Revenue growth, optimization of the working capital requirement (WCR) and cash, increase of the profitability and of earnings are all issues related to the management of the accounts receivable orchestrated by the credit manager.

Revenue growth, optimization of the working capital requirement (WCR) and cash, increase of the profitability and of earnings are all issues related to the management of the accounts receivable orchestrated by the credit manager.The accounts receivable are also the first or second position in asset value of most corporate balance sheets. It is certainly one that is potentially the most risky, especially if poorly managed.

So it is natural that it is a central concern of the Chief Financial Officer (CFO) who is the guardian of his company's economical performance.

If the credit manager has to secure business from commercial negotiation phase, and has to accelerate the collection of invoices, what is the role of the CFO in credit management?

Define the organization and credit management strategy

First of all the CFO shall put the credit management position under his responsibility (it is not always the case). Indeed, the challenges of cash and profitability linked to credit management are so high that it is necessarily the financial department who has to control the actors and processes related to them.Second step, the CFO is involved in the organization of credit management department who depends on several factors:

- Size of the company.

- Type of the customer (individual, professional, export, public ... etc.).

- Average amount of transactions.

- Sector of activity.

- Commercial culture.

- …etc.

Based on these realities specific to each company, the CFO will set up an Anglo-Saxon model or Taylorism one, with or without the use of external providers such as credit insurance or a collection agency.

Based on these realities specific to each company, the CFO will set up an Anglo-Saxon model or Taylorism one, with or without the use of external providers such as credit insurance or a collection agency.He will set up a consistent credit management strategy consistent with the company's business plan.

He has to define the credit management priorities stemming from the company's main objectives.

Are they:

The definition of credit management strategy leads to weight each of these elements and to clarify their implementation.

- Minimize the DSO to improve cash flow and investment capabilities with:

» Set the reduction of payment delays and obtaining downpayments as priorities for trade negotiations.

» Financing receivables with discount offers or factoring.- Promote the development of revenue by providing advantageous payment terms to customers?

- Maintain maximum profitability with zero tolerance in securing receivable with a strict rule as : every sale must be secured?

- A credit management procedure defining the framework the credit team is involved for every step of the sales process.

- General Terms and Conditions (GTC) stating:

- The standard payment terms (downpayments, payment delays)

- The rate of discount for early payment, in line with the wheighted average cost of capital (wacc) of the company and its business strategy.

- The application of late payment penalties in case of overdue.

- The choice of a credit management organization.

- The use or not of a credit insurance.

- The use or not of financing tools such as factoring with or without recourse, discounting of bills ... etc.

- The establishment of an approval matrix.

- A collection of receivables methodology and the application or not of late payment penalties.

What involvement of the CFO on a daily basis?

Once the organization and credit policy in place, the CFO delegates all routine operations to his credit manager and his team.

Once the organization and credit policy in place, the CFO delegates all routine operations to his credit manager and his team.Nethertheless, he is involved in the operational management of his credit manager to ensure that he implements the credit policy defined by top management.

He defines DSO performance targets, % of overdue and bad debts objectives in line with the company's financing plan.

The CFO is also involved for all cases that are outside the usual framework based on the approval matrix.

For example, an important case that requires exceptional measures (risk taking, significant deviation from the GTC ... etc.) will be arbitrated by management based on the recommendations of the credit manager.

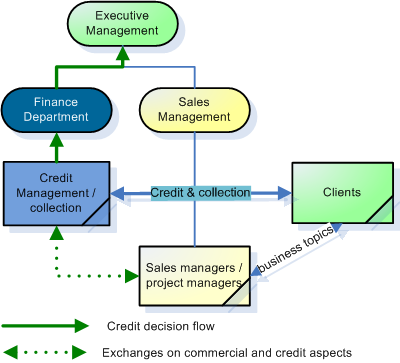

Furthermore, the functional positioning of the credit manager in the company is very specific, halfway between finance and trade (read the article « The credit manager: Anatomy of an unusual species »). His role is to reconcile the two worlds and to ensure that the financial and commercial issues work well together in the interest of the company. This role is difficult but essential.

He facilitates relations of his credit manager with other services (logistics, sales administration, quality) in order to resolve quickly disputes expressed by customers which prevent the payment of invoices.

Conclusion

The role of CFO is essential in credit management. He sets up a coherent organization and defines the objectives and the means to achieve them. He intervenes and arbitrates on sensitive cases being always aware of the effects of his decisions on the profitability and working capital of his company.As the credit manager at his level, he works closely with the sales department.

As guarantor of the balance sheet of its business and interested both by the revenue and the company's financial performance, he is in an ideal position to make good initiatives about strategic stakes of credit management.