The cash against documents is a management and payment tool for international transactions. Its purpose is for the vendor to get the amount owed by a customer from a bank against delivery of documents (invoices, bill of lading...etc.).

Documents are delivered to the customer only against payment or acceptance of a bill of exchange. In this last case, the bill of exchange may be guaranteed by a bank, which provides the supplier with a significantly higher payment security.

Obtaining documents allow the buyer to take possession of the goods and to clear the shipment at customs.

The risks are very important for the seller in a cash against documents. This tool does not provide a good payment security.

The risks are very important for the seller in a cash against documents. This tool does not provide a good payment security.

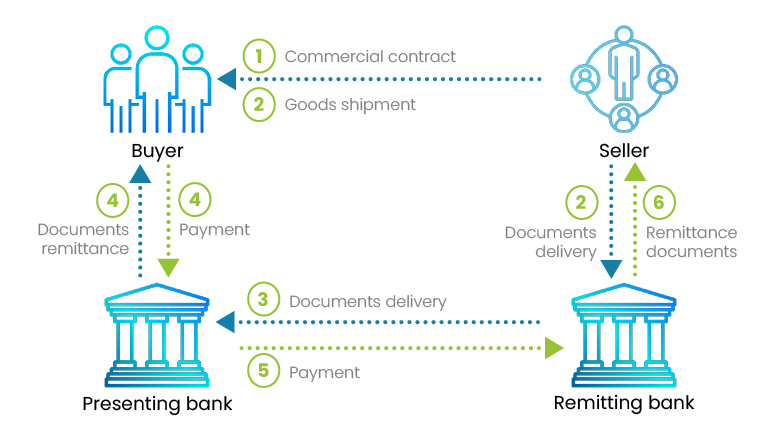

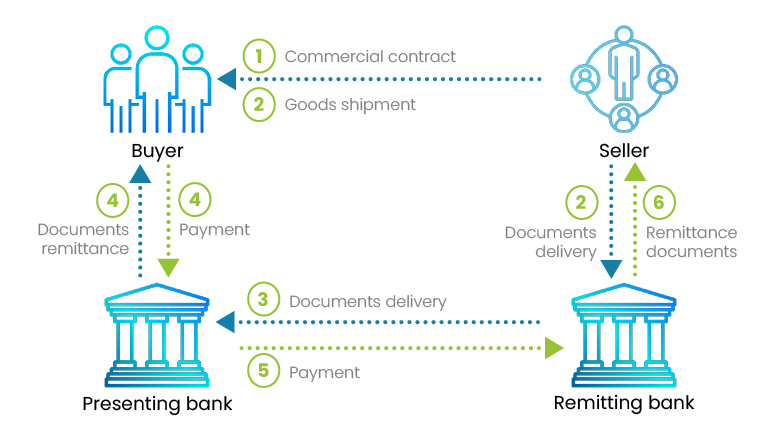

Conclusion of the contract between the customer / supplier and importer / exporter.

Conclusion of the contract between the customer / supplier and importer / exporter.

Shipment of goods and forwarding of documents to the remitting bank.

Shipment of goods and forwarding of documents to the remitting bank.

Sending documents to the presenting bank. The supplier's bank (remitting bank) transmit these documents to the customer's bank, and asked to return them to the client, either against payment or against acceptance.

Sending documents to the presenting bank. The supplier's bank (remitting bank) transmit these documents to the customer's bank, and asked to return them to the client, either against payment or against acceptance.

Delivery of documents to the client. The presenting bank delivers the documents to the client (buyer) either against payment or against acceptance in accordance with instructions received from the remitting bank. The customer can take the goods.

Delivery of documents to the client. The presenting bank delivers the documents to the client (buyer) either against payment or against acceptance in accordance with instructions received from the remitting bank. The customer can take the goods.

Payment of the remitting bank and the supplier.

Payment of the remitting bank and the supplier.

Cash against documents is simple, fast (the goods sent very quickly) and is a cheap option. However, it gives only a relative safety of payment especially in case of cancellation of the buyer or if the presenting bank fails to enforce payment against delivery of documents.

Cash against documents is simple, fast (the goods sent very quickly) and is a cheap option. However, it gives only a relative safety of payment especially in case of cancellation of the buyer or if the presenting bank fails to enforce payment against delivery of documents.

Documents are delivered to the customer only against payment or acceptance of a bill of exchange. In this last case, the bill of exchange may be guaranteed by a bank, which provides the supplier with a significantly higher payment security.

Obtaining documents allow the buyer to take possession of the goods and to clear the shipment at customs.

Cash against document method advantages

- Ease of implementation by the buyer: its formalism is considerably reduced compared to the documentary credit.

- No use of bank credit line.

- Ease of use by the seller.

- Banks do not control the documents as for a documentary credit.

- Cost is low.

-

My DSO Manager, the innovative debt collection software

My DSO Manager offers powerful and flexible features for credit management and debt collection management.

It is very easy to implement and user friendly.

Dunning ations are triggered depending on the collection scenario assigned to each customer and the situation of the account (overdue invoices ...).

Recovery documents (e-mails, interactive e-mails, postmail letters, SMS, ...) are easy to create and to customize with the use of #Hashtags. See more with the demo.

Disadvantages of cash against documents

The disadvantages are related to the fact that banks are not engaged as for a documentary credit. So there is no bank guarantee of payment or insurance on the proper management of the process by the presenting bank.- Issuance of documents to the buyer without payment or without acceptance of a draft.

- Refusal of the buyer to take possession of documents and goods. In this case the seller is not paid and finds himself with the material located in the country of the buyer!

- No payment to the seller.

How to improve the cash against document?

Several best practices can improve this imperfect instrument.- Give specific instructions to the presenting bank.

- Send the original documents to the bank and never directly to the buyer.

- Refer to the ICC Rules 522

- Set the period for payment from a generator which is controlled (eg issuance of B / L).

- Ship by sea and label the B / L to order the bank.

Process

Conclusion of the contract between the customer / supplier and importer / exporter.

Conclusion of the contract between the customer / supplier and importer / exporter.  Shipment of goods and forwarding of documents to the remitting bank.

Shipment of goods and forwarding of documents to the remitting bank.  Sending documents to the presenting bank. The supplier's bank (remitting bank) transmit these documents to the customer's bank, and asked to return them to the client, either against payment or against acceptance.

Sending documents to the presenting bank. The supplier's bank (remitting bank) transmit these documents to the customer's bank, and asked to return them to the client, either against payment or against acceptance.  Delivery of documents to the client. The presenting bank delivers the documents to the client (buyer) either against payment or against acceptance in accordance with instructions received from the remitting bank. The customer can take the goods.

Delivery of documents to the client. The presenting bank delivers the documents to the client (buyer) either against payment or against acceptance in accordance with instructions received from the remitting bank. The customer can take the goods.

Payment of the remitting bank and the supplier.

Payment of the remitting bank and the supplier.