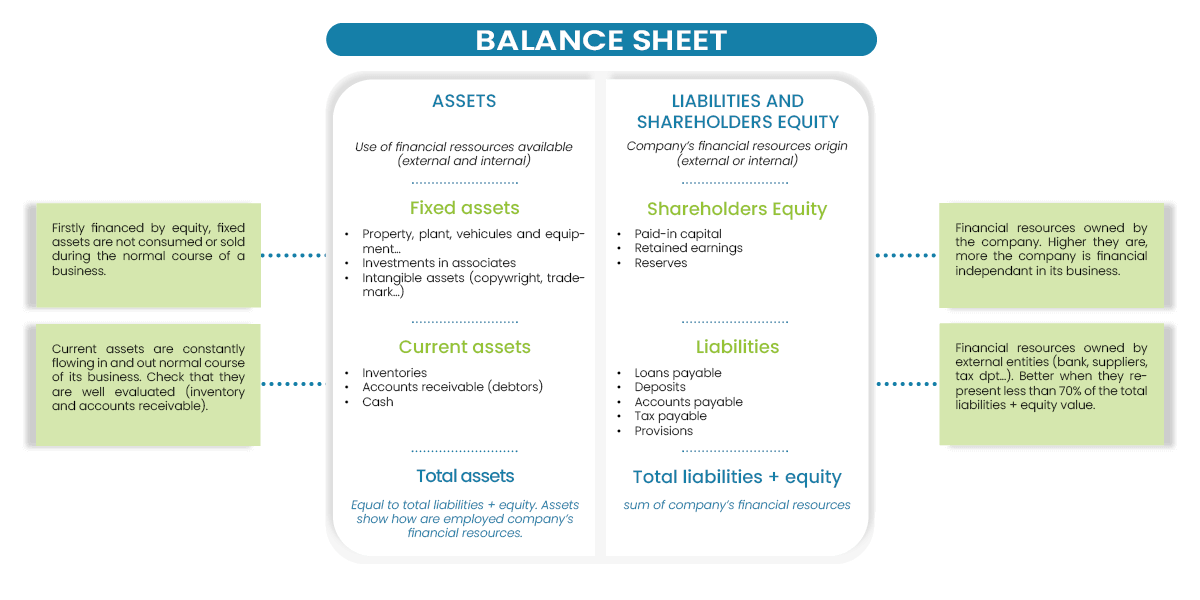

- Owners’ equity: capital stock, retained earnings, reserve,

- liabilities: accounts payable, loans payable, and tax payable.

This assessment must be put into perspective with the use of available financial resources that we find on the assets side of the balance sheet. Which resources finance which assets?

-

My DSO Manager, the innovative credit management software

My DSO Manager offers powerful features to manage credit risk and assess customers' creditworthiness. My DSO Manager is used by SMEs as well as worldwide companies in 85 countries to improve the cash collected.

Scoring, credit analysis, connectors with financial information providers, credit limit workflows, risk agenda, etc. allow a full monitoring of the company's exposure and the adaptation of collection strategies accordingly.

See the online demo.

What is the balance sheet?

Schematic view of a balance sheet:

Assets are divided into two parts:

- current assets: accounts receivable, inventory, work in process, cash, etc., that are constantly flowing in and out of a firm in the normal course of its business, as cash is converted into goods and then back into cash,

- fixed assets: land, buildings, equipment, machinery, vehicles, leasehold improvements, and other such items. Fixed assets are not consumed or sold during the normal course of a business, but their owner uses them to carry on its operations.

