There are 2 types of outstanding payments for credit insurers:

If the purchaser manage to convince the credit insurer that there is a rightful dispute about your invoices you won’t be compensated any more.

credit insurance compensation" />

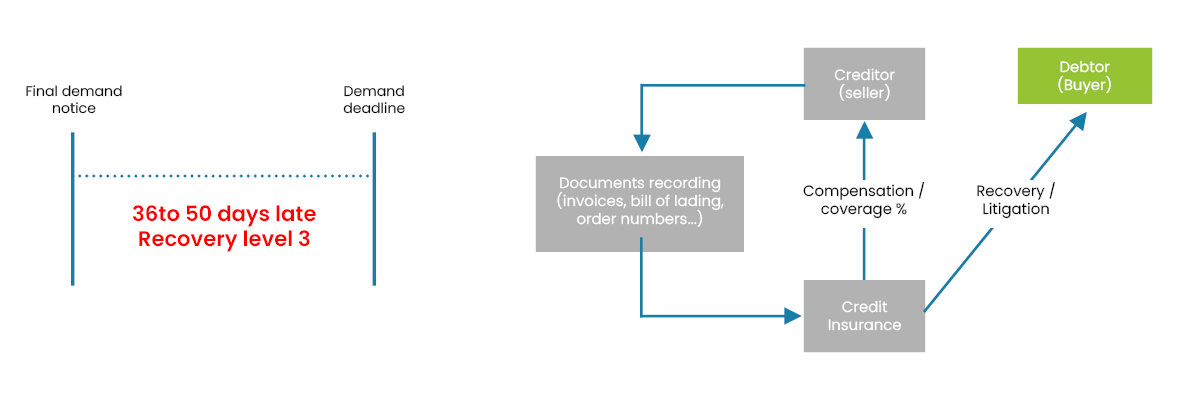

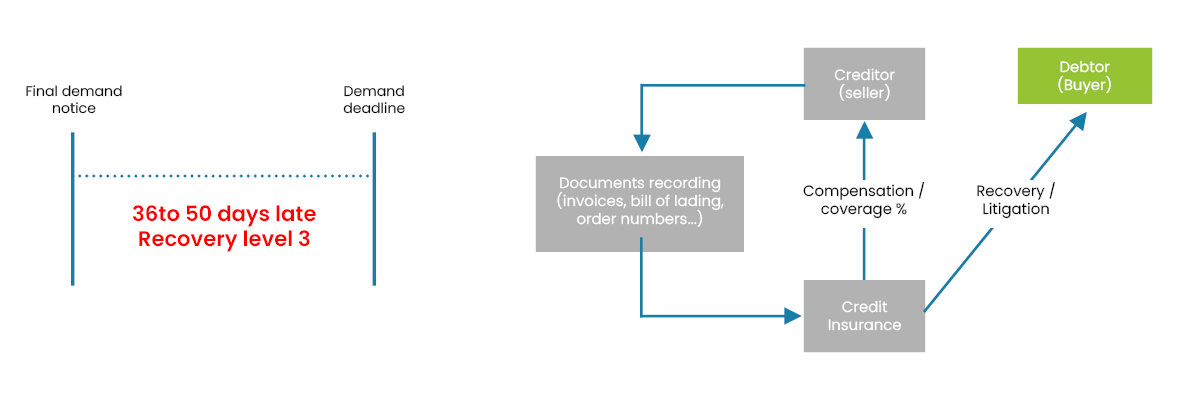

In order to get your compensation, you must report your unpaid within the contractual period agreed with your insurer and have respected each clause in your contract that imply good management of your receivables. Otherwise, you will be considered "neglected creditor" and your insurer will refuse to compensate you.

credit insurance compensation" />

In order to get your compensation, you must report your unpaid within the contractual period agreed with your insurer and have respected each clause in your contract that imply good management of your receivables. Otherwise, you will be considered "neglected creditor" and your insurer will refuse to compensate you.

Upon compensation paid by the insurer, he will turn against the debtor and will do the necessary steps in case of bankruptcy proceedings (statement of claim, negotiation with the administrator) and actions of collection in other cases. If he manages to get the full payment of the amount due, it is possible that he pay you back the full amount of your claim. When reporting the unpaid to the credit insurer you grant a mandate for the actions he will initiate for you to recover your bills.

When reporting the unpaid to the credit insurer you grant a mandate for the actions he will initiate for you to recover your bills.

The credit insurer becomes the creditor and considers your own client as his debtor. He will cancel the guarantees given to other suppliers of your client who may in their turn cancel credit lines previously established in its favor.

Before sending the record to the credit insurer you can warn your client about the risks he faces. He may change his mind and pay your bills.

The use of credit insurance requires a good receivables management and debt collection. If this is not the case, you will have both insurance costs and the cost of credit outstanding to bear. It is for this reason that the establishment of a credit insurance contract is often structuring your company because it forces to adapt your processes to the contractual terms of the credit insurance.

The use of credit insurance requires a good receivables management and debt collection. If this is not the case, you will have both insurance costs and the cost of credit outstanding to bear. It is for this reason that the establishment of a credit insurance contract is often structuring your company because it forces to adapt your processes to the contractual terms of the credit insurance.

- bad debts contracted after a bankruptcy proceedings concerning your client,

- unpaid without bankruptcy proceedings and due to a dispute, cash problem or dishonesty of the purchaser.

If the purchaser manage to convince the credit insurer that there is a rightful dispute about your invoices you won’t be compensated any more.

credit insurance compensation" />

credit insurance compensation" />Upon compensation paid by the insurer, he will turn against the debtor and will do the necessary steps in case of bankruptcy proceedings (statement of claim, negotiation with the administrator) and actions of collection in other cases. If he manages to get the full payment of the amount due, it is possible that he pay you back the full amount of your claim.

The credit insurer becomes the creditor and considers your own client as his debtor. He will cancel the guarantees given to other suppliers of your client who may in their turn cancel credit lines previously established in its favor.

Before sending the record to the credit insurer you can warn your client about the risks he faces. He may change his mind and pay your bills.