What is the Working Capital Requirement ?

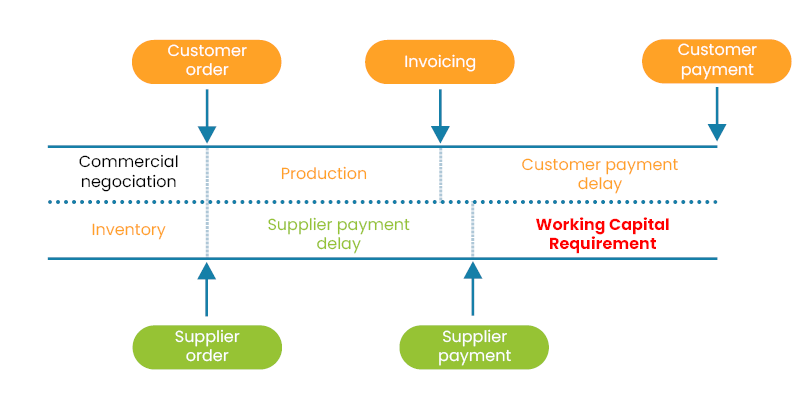

Working Capital Requirement is the amount of money needed to finance the gap between disbursements (payments to suppliers) and receipts (payments from customers).Almost every company must incur expenses before obtaining the fruits of his labor (the payment of customer invoices). The nature of these costs depends on the activity.

For example, if the business activity consists to buy and resell goods, it will require to purchase a stock of goods before selling. If it's an industry, it is necessary to buy the raw material before transforming it and then sell the finished product.

This operating cycle must be financed because it is necessary in most cases to pay suppliers before being paid. The working capital requirement represents the amount necessary to finance this delay.

The financial resources of businesses are always limited. It is therefore desirable to minimize the Working Capital Requirement:

- Because it is a major consumer of cash,

- Because it reveals dysfunctions that have "in fine" an impact on the company's profitability:

- Mismanaged the inventory will tend to swell it and cause dead inventory which will lead to losses due to the necessary decrease of the inventory value,

- Lax management of receivables result in significant late payments that can not be recovered, that is generating losses due to bad debts,

- Cash,

- Profitability,

- Business organization efficiency.

-

Discover My DSO Manager, the online credit management software

My DSO Manager offers a set of powerful features to manage accounts receivable and to improve working capital.

It includes innovative functionnalities for credit management and cash collection.

Dunning documents (e-mails, interactive e-mails, SMS, mails...) are dynamically generated through #Hashtag and are customizable for each customer for optimum efficiency.

The software can be used very quickly with Smart upload module, automatic import by FTP or our connectors (Quickbooks, Salesforce...). See more with the online demo.

The WCR today !

At a time when margins are getting lower because of the increase of raw materials cost and an increasingly tense competition, where external financing (bank, investors) is less and less accessible, companies are obliged to find other means to finance their activities.This concerns especially companies whose equity level is low, which is the case with many of them, particularly in France where the under-capitalization of companies is chronic.

The most obvious answer to this permanently stronger tension imposed by the outside world is to optimize the use of financial resources available internally to the company, through a precise and efficient management.

How to do that ? By reducing the WCR! This allows to improve cash and to use the financial resources available of the company for truly useful means: investment, development ... etc., instead of immobilizing them in areas that are inert like trade receivables and inventories.