Nowadays, profiling is best known as a solid way to collect information related to the profiles of Internet users from their reactions to e-mails, advertisements and their browsing behavior on the web in order to identify in particular their buying behavior.

So why not imagine that your customers are also Internet users whose purchasing behavior must be analyzed through the prism of their payments since it is your products or services that have been invoiced?

This is what we call defining the payment profile. There is a significant number of companies that provide payment profiles based on market observation.

But imagine that tomorrow you will be able to determine your own paying profiles.. Indeed, are you going to consider that your customer is a bad payer on the pretext that their national or international rating is not good? And conversely, do you think that a good-rated customer will certainly adopts a Good Payer profile with your company?

First, let's try to define what is a good payer: it is a customer who respects the contractual due dates mentioned on the invoices and who triggers his payment so that the cash arrives on the supplier's account on time..

Indeed, are you going to consider that your customer is a bad payer on the pretext that their national or international rating is not good? And conversely, do you think that a good-rated customer will certainly adopts a Good Payer profile with your company?

First, let's try to define what is a good payer: it is a customer who respects the contractual due dates mentioned on the invoices and who triggers his payment so that the cash arrives on the supplier's account on time..

In other words, it is a customer who has no overdue. I even think that he can even be called a Very Good Payer.

So what is the good payer, who is he?

This is the customer who is only a few days late at most. Obviously, this analysis must be done on the average delay in order to have a homogeneous and smoothed vision of what really characterizes the payment behavior of the customer.

We see the arising of a payment profile: relying on payment experiences with a history of a few months

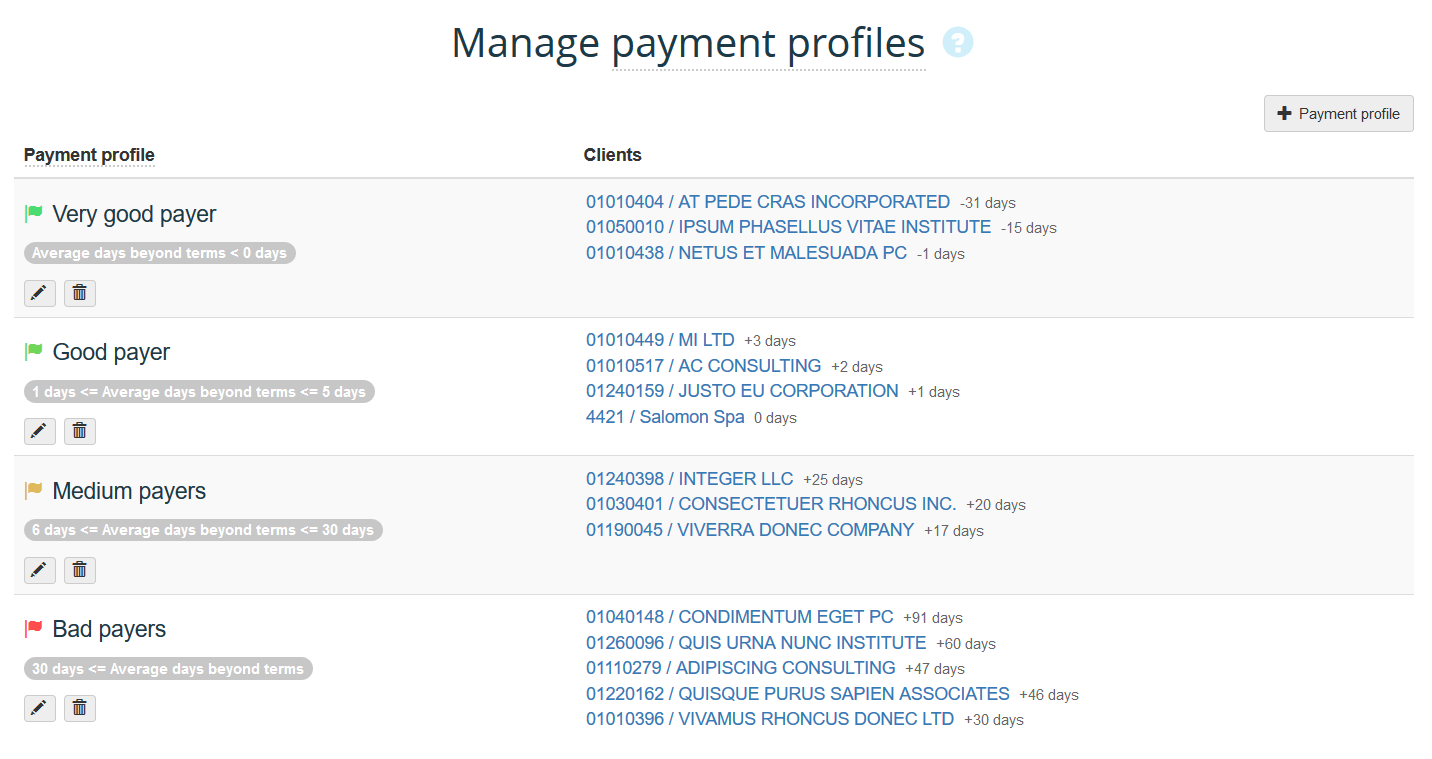

The most complex operation consists in agreeing on the classification of payment profiles and the associated management rule. We have to define the range of the average number of days late and to associate it with a profile.

The matrix below presents an interesting framework:

The ultimate is that your customers are then automatically attached to a profile according to the average delay: a clear, synthetic, reliable vision of your customer portfolio. Note that a customer with a so-called bad payer profile may only be because you are their supplier, so it is also an effective lever to ensure that your Order to Cash process is under control in order to avoid making your own Bad Payers.

So go ahead, become the Profiler of your own customers.

Note that a customer with a so-called bad payer profile may only be because you are their supplier, so it is also an effective lever to ensure that your Order to Cash process is under control in order to avoid making your own Bad Payers.

So go ahead, become the Profiler of your own customers.

More information: Manage payment profiles.

So why not imagine that your customers are also Internet users whose purchasing behavior must be analyzed through the prism of their payments since it is your products or services that have been invoiced?

This is what we call defining the payment profile. There is a significant number of companies that provide payment profiles based on market observation.

But imagine that tomorrow you will be able to determine your own paying profiles..

In other words, it is a customer who has no overdue. I even think that he can even be called a Very Good Payer.

So what is the good payer, who is he?

This is the customer who is only a few days late at most. Obviously, this analysis must be done on the average delay in order to have a homogeneous and smoothed vision of what really characterizes the payment behavior of the customer.

We see the arising of a payment profile: relying on payment experiences with a history of a few months

The most complex operation consists in agreeing on the classification of payment profiles and the associated management rule. We have to define the range of the average number of days late and to associate it with a profile.

The matrix below presents an interesting framework:

The ultimate is that your customers are then automatically attached to a profile according to the average delay: a clear, synthetic, reliable vision of your customer portfolio.

More information: Manage payment profiles.