Downloadable tools are available at the bottom of the page

Prevention is better than cure. This maxim applies perfectly to the credit management function. It is preferable to identify the risks of non-payment as early as possible rather than battling in costly litigation following unpaid debts.

Credit management is divided into two parts: The first part is preventive about customer assessment and securing payments; the second part is curative relative to cash collection and performance management (DSO, working capital, etc.).

The second part is dependent on the first, which is fundamental for the success of the relationship between seller and buyer from a financial point of view.

It is indeed during the trade negotiations that payment terms, any associated guarantees, and contractual clauses will be defined.

The basis for preventing credit risk is to achieve a good credit analysis. This will highlight the risks in front of security tools, or risk mitigation may be proposed.

Credit analysis is not only financial analysis. It goes well beyond that, it takes into account the entire business environment to determine the risk for the seller to extend credit to the buyer.

The credit analyst compiles this information and synthesizes it to get a "snapshot" of the risks (weaknesses) and reinforcing elements (strengths) of the business opportunity.

Credit analysis is not only financial analysis. It goes well beyond that, it takes into account the entire business environment to determine the risk for the seller to extend credit to the buyer.

The credit analyst compiles this information and synthesizes it to get a "snapshot" of the risks (weaknesses) and reinforcing elements (strengths) of the business opportunity.

He then offers solutions to make the risk acceptable in accordance with the risk management strategy of the company. The role of the credit analyst in the company is to be a source of proposals to reduce the risk and allow for sales opportunities. By doing so, it facilitates trade and becomes an ally of businesses in their search for revenue.

The role of the credit analyst in the company is to be a source of proposals to reduce the risk and allow for sales opportunities. By doing so, it facilitates trade and becomes an ally of businesses in their search for revenue.

Anticipation and intervention early in the sales process by the credit analyst are key success factors. Then he can identify risks and counter them with the appropriate tool.

The first effect was to reduce economic activity by around 40%, with a very variable rate depending on the business sector. The building sector and several others fell by 90%, while rare sectors such as digital or online commerce benefited from a certain stability or even an increase.

The suddenness of the crisis had a very strong and quick impact on companies.

Therefore, credit analysis must adapt and assess the financial capacity of the company to successfully face this situation.

We can see two main points:

The risk of bankruptcy assessment depends on the combination of these two elements: financial strength based on financial analysis and crisis impacts on cash according to the type of business.

The risk of bankruptcy assessment depends on the combination of these two elements: financial strength based on financial analysis and crisis impacts on cash according to the type of business.

Keep in mind that with this crisis, you need to focus on the short-term risk first, which is the risk of a liquidity shortage. Then, medium-term risk depends on the background impacts the crisis will have on the market and the consequences that may occur for the company analyzed. At that point, the capacity the company to adapt is critical.

Keep in mind that with this crisis, you need to focus on the short-term risk first, which is the risk of a liquidity shortage. Then, medium-term risk depends on the background impacts the crisis will have on the market and the consequences that may occur for the company analyzed. At that point, the capacity the company to adapt is critical.

There is no minimum company size required to incorporate this function, which applies to any company selling to other businesses. It requires a few hours per week or per month, up to several full-time positions, depending on the number and type of clients.

In large enterprises, the credit analyst reports to the Credit Manager. Based on the credit analysis conducted, the Credit Manager will then negotiate with the sales team and clients, and validate the decisions made.

There is no minimum company size required to incorporate this function, which applies to any company selling to other businesses. It requires a few hours per week or per month, up to several full-time positions, depending on the number and type of clients.

In large enterprises, the credit analyst reports to the Credit Manager. Based on the credit analysis conducted, the Credit Manager will then negotiate with the sales team and clients, and validate the decisions made.

In the era of accelerated digitalization of credit management processes, credit analyses can be largely automated through the use of interconnected credit management software, thus making it possible to retrieve all available information and use it to perform scoring and apply your strategies. Human supervision and analysis remain essential, particularly to take into account specific elements that digital tools would not be aware of, and to go beyond standards, particularly on key and specific customers.

In the era of accelerated digitalization of credit management processes, credit analyses can be largely automated through the use of interconnected credit management software, thus making it possible to retrieve all available information and use it to perform scoring and apply your strategies. Human supervision and analysis remain essential, particularly to take into account specific elements that digital tools would not be aware of, and to go beyond standards, particularly on key and specific customers.

Credit management is divided into two parts: The first part is preventive about customer assessment and securing payments; the second part is curative relative to cash collection and performance management (DSO, working capital, etc.).

The second part is dependent on the first, which is fundamental for the success of the relationship between seller and buyer from a financial point of view.

It is indeed during the trade negotiations that payment terms, any associated guarantees, and contractual clauses will be defined.

The basis for preventing credit risk is to achieve a good credit analysis. This will highlight the risks in front of security tools, or risk mitigation may be proposed.

-

My DSO Manager, the innovative credit management software

Agile and quick to implement, including intuitive and powerful features, My DSO Manager allows you to manage your accounts receivable on all aspects.

It helps to significantly improve cash (get paid faster by your customers), profitability (with fewer bad debts) and customers satisfaction (with quicker dispute resolution).

My DSO Manager includes many credit risk management functionalities: custom scoring, links with financial information providers, risk reports, AI, etc.

See more with our online demo.

What is the credit analysis?

The credit analysis is an overall assessment of the current business relationship or the one what will arise with a client. It takes into account several additional elements.About the buyer:

- Creditworthiness of the buyer with the completion of a financial analysis of its balance sheet and its income statement.

