Nowadays, the "documentary credit" has changed considerably but the basic principle is similar to that which existed 2500 years ago. It is widely used and provides, under certain conditions, an excellent level of securing business.

It is both a means of payment and a bank guarantee that protects the supplier and the buyer and force both parties to fulfill their commitments. It requires a binding formal with which compliance is the condition of its validity.

It is therefore necessary that it is opened by a prime bank (usually by the bank of the buyer). It is recommended to confirm it with his own bank. Confirmation transfers the risk that the issuing bank fails to meet its commitments to its own bank.

-

My DSO Manager, the online credit management software

My DSO Manager offers a set of powerful features to manage accounts receivable and to improve working capital.

It includes innovative functionnalities for credit management and cash collection like interactive e-mails including payment solutions, etc.

Dunning documents (e-mails, interactive emails, SMS, mails...) are dynamically generated through #Hashtag and are customizable for each customer for an optimum efficiency required to manage export receivable.

The software can be used very quickly with Smart upload module, automatic import by secured FTP, API or our connectors (Quickbooks, Salesforce...). My DSO Manager is used by more than 1,000 companies in 80 countries. See more with the online demo.

Why using the documentary credit?

The objective of the documentary credit is to reconcile the conflicting expectations of the seller and the buyer:Seller: Be paid the agreed amount on the date specified in the contract.

Buyer:

- Being delivered with goods ordered in accordance with what was expected at the opening of documentary credit..

- Make sure not to pay the seller before it has fulfilled its contractual obligations.

Some definitions

The contracto: the buyer.The issuing bank : buyer's bank.

The advising bank (and possibly confirming) the seller's bank.

The beneficiary : the seller.

Banks, pivots of the documentary credit

The role of banks is central. Their commitments are conditioned by the presentation of compliant documents from the seller. The bank makes precise control of documents to be 100% consistent with the terms of the credit.3 types of documentary credit

Revocable documentary credit

It has the characteristic that it can be revoked or amended at any time without notice by the issuing bank or the payer (buyer). It provides no security and is therefore prohibited.Irrevocable and notified credit

This credit materializes a firm and irrevocable commitment from the issuing bank (the buyer's one). So it can not be changed or canceled without the agreement of all parties. The advising bank (the seller's bank) assumes no risk. The risk therefore focuses entirely on the issuing bank.This Credit is acceptable when the political risk is low and the issuing bank is solvent. If this is not the case, it is insufficient.

Irrevocable and confirmed documentary credit

It differs from the previous credit by the fact that the seller's bank adds its commitment to pay on receipt of documents. It therefore assumes the risk of insolvency of the buyer and his bank whatever is the reason (political event in the country, failure, lack of currency ... etc).This credit provides maximum security to the seller when his own bank is solvent. It is preferred over the irrevocable and notified credit even if the cost is higher due to the commitment of the seller's bank. The payment is also faster than for other types of credit, between 2 and 7 days.

Process

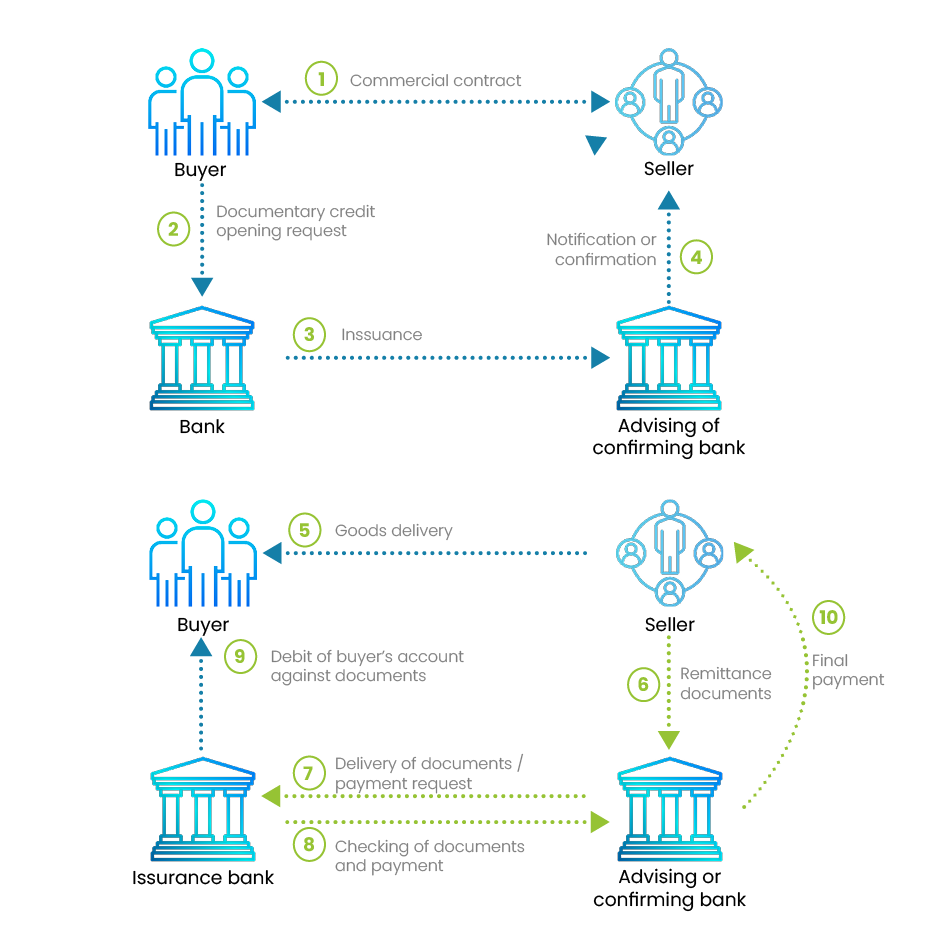

Conclusion of the contract between the customer / supplier and importer / exporter. During negotiations, it was agreed that the payment would be an irrevocable letter of credit.

