Downloadable tools are available at the bottom of the page

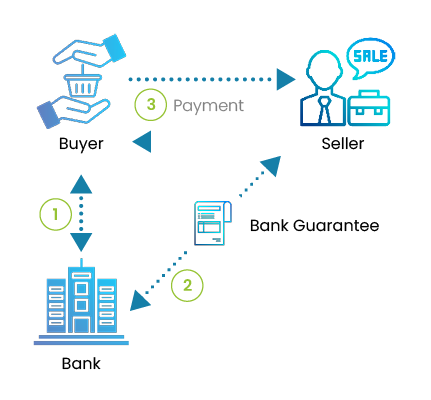

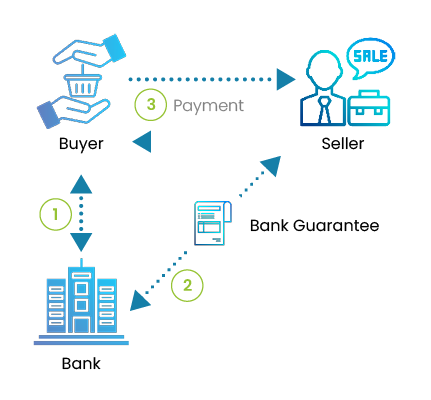

The bank guarantee on first demand is granted by the bank of your client. It is simple and very effective to protect your business against unpaid as far as the guarantor (the bank) is creditworthy.

In case of unpaid, the bank is obliged to pay you at receipt of a registered mail from you.

The bank guarantee allows you to give a "normal" payment term to your customer while being assured of the payment.

The cost depends on the bank and the risk estimation that the bank will do. It is generally calculated with a rate around 1% per year.

Request a bank guarantee to its client allows to realize the quality of his relationship with his bank. If she refuses this confirms the financial difficulties of your customer because it shows that it is not supported by its own bank.

Request a bank guarantee to its client allows to realize the quality of his relationship with his bank. If she refuses this confirms the financial difficulties of your customer because it shows that it is not supported by its own bank.

Offer to your customer to pay yourself all or part of the costs of the bank guarantee. Your customer will appreciate this offer which will limit the feeling of mistrust sometimes induced by a demand of bank guarantee.

Offer to your customer to pay yourself all or part of the costs of the bank guarantee. Your customer will appreciate this offer which will limit the feeling of mistrust sometimes induced by a demand of bank guarantee.

This kind of guarantee is used for international trade. This is the Standby Letter of Credit, effective against the risk of non payment of your foreign customers.

This kind of guarantee is used for international trade. This is the Standby Letter of Credit, effective against the risk of non payment of your foreign customers.

This solution is less flexible than the bank guarantee because you have to repeat the request for approval for each bill of exchange. However, it is possible to discount the bill of exchange which can be very good for your cash.

In case of unpaid, the bank is obliged to pay you at receipt of a registered mail from you.

The bank guarantee allows you to give a "normal" payment term to your customer while being assured of the payment.

The cost depends on the bank and the risk estimation that the bank will do. It is generally calculated with a rate around 1% per year.

The bank guarantee on demand

The bank guarantee for the domestic trade and the letter of credit stand by for the international trade are particularly suitable in the context of regular orders received with the same client. Beware of restrictive covenants used by some banks which degrade the level of guarantee.

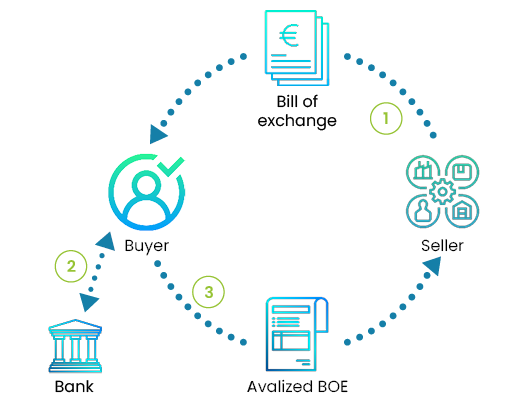

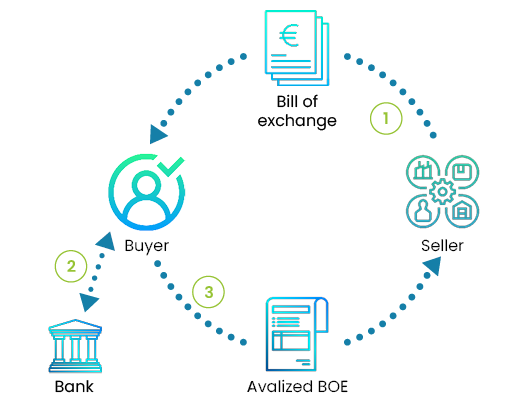

The endorsed bill of exchange

The bill of exchange endorsement makes sure that you will get the payment on your invoice due date. Unlike the bank guarantee which is disconnected from the means of payment, the bank's commitment relates specifically to the bill of exchange.This solution is less flexible than the bank guarantee because you have to repeat the request for approval for each bill of exchange. However, it is possible to discount the bill of exchange which can be very good for your cash.