- The understanding of the balance sheet and of the profit and loss account,

- The analysis of the large masses which compose them.

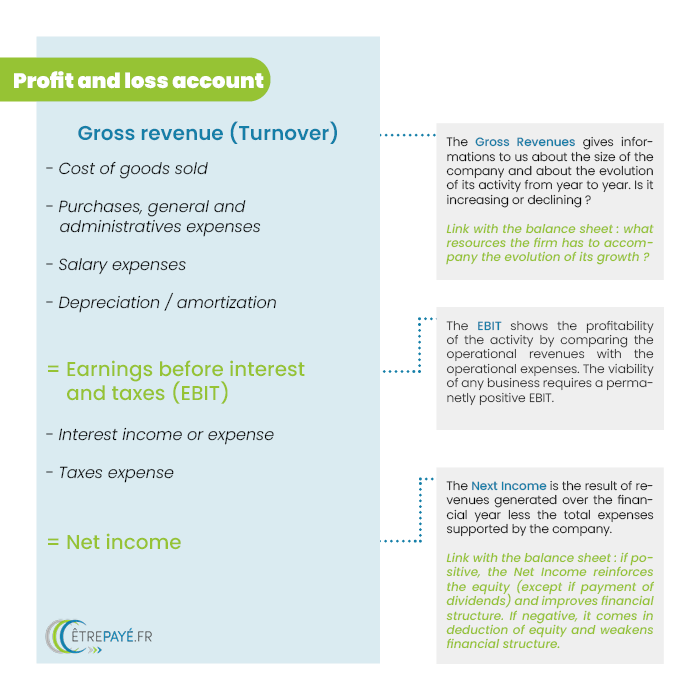

Understand the profit and loss account

The profit and loss account highlights the turnover accomplished over the given period (usually 1 year) from which it subtracts expenses supported by the business during the same period. The result of this subtraction shows the benefit or loss made by the company at the end of the financial year.

Why?

Simply because the need for cash rises with the increase in turnover while financial resources do not increase.

Consequently, problems of financing growth and cash difficulties can appear, which can be controlled only with third-party contributions (banks, factoring, credit given by suppliers etc.). This will reduce the financial autonomy of the company.