Conclusion of the contract between the customer / supplier and importer / exporter. During negotiations, it was agreed that the payment would be an irrevocable letter of credit.  Opening Instructions. The client requests his bank to open a documentary credit that must be notified without confirmation from the seller's bank. In the opening statements, the customer fills out a form specifying the documents required for the importation of the goods.

Opening Instructions. The client requests his bank to open a documentary credit that must be notified without confirmation from the seller's bank. In the opening statements, the customer fills out a form specifying the documents required for the importation of the goods. The buyer's bank checks the creditworthiness of the customer as well as the signatures on the application form. It also ensures that the instructions are clear and complete.

Opening. The customer's bank issues the letter of credit and sends via the SWIFT network to the supplier's bank. The buyer then receives a copy of the sending.

Opening. The customer's bank issues the letter of credit and sends via the SWIFT network to the supplier's bank. The buyer then receives a copy of the sending. After receiving the credit, the supplier's bank verifies its authenticity and if it is subject to the UCP (Uniform Customs and Practice). Then, it checks if the instructions do not contain errors.

Notification. The seller's bank notifies the client that he has received a letter of credit in his favor. Control: Upon receipt of the notice, the recipient checks if the specified conditions are in accordance with what had been established during the negotiations. If the beneficiary does not agree with any clause, it must ask the buyer to change the conditions.

Notification. The seller's bank notifies the client that he has received a letter of credit in his favor. Control: Upon receipt of the notice, the recipient checks if the specified conditions are in accordance with what had been established during the negotiations. If the beneficiary does not agree with any clause, it must ask the buyer to change the conditions.  Goods delivery. The recipient sends the goods and prepares the documents requested in the instructions of the credit.

Goods delivery. The recipient sends the goods and prepares the documents requested in the instructions of the credit.  Documents remittance. The beneficiary shall submit the documents to the bank. The seller's bank verifies that all documents comply with what was required in the documentary credit. If errors are present, the client is no longer guaranteed to be paid.

Documents remittance. The beneficiary shall submit the documents to the bank. The seller's bank verifies that all documents comply with what was required in the documentary credit. If errors are present, the client is no longer guaranteed to be paid.  Documents delivery. The seller's bank sends the documents to the buyer's bank and asks to be paid.

Documents delivery. The seller's bank sends the documents to the buyer's bank and asks to be paid.  Verification. The customer's bank verifies all documents to decide on compliance. If everything is in order, the customer's bank makes payment to the supplier's bank, less any applicable fees.

Verification. The customer's bank verifies all documents to decide on compliance. If everything is in order, the customer's bank makes payment to the supplier's bank, less any applicable fees.  Buyer's bank account debit against documents. The customer's bank debits the buyer of the amount of the documentary credit, less applicable fees and gave him all the documents. The client can clear the goods and take possession.

Buyer's bank account debit against documents. The customer's bank debits the buyer of the amount of the documentary credit, less applicable fees and gave him all the documents. The client can clear the goods and take possession.  Payment. The supplier's bank pays the seller less any applicable fees.

Payment. The supplier's bank pays the seller less any applicable fees.

Documentary credit and payment delays

There are three embodiments of the documentary credit:- Credit achievable through "payment": payment is made by the bank or deferred for a number of days

- Credit through the "acceptance": payment is made by a bill of exchange at sight or at maturity. It is included in the documents and must be drawn on the issuing bank.

- Credit through "negotiation" : if the payment is scheduled to expire, eg 90 days, the seller requests the bank to discount the bill to be paid in cash. The bank deducts financial costs of payment.

Negotiate a documentary credit

Essential step to integrate in the trade negotiations, the exchange with the client must determine:- The type of credit (revocable notified or confirmed).

- Required documents list.

- The incoterm to be used.

- Who will pay the fees (the seller or the buyer)?

What is the cost?

The documentary credit is a relatively expensive tool especially when it is confirmed. It has several costs that depend on the type of credit and of risk assessment conducted by the confirming bank. The higher the risk, the higher the cost. There is a cost ranging from 0.5% to 3% per year for confirmation.Other types of documentary credits

The back to back documentary credit: it is a new credit issued by the advising or confirming bank in favor of the supplier of the seller. No legal relationship links both documentary credit but it allows the seller to not inform the buyer that it outsources its operation.The transferable documentary credit : This is a documentary credit that the seller can transfer all or part of the supplier with the same conditions. The recipient becomes the supplier of the seller. The transferred credit will be achieved through the delivery of documents corresponding to those required for the first documentary credit.