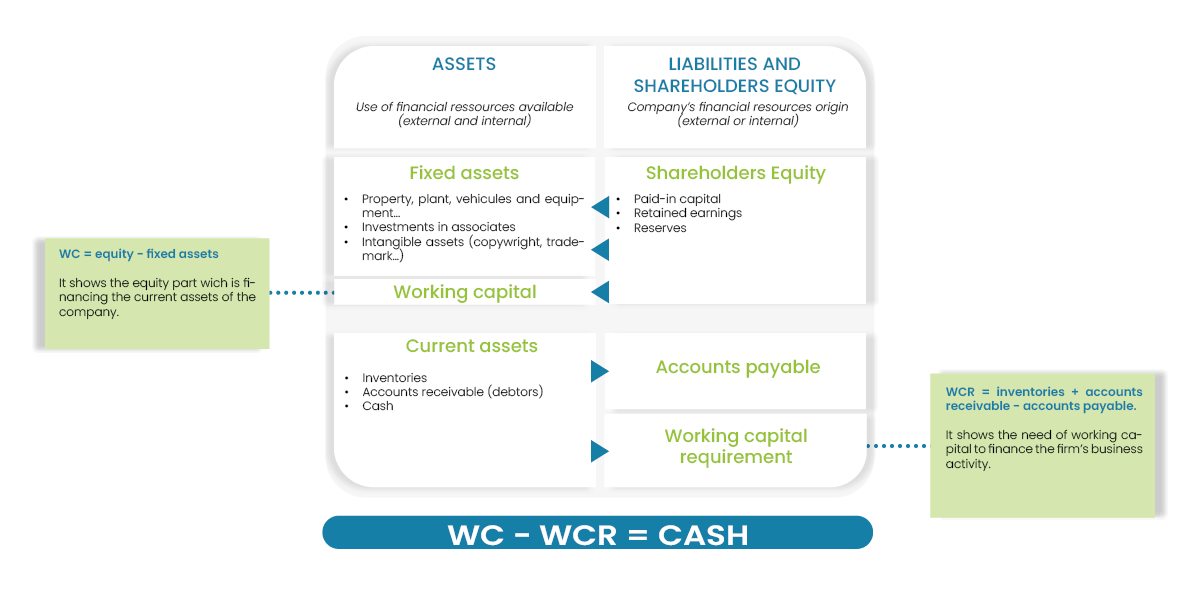

If working capital is weak, working capital requirement is financed by liabilities. In this case, the company is financially weak and depends on its creditors (banks, suppliers) to maintain and develop its activity.

This situation can be problematic because the company is dependent on short-term cash credit. The renewal of these credits is not certain. Therefore, the risk of failure increases with this dependence! It may be normal to have recourse to bank credit, but in reasonable proportions.

A dynamic view of the balance sheet: the working capital and the working capital requirements

How to calculate the WCR, WC and cash?

Working capital: equity minus fixed assets.

The WC must be positive and large enough to cover the WCR.

If the WC is negative, that means that equity is not sufficient to finance fixed assets and the company has recourse to bank loans (whose renewal is not guaranteed) to finance them. The credit risk is high with this type of structure!

Working capital requirement: Operating assets (inventories plus accounts receivable) minus operating liabilities (payables).

The WCR represents the financial need to fund the business' operations. It depends strongly on the sector of activity. For example, industrial companies generally have a higher WCR, while the major retailers have negative working capital (they are paid by their customers before they pay their suppliers).

Net cash: WC - WCR.

The Net cash is the remaining WC after the absorption of WCR. If the WC covers WCR, the net cash is positive. This amount is reflected in cash (excess cash on a bank account).

If the WC does not cover the WCR, net cash is negative. Stable financial resources are insufficient to finance the activity, and the company has recourse to short-term bank loan or credit suppliers to finance the operating cycle.

This situation is problematic because the company depends on credit given by suppliers or short term loans whose renewal is not assured. The risk of failure is high, even if many businesses are in this situation!

Tensions in the treasury are almost systematic, and the risk of delays in payment or unpaid invoices is very high. A decrease in turnover, an unpaid invoice, or a disengagement from a creditor (bank, supplier) can be fatal and lead the company to bankruptcy.

Thus, a simple trade has to finance mainly its stock, while an iron and steel company must finance very heavy fixed assets (equipment, grounds, etc.), stock, and credits allowed to customers.

The interpretation of the balance sheet must be done in parallel with an understanding of the activity of the company, its operating mode, its profitability, its operating cycle, etc. It is taking into account all of the realities of business, which makes it possible to deduce its solvency, its sustainability, and the level of credit limit that can be granted to this company.