The summons to pay is usable in many countries. It is a legal procedure designed to compel your debtor to pay you through a judgment done in your favor by the Commercial Court.

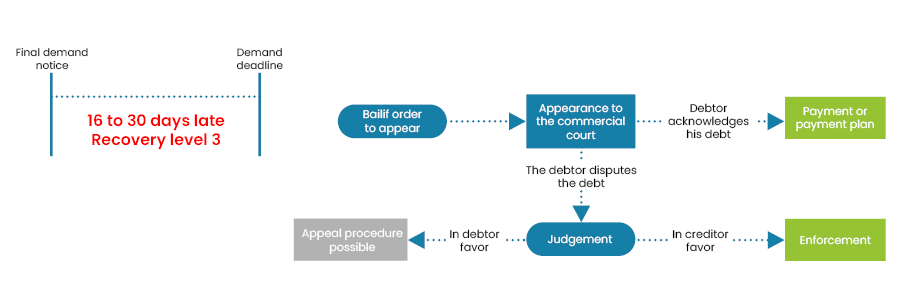

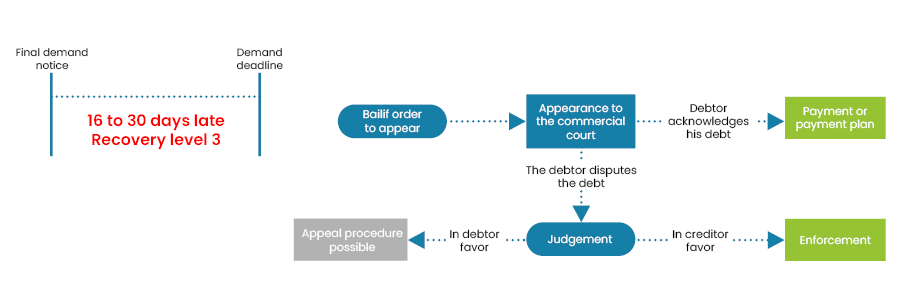

Longer (it can take up to 2 years) and more expensive, it is nevertheless preferable to the order for payment if you suspect that your debtor will dispute your claim (and make opposition to the order for payment) and send you back to a judgment to settle the litigation. The summons to pay is materialized by a note issued by a bailiff representing the plaintiff (creditor) to cite his opponent (the client or debtor) to appear to the Commercial Court. During the confrontation, make sure you have a complete file proving that your claim is:

The summons to pay is materialized by a note issued by a bailiff representing the plaintiff (creditor) to cite his opponent (the client or debtor) to appear to the Commercial Court. During the confrontation, make sure you have a complete file proving that your claim is:

Be preferably represented by a lawyer during a court appearance in order to increase your chances to win the lawsuit.

Be preferably represented by a lawyer during a court appearance in order to increase your chances to win the lawsuit.

Longer (it can take up to 2 years) and more expensive, it is nevertheless preferable to the order for payment if you suspect that your debtor will dispute your claim (and make opposition to the order for payment) and send you back to a judgment to settle the litigation.

The summons to pay process

- real: your debt must have an undeniable existence. The proof to be provided are order(s), delivery order (s), invoice(s), the contract signed by both parties and any correspondence in which the debtor acknowledges your claim.

- valuable: which means that its amount should be assessed. If you apply delay penalties, you may use the interest rate written in your sales conditions which has to be compliant with the Law.

- due ! Your claim must be for a specific amount that has fallen due at the time when the application for a summons to pay is submitted.