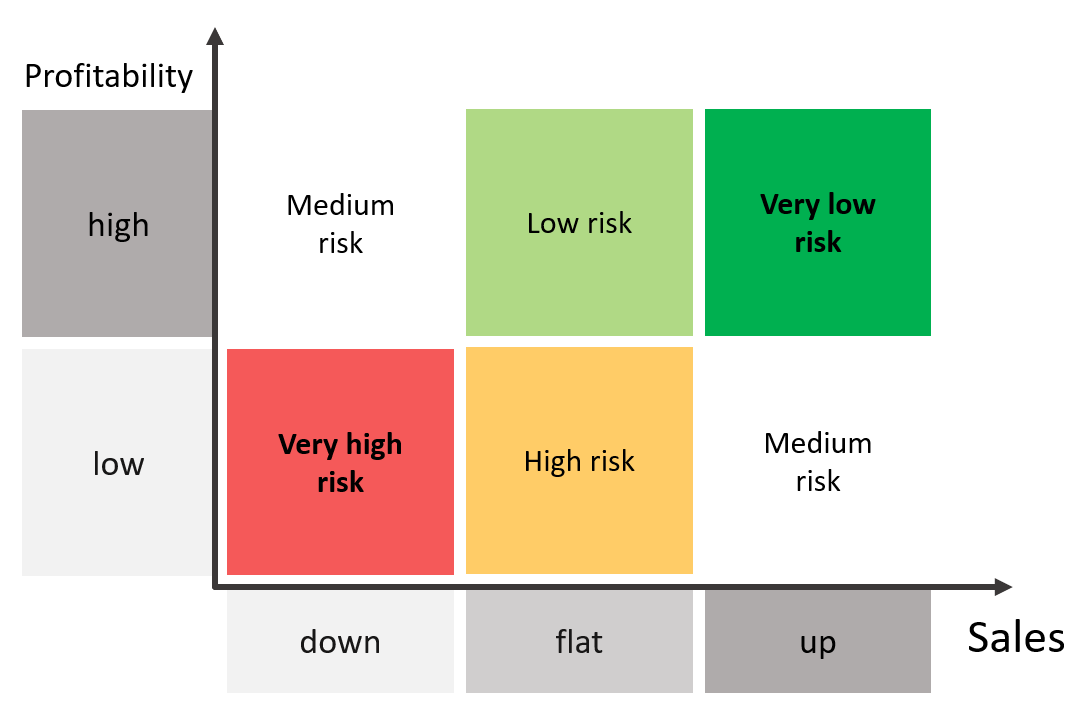

Turnover is therefore an indicator of the commercial dynamism of the company whose interpretation must be correlated with the financial capacities to finance it. A good level of profitability is the first way to finance the company's activity. Conversely, a drop in turnover is not necessarily dramatic in the short term, even if it is not a good sign, because the drop in activity reduces the need for working capital and the financing needs of the company.

Go further with income statement intermediate balances

These indicators help to determine if the company is profitable and to understand what the main factors are contributing to the net result (positive or negative). Is the company's business profitable or not? Is it burdened by financial costs, or is her net income temporarily improved by an exceptional profit?This analysis will help you not to get fooled by an "artificial" positive result or to stop your analysis based on a net loss but on an intrinsically profitable and viable business.

| Intermediate balance | Calculation | Interpretation |

| Gross margin | Sales of goods, purchases of goods, and goods inventory change | Relevant indicator to determine the gross margin of an activity of reselling such as reselling, distribution, or trading. |

| Value added | Trade margin + production, purchases of raw materials - other purchases, and external charges | Represents the creation of value that the company provides for goods and services purchased from third parties. The value added must be sufficiently high to absorb all other expenses of the . |

| operating profit before depreciation and amortization (EBITDA) | Value added - tax - wages and salaries - payroll taxes | Remaining amount after deduction of operating expenses to value added. It is a key indicator of profitability and business performance as it is independent of the financial policy of the company. EBITDA should maintain and develop the means of production and pay the capital invested. |

| Operating profit | EBITDA: depreciations and provisions | Operating profit includes the amortization of fixed assets and provisions for risk (e.g., the accrual of bad debts). |

| Financial result | Financial income and financial charges | This purely financial result is often negative because firms are generally consumers of financial products (lines of bank overdrafts, bank loans, factoring, etc). A significant negative financial result often reflects a weak financial structure and excessive recourse to banks. Warning! |

| Result before tax | Operating profit plus financial result | The final result is calculated from operating income and expenses. It is independent of taxation and exceptional income and expenses. |

| Exceptional result | Exceptional income and Exceptional expenses | This result relates to unusual activity. For example, a capital structure transaction can create an exceptional result. Be careful because it can distort the true profitability of the business and distort an analysis that would be based solely on net income. |

| Net income (profit or loss) | Result before tax + exceptional result - income tax |

The net income represents the profit or loss at the end of the year (the difference between total revenue and total expenditure). It is increasing (if positive) or decreasing (if negative) the equity. If positive, it can remain invested in the company or be partially distributed to shareholders as dividends. |

Cash flow

Cash flow represents the excess cash generated by the activities of the company during the year. It allows:- to repay loans,

- to pay shareholders,

- to invest,

- to strengthen the financial structure of the company.

How to calculate the Cash flow: Net income + allocations to depreciation and provisions - reversals of depreciation and provisions.

The cash flow demonstrates the ability of a company to finance its projects and its development by its own means, which is always preferable rather than resorting to third parties (banks, investors), even if they are useful or even essential in certain cases (heavy investments, strong growth, companies in difficulty, etc.).

Conclusion

The analysis of the income statement sheds light on the credit analyst on many aspects of the company such as the activity of the company. commercial development and its evolution, profitability and and the ability to à generate financial surpluses in order to self-finance. These elements are up to date. put into perspective with the financial structure of the company (how is it financed, how is it managed), its Working Capital as well as its Working Capital Requirement. From this perspective, the assessment analysis will bring many answers.