In order to optimize the collection actions carried out with each customer, the collection strategies should be adapted according to the type of customer and his payment behavior. This principle seems obvious, doesn't it?

In order to optimize the collection actions carried out with each customer, the collection strategies should be adapted according to the type of customer and his payment behavior. This principle seems obvious, doesn't it?However, from the intellectual idea to the practice, there is a gap which is not easy to cross. Indeed, when you have to manage hundreds or thousands of customer accounts, it is essential to have recourse to the computer tool to determine in real time the payment profile of each of them. Without its computing power, nothing or almost nothing is possible.

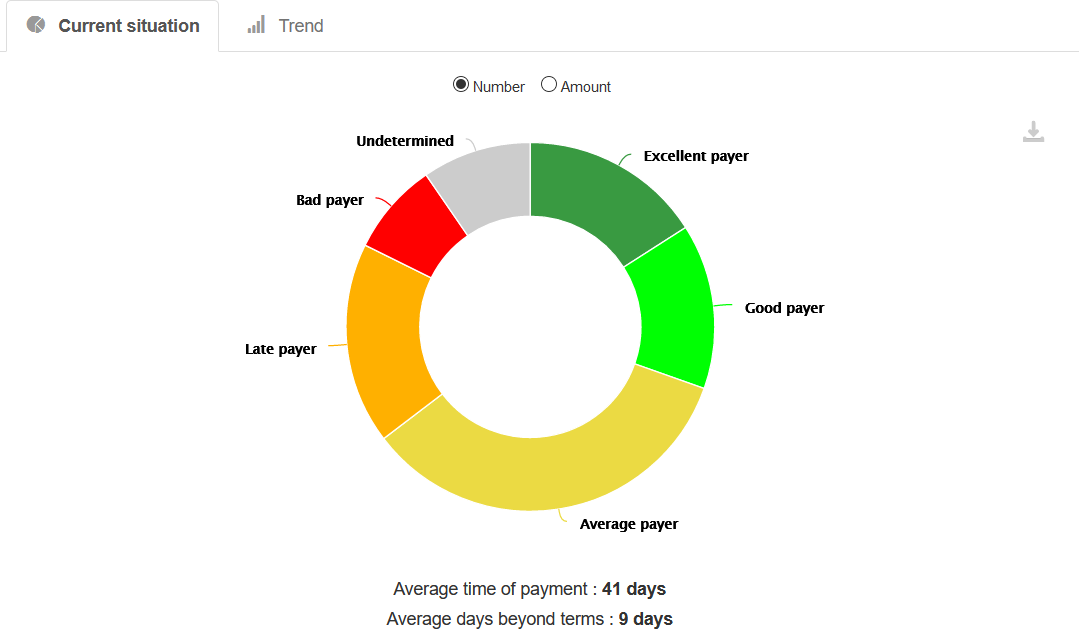

See how the determination of the payment profile rules is in My DSO Manager, their real-time restitution and the real effect in the practice of recovery and customer risk management are articulated!

Read the article !