Downloadable tools are available at the bottom of the page

Propose, negotiate, obtain an advance payment in exchange of a commercial discount is a great way to improve cash flow and reduce the overall risk to have default customers accounts.

Indeed, longer is the time during which bills are not settled, greater is the risk of outstanding is high. There is therefore clearly a statistical link between the DSO (the average number of days fixed in the receivables) and overdue invoices.

Moreover, the advance payment against a discount is a useful tool in many contexts. Each company has the ability to set its discount rate, depending on its objectives and constraints (profitability, liquidity constraints ... etc. .).

The real annual interest rate of the operation is therefore calculated as follows: discount rate granted / (number of days prepaid / 360).

When you set up a standard prepaid offer, it should appear:

When you set up a standard prepaid offer, it should appear:

Indeed, it is first necessary to determine what is the average cost of money in your business. It depends on its origin (shareholders, banks, third ... etc..). This allows to know the breakeven on prepaid offers. These can be profitable or can cost to your company.

The two cases are possible. Everything depends on the context of your company and the business relationship. In fact, if your company does not have cash flow problems and that your client is creditworthy it does not make sense to propose a discount rate higher than the average cost of capital of your business.

However, if your business' cash is tight and / or if your client is insolvent, it may be interesting to "drop" few points of margin to be paid immediately rather than 60 days after invoice date if all goes well! The limit of the discount is the profitability of your business. Indeed, it would not make sense to offer a higher interest rate if your profitability very low. This would contribute to decrease it more. The gains / cost ratio must always be taken into account knowing that the gains are many: cash, commercial, risk reduction, improved balance sheet.

The proposed tool below allows you to calculate the weighted average cost of capital of your business and sets the discount rate consistent that you can offer your customers depending on the context.

The limit of the discount is the profitability of your business. Indeed, it would not make sense to offer a higher interest rate if your profitability very low. This would contribute to decrease it more. The gains / cost ratio must always be taken into account knowing that the gains are many: cash, commercial, risk reduction, improved balance sheet.

The proposed tool below allows you to calculate the weighted average cost of capital of your business and sets the discount rate consistent that you can offer your customers depending on the context.

Indeed, longer is the time during which bills are not settled, greater is the risk of outstanding is high. There is therefore clearly a statistical link between the DSO (the average number of days fixed in the receivables) and overdue invoices.

Moreover, the advance payment against a discount is a useful tool in many contexts. Each company has the ability to set its discount rate, depending on its objectives and constraints (profitability, liquidity constraints ... etc. .).

The benefits of commercial discount

Insert in its contracts and its sales conditions prepayment offers (relative to the maturity date of the invoice) has only advantages.- Commercial advantage: your client may be interested in this offer and use it to improve its profitability. Is better to give this money to its client rather than to his bank for a financial discount!

- Financial advantage:

- Advance payments will improve cash flow and working capital requirement,

- They may help to improve the profitability of your business when the % discount is less than the weighted average cost of capital of your business.

- This offer represents a base from which you can perform special actions based on the context and situation of your cash. For example, an offer prepaid together with a very attractive discount rate when cash flow is tight or when you want to improve your balance at the end of accounting year.

- If the buyer has a high risk of insolvency at short term, offer him a very attractive rate can help you achieve revenue (take the order and do business) despite its financial situation while avoiding bad debts.

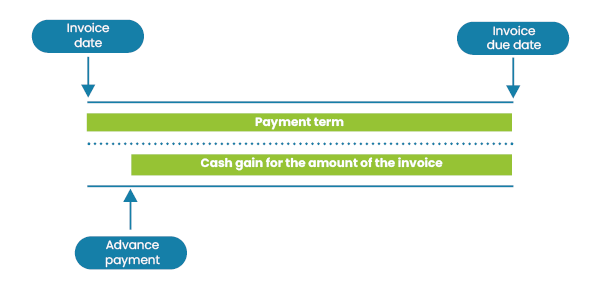

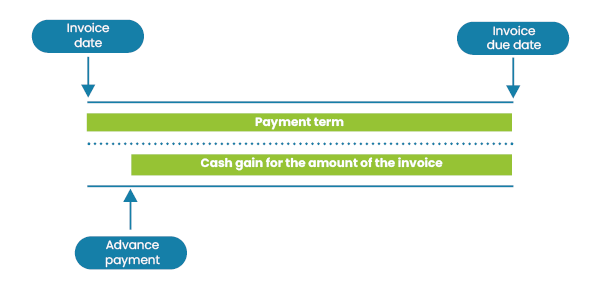

Discounted payment process

The payment is made before the due date of the invoice which is based on payment term of the buyer. The difference between the effective date of payment and the due date is the period of cash gain of the seller.The real annual interest rate of the operation is therefore calculated as follows: discount rate granted / (number of days prepaid / 360).

- On your bills with a specific mention. See invoice template tool.

- In the Sales conditions.

How to set up the discount rate?

The interest rate offered to customers depends on the average cost of funding of your business and on the purpose of your offer.Indeed, it is first necessary to determine what is the average cost of money in your business. It depends on its origin (shareholders, banks, third ... etc..). This allows to know the breakeven on prepaid offers. These can be profitable or can cost to your company.

The two cases are possible. Everything depends on the context of your company and the business relationship. In fact, if your company does not have cash flow problems and that your client is creditworthy it does not make sense to propose a discount rate higher than the average cost of capital of your business.

However, if your business' cash is tight and / or if your client is insolvent, it may be interesting to "drop" few points of margin to be paid immediately rather than 60 days after invoice date if all goes well!