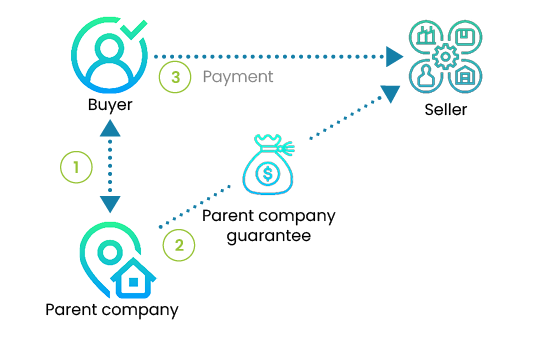

This contract is particularly relevant when your client is insolvent, but that he belongs to a parent company financially strong. It transfers the credit risk of your client on the guarantor.

Advantages and inconvenients of the parent company guarantee

- The implementation of a parent company guarantee is free.

- It requires a precise formalism from the guarantor in order to be valid. The person who signed must have the approval in writing of its Board of Directors otherwise the document is considered null!

- The parent company guarantee provides the same flexibility as the bank guarantee. You normally work with your client with a standard payment term,

- In case of unpaid invoices there are two possibilities:

- The guarantor honors its commitment and make the payment instead of your client,

- In the other case (the guarantor doesn’t want to pay) you will need to start a legal proceeding against him to get the guarantee applied and your Invoices paid.

-

My DSO Manager, the online debt recovery software

My DSO Manager offers powerful features to assess customers creditworthyness and to perform collection actions at the right time.

Dunning actions are triggered depending on the recovery scenario of each customer and the situation of the account (overdue invoices ...).

Recovery documents are dynamically generated through #Hashtag and are customizable for each customer for optimum efficiency.

The software can be used very quickly with Smart upload module, automatic import by FTP or our connector (Quickbooks, Salesforce...). See more with the online demo.