Downloadable tools are available at the bottom of the page

The first step, prior to commercial negotiation and good practice throughout the business relationship, is getting information about your clients. You need to:

- Know who your client is; what is the history of the company? Does he respect the commitments? Is it solvent? What's its financial structure?

- Well-oriented commercial negotiation. Knowing your client from different points of view (size, profitability, solvency, position on the market, etc.) will be useful as much in your commercial approach as in the prevention of a potential payment default.

- Set a credit limit and find and offer solutions to insolvent clients to collaborate without risk of unpaid invoices: credit insurance, down payments, delegations of payment, bank guarantees, etc. Many solutions are available to secure an order coming from a risky client. Explore more on Secure your receivable.

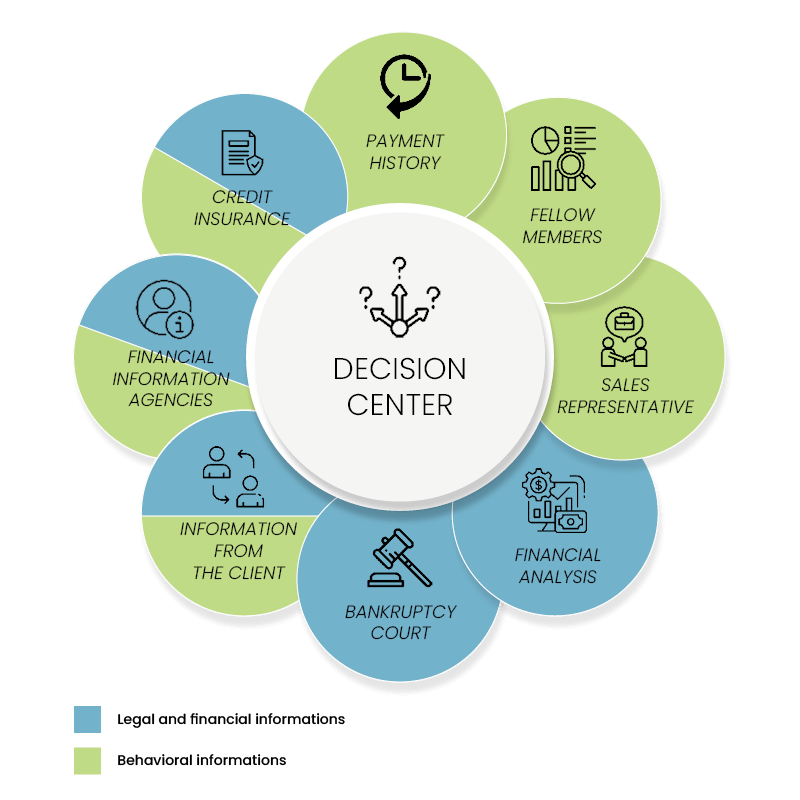

What sources of financial and behavioral information exist?

The sources of information are varied and multiple. It is advisable to favor quality over quantity and to recover those that are relevant for your credit analyses.

The economic context of the buyer's sector of activity

The situation of the sector of activity (e.g., building, steel, distribution, cars, etc.) of the analyzed company is also taken into account. It is macroeconomic information that indicates what the market trend is for the buyer. It therefore has an impact on the assessment of its solvency.However, the situation of the sector of activity should not prevail over the intrinsic situation of the buyer in his creditworthiness assessment. Some companies can be successful in sectors in crisis, and vice versa.

How do we get this information?

Getting information is very different depending on the country of the buyer. In France, for example, every company has to publish its financial statements every year. Therefore, it is quite easy to find this information (see below). In Saudi Arabia, it is very difficult to get these data as financial statements are used only as an internal management tool.However, the best way to get information is to request it from your client himself! Meeting him with this aim in mind has numerous advantages:

- You are guaranteed to get fresh information. The situation for businesses changes very quickly!

- It is free, and it only consumes a little time!

- The exchange of information allows for the establishment of a relationship of confidence as well as the foundations of a solid partnership. If your client refuses to transmit to you this information, try first to understand the reason for this refusal, then be careful before working with him and ensure that you can get guarantees of payment.

Big Data and Artificial Intelligence in Financial Information

Concepts are developing more and more every day, and the use of big data and algorithms that allow us to draw indicators is a real plus in mass financial information.The principle is to interpret very large amounts of data, for example, payments versus due dates, to determine the payment behavior of each company.

This indicator could be included in the evaluation criteria of the company.

Many players are investing a lot in this way, which involves collecting the most exhaustive data possible with algorithms that make it possible to extract the substance.

- Indeed, it depends on the quality and exhaustion of the data on which the analysis is carried out. However, these two conditions are rarely met, and the complexity of big data makes it easy to hide these shortcomings from endusers.

- A "big data" truth is not necessarily consistent with your own experience with your customer (or the one you will have). It is your "small data" customer history that should take precedence simply because it is more accurate and relevant.

Main sources of financial information to perform credit analysis

| Financial information agencies such as D&B and CreditSafe provide you with fully automated financial reports. Quality and cost depend on each agency and the localization of the buyer. | Credit insurances: AIG, Euler Hermes, and Coface offer their clients good-quality information about financial statements, legal events, and payment behavior based on their own experience with these businesses. |

| Your client's other suppliers. Request references from your client in order to get from his own suppliers his payment behavior. | Bank of your client: It is completely possible to get information from the banks that work with your client. They are in the first "lodges" to see the treasury of firms. Be cautious since, in some cases, the banker may conceal unfavorable facts because his interest is that you grant credit to his troubled client in order to reduce his own risk. |

| Your client himself will give you his last balance sheet and very recent information on the evolution of his financial standing. His explanation will allow you to understand more easily some features transcribed in his financial statements. | Payment history you have with your client. Are you getting payment on time or with delay? Read our tutorial on payment profiles. |

| Your own sales representative is in the best position to get information from the client and from the market. However, be careful and check the information you receive from them. | Business intelligence companies. Do you want a high-quality financial report? It is better to look at specialists who perform investigations done by analysts. Cristal Credit and Inter Sud provide with this type of advanced service. |