Schneider Electric is committed to establishing a culture of value and expertise throughout their organization via ensuring that each individual feels valued, competent, and empowered to express their opinions. Their main objective is to collaborate and coordinate seamlessly across their different worldwide entities, a strategic imperative that becomes critical when considering organizational changes. The convergence of digital transformation and change management is a critical component in this endeavor, strategically leveraged to magnify the human dimension inside their workforce. This collaborative effort has the dual purpose of improving employee experience while also strengthening their ability to service a worldwide clientele successfully.

The incorporation of a cutting-edge cloud-based credit management software system was a key to their multidimensional strategy. This endeavor, however, goes beyond mere technology breakthroughs; it represents a dedication to long-term goals. Rather than limiting the discussion to all the benefits the solution of My DSO Manager provides to their credit management area, their goals are much broader. This program was rigorously evaluated by their own employees before being implemented across the whole firm. This precedent represents a watershed moment in evaluation methodology and the adaptability of the solution. They negotiated the complexities that come with enterprise-scale transformational projects by incorporating feedback from internal stakeholders during execution.

Foremost among their aspirations was to integrate a software solution that was uniquely linked with the critical pillars of credit management. This user-centric strategy ensures that credit managers lead the initiative, removing unnecessary complexity for information system administrators and IT departments. This adaptability demonstrates their thorough understanding of operational requirements, indicating a progression in the articulation of their actual demands.

Their objectives encompassed harmonizing global data repositories, extracting important insights from this massive corpus, and providing practical suggestions. This effort is unusual in that it encourages employees to refine their daily tactics, which are supported by a foundation of educated judgments.

![]() Our pursuit of analytical excellence revolved around harnessing the power of Artificial Intelligence (AI). This involved a meticulous process that begins with the harmonization and centralization of vast datasets through a cutting-edge software. Through this initial step, we laid the foundation for a more sophisticated and insightful analysis. The significance of this strategy became even more apparent when critical aspects it addressed were considered. Utilizing AI-driven methodologies, we delved into crucial domains such as credit risk assessment. This involved generating a credit risk score, assigning a credit risk category, and predicting an appropriate credit limit for each client's account receivables. The value of this procedure multiplies. It provides us with a thorough and nuanced understanding of our strategic clients. This is not a one-size-fits-all approach, but rather a customized evaluation that takes into account the unique characteristics and circumstances of each client. By accurately calculating their credit limits, we ensured that our financial interactions with them continue to meet their particular needs.

Our pursuit of analytical excellence revolved around harnessing the power of Artificial Intelligence (AI). This involved a meticulous process that begins with the harmonization and centralization of vast datasets through a cutting-edge software. Through this initial step, we laid the foundation for a more sophisticated and insightful analysis. The significance of this strategy became even more apparent when critical aspects it addressed were considered. Utilizing AI-driven methodologies, we delved into crucial domains such as credit risk assessment. This involved generating a credit risk score, assigning a credit risk category, and predicting an appropriate credit limit for each client's account receivables. The value of this procedure multiplies. It provides us with a thorough and nuanced understanding of our strategic clients. This is not a one-size-fits-all approach, but rather a customized evaluation that takes into account the unique characteristics and circumstances of each client. By accurately calculating their credit limits, we ensured that our financial interactions with them continue to meet their particular needs.

In addition, this exhaustive analysis extends beyond an internal strategy. With the data generated by AI models, we are in a position to negotiate with insurers in a more informed manner. This can include discussions on both the amount of credit extended and the contractual frameworks underlying it. The precise and credible information at our disposal enables us to confidently engage in these discussions, resulting in more favorable outcomes for all parties.

-Anna Chudy, Schneider Electric

As stakeholders are equipped to trace and comprehend critical indications easily, whether at the entity or group level, thanks to democratized access to information, this universal accessibility bolsters real-time, effortless reporting across credit management, commercial, and financial sectors. These insights are dynamically updated, providing stakeholders with a clear perspective on the impact of their contributions in the digital arena.