- Behavioral references of the buyer: does it meet with its commitments? What is its payment behavior?

- Commercial references of the buyer. Is it a business with great potential? Does it have favorable market positioning? What is its age?

- Legal form of the company. Is it a private or public company?

About the environment of the buyer:

- Sector risk: is the customer part of a sector in crisis or experiencing with a strong increase in business? With the COVID-19 crisis; the impact is very different according to the sector, this has to be taken into account.

- Country risk: does the country of the buyer have a significant political risk that could affect the progress of the business case?

- Currency risk for export to a country that has another currency if the contract is signed in the buyer's currency.

Regarding the advisability of sale for the seller:

- Is it a strategic business? What is the level of margin? Is it profitable from a cash point of view, or does it contribute to increasing the working capital?

- Is the business secured (documentary credit, credit insurance, etc.)?

- Is it a business which involves a high part of the financial resources of the seller? Does the risk of non-payment threaten the sustainability of the seller?

- Does the contract seem balanced? What are the contractual risks and responsibilities of the seller (liability limit, termination clause, etc.)?

He then offers solutions to make the risk acceptable in accordance with the risk management strategy of the company.

Purpose of credit analysis

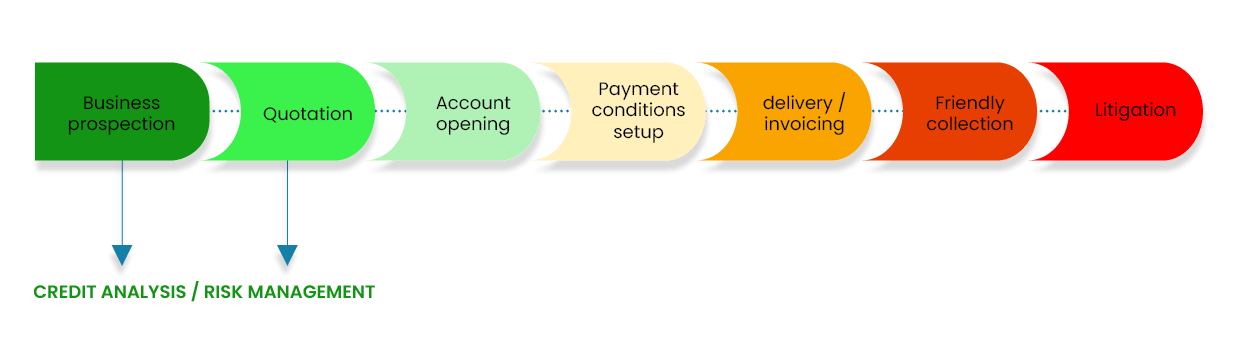

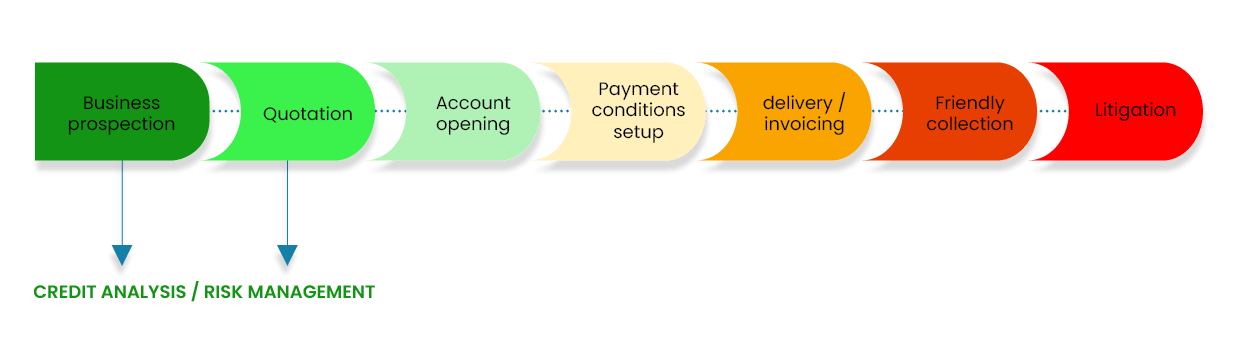

Ultimately, the credit analysis leads to the setting up of payment terms and payment guarantees that will be consistent with the credit limit allowed to the customer (if any). Another goal is to include in the sales contract clauses protecting the seller according to the risks identified.Anticipation and intervention early in the sales process by the credit analyst are key success factors. Then he can identify risks and counter them with the appropriate tool.

Sales process

Credit analysis during the COVID-19 crisis

The economic crisis following the COVID-19 health crisis is different from all those we have experienced before. Never have whole swathes of the economy been shut down brutally in modern history.The first effect was to reduce economic activity by around 40%, with a very variable rate depending on the business sector. The building sector and several others fell by 90%, while rare sectors such as digital or online commerce benefited from a certain stability or even an increase.

The suddenness of the crisis had a very strong and quick impact on companies.

Therefore, credit analysis must adapt and assess the financial capacity of the company to successfully face this situation.

We can see two main points:

- With the financial analysis, assess the resilience of your customers, who may suffer a real blackout in turnover.

- With the sector analysis and a cash forecast evaluation, assess the evolution of their cash.

Locate the credit analyst in the company

Depending on the size of the company, the credit analysis is performed by a qualified analyst, a credit Manager, or a person trained in the financial department (Chief Financial Officer, accounting, etc.). She or he is responsible for credit granted to customers and must be attached to the Finance Department.