It is issued as a documentary credit with or without confirmation. However, it may be sent direct to the supplier without going through his bank.

The advantages of the standby letter of credit

- L / C standby facilitates exchanges that do not have to be formatted as with a documentary credit.

- It allows the seller to accept a simple mode of payment such as bank transfer with the security of the bank guarantee in the background.

- Its cost is low relative to the documentary credit

-

My DSO Manager, the online debt recovery software

My DSO Manager offers a set of powerful features to manage accounts receivable and to improve working capital.

It includes innovative functionnalities for credit management and debt collection.

Dunning documents (emails, interactive emails, SMS, mails...) are dynamically generated through #Hashtag and are customizable for each customer for optimum efficiency.

The software can be used very quickly with Smart upload module, automatic import by FTP or our connector (Quickbooks, Salesforce...). See more with the online demo.

Process

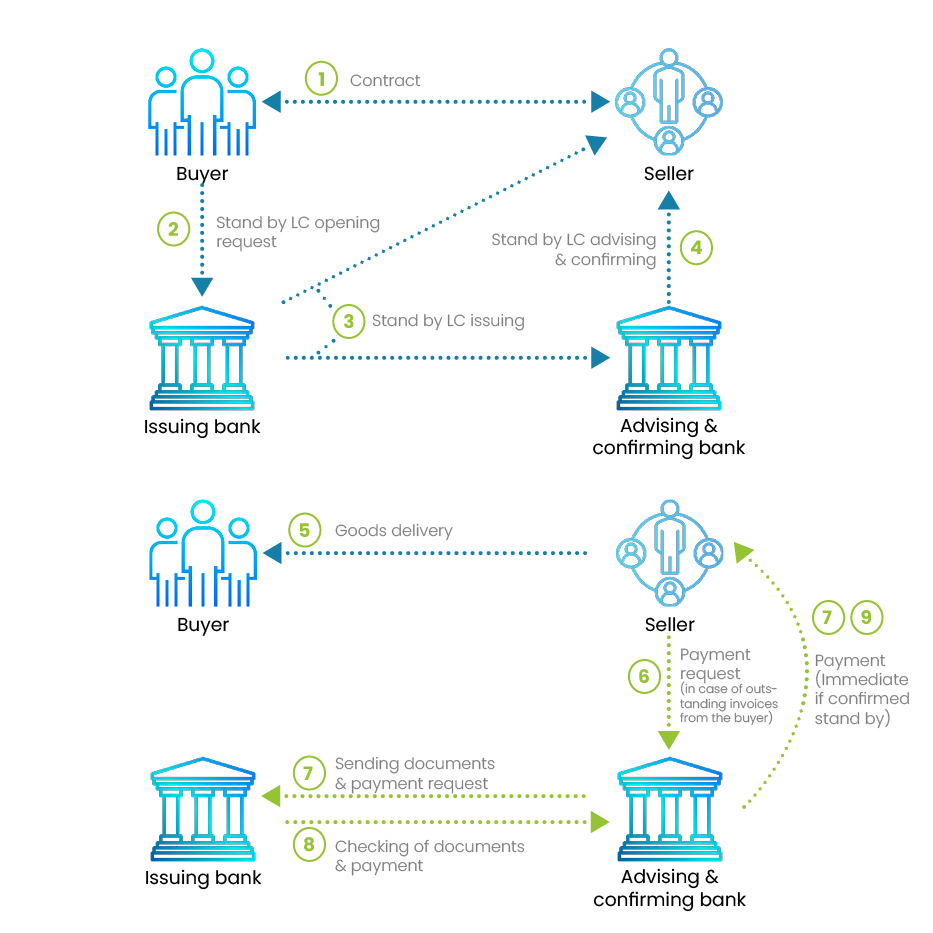

The implementation is similar to the documentary credit except that the standby letter of credit can be sent directly to the supplier without going through his bank.

Conclusion of contract between the customer / importer and supplier / exporter. During negotiations it was agreed that the payment would be made by an irrevocable letter of credit.

Conclusion of contract between the customer / importer and supplier / exporter. During negotiations it was agreed that the payment would be made by an irrevocable letter of credit.  Opening Instructions. The client requests his bank to open a Letter of Credit which must be notified without confirmation from the seller's bank. In opening statements, the client fills out a form specifying the documents required for import the goods. The buyer's bank verifies the solvency of its clients as well as the signatures on the application form. It also ensures that the instructions are clear and complete.

Opening Instructions. The client requests his bank to open a Letter of Credit which must be notified without confirmation from the seller's bank. In opening statements, the client fills out a form specifying the documents required for import the goods. The buyer's bank verifies the solvency of its clients as well as the signatures on the application form. It also ensures that the instructions are clear and complete.  Opening. The customer's bank issues the Letter of Credit and sent via the SWIFT network to the supplier's bank. The buyer then receives a copy of the consignment.

Opening. The customer's bank issues the Letter of Credit and sent via the SWIFT network to the supplier's bank. The buyer then receives a copy of the consignment.After receiving the letter of credit, the supplier's bank verifies the authenticity of documentary credit and if it is subject to the UCP (Uniform Customs and Practice). It then checks if the instructions not contain errors.

Notification. The seller’s bank notifies his client that he received a letter of credit in its favor.

Notification. The seller’s bank notifies his client that he received a letter of credit in its favor. Upon receipt of the notice, the recipient checks whether the conditions specified in the documentary credit are consistent with what had been established during negotiations. If the beneficiary does not agree with any clause, it must ask the buyer to change the terms.

The supplier ships the goods to his client. But the buyer does not pay the amount of goods delivered.

The supplier ships the goods to his client. But the buyer does not pay the amount of goods delivered.  The provider presents at that time the documents listed in the issue of the standby letter of credit to the correspondent bank (advising or confirming bank) which do the payment after checking the strict compliance of the standby letter of credit.

The provider presents at that time the documents listed in the issue of the standby letter of credit to the correspondent bank (advising or confirming bank) which do the payment after checking the strict compliance of the standby letter of credit.  advising or confirming bank presents the documents to the issuing bank against payment that is returned to the supplier.

advising or confirming bank presents the documents to the issuing bank against payment that is returned to the supplier.