicators.

- Create customized reports using searches and advanced searches that allow you to use and combine all the information present in My DSO Manager.

- Give access to performance reports to specific stakeholders in your company, including management and sales managers, to increase their involvement in cash collection and dispute resolution.

- Manage your Group's performance indicators using our multi-entity platform, which manages an unlimited number of reminder languages and currencies, and offers consolidated reports.

- AI Cash Forecast report that predict incoming payments for follwing weeks and months, very relevant for tresury and cash managers (and softwares).

The Global View, real Credit Manager Dashboard

The global view allows you to display all reports globally or filtered on the desired data. Each user can customize it according to their role and wishes: choice and order of reports, viewing scope. In one click, the user can access the details of each report.

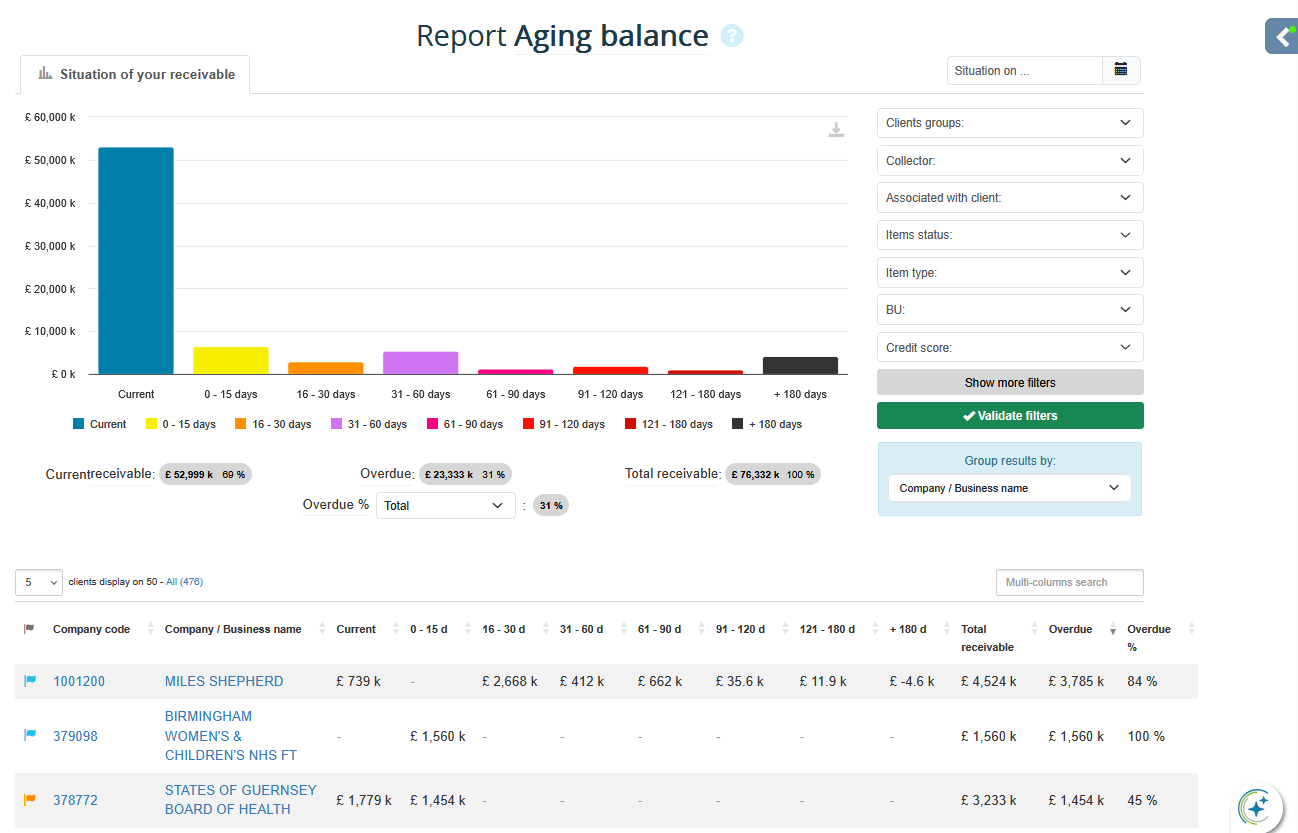

Example of a detailed report with the aging balance

Each report can be customized and filtered according to multiple criteria: client groups, user portfolios, risk, set of analytical fields which are fields customized by client and which allow you to reproduce the client segmentation and parts of your company in My DSO Manager.