Schneider Electric began the project within their UK organizations, then scaled over a large network, eventually encompassing following geographical regions:

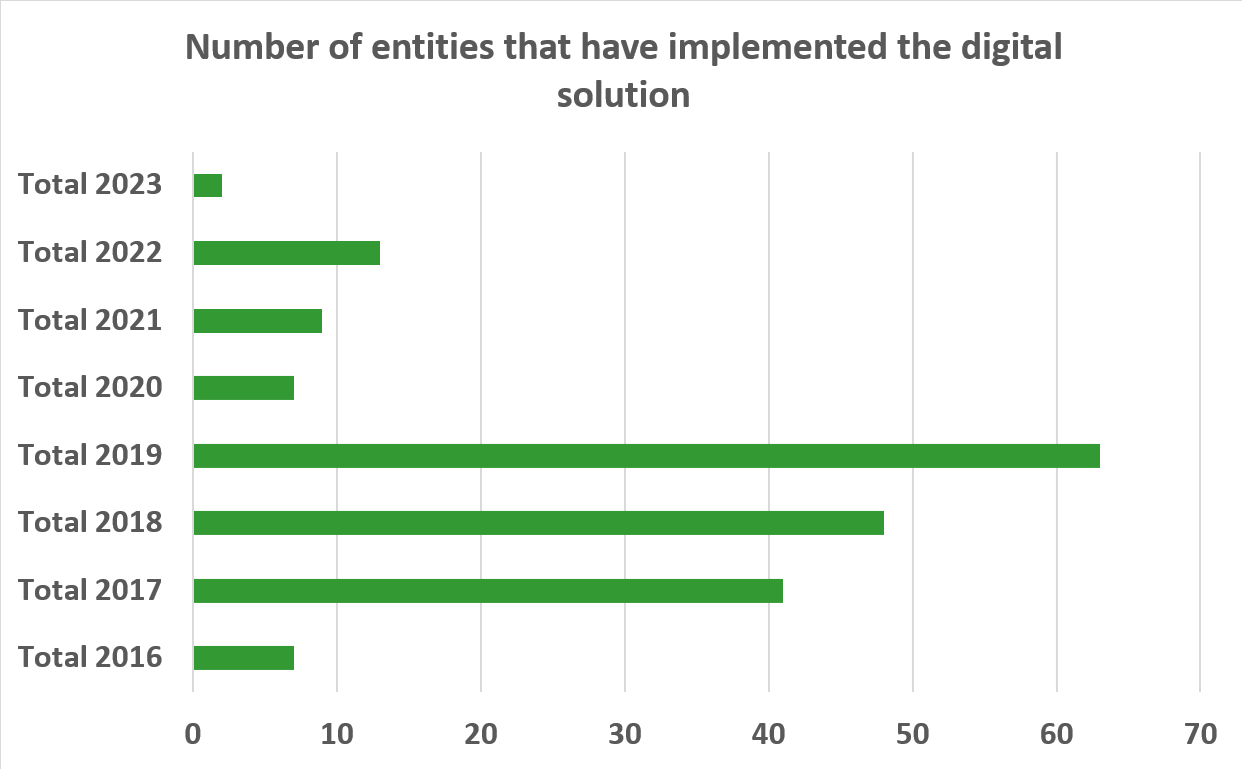

This transformative journey mostly spanned 2016 to 2019, accompanied by the anticipated complexities of harmonizing global processes.

Nonetheless, the pivot of this achievement was their credit managers, the fundamental architects of this digital transformation, along with the right choice of the solution which was evaluated by themselves at the first place.

This participatory participation accelerated the assessment and execution of benefits and drawbacks, resulting in an agile, yet deliberate, transformation.

This project, gratefully, went beyond technology modernization. It transformed their workforce, expanding their capabilities from tactical to strategic levels. This empowerment fueled astute assessments of both short- and long-term organizational plans, while also enhancing stakeholder interactions with renowned clients. This achievement goes beyond the practical application of technology; it champions consolidation.

By combining various digital platforms, Schneider Electric provided a unified interface that improves connections, communication and collaboration. The emphasis on analytical dimensions improved credit managers' decision-making abilities by transforming data into every day, measurable benefits.

As they traveled through this transformational journey, international collaboration among 192 entities flourished, demonstrating the long-term impact of their endeavor, which is still ongoing.