This is an operational document defining a number of operating rules for the sales process that must be followed by the entire company, including of course the credit team.

It defines the standard conditions of sale (standard payment terms, early payment discount rate, etc.) and the processes to apply the rules (how to open an account, how to set a credit limit, how to recover the bills, etc.).

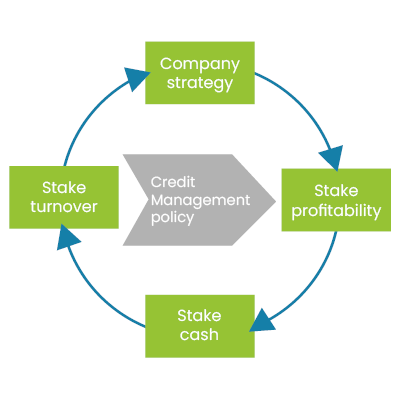

These rules are intended to do "good" sales and to converge business strategy, commercial stakes, and financial issues (credit risk, cash, profitability, working capital improvement).

Why implement a credit management policy?

The establishment of a procedure for credit management is necessary and critical in business since the number of employees exceeds ten and unwritten rules are no longer appropriate. It defines the rules of operation at each stage of the sales process and clarifies the responsibilities in line with the business strategy.-

My DSO Manager, the online credit management software

You have a Credit Policy on paper? Make it a reality with My DSO Manager!

This SaaS software allows you to implement your credit and collection strategies depending on your customers types.

Interactive dunning e-mails, automatic dunning actions, customization of collection workflows, scoring, etc, help to optimize accounts receivable management according to the way you have setup them.

See the demo.

The policy of credit management clarifies the objectives of the company and sets best practices that must be followed by the entire organization.

Key factor of success, it must be shared between vendors, business management and finance department. It is a document that specifies operating "standard" modes for all stakeholders while providing rules for exceptions.

Indeed, the principle of trade is to be specific from one business relationship to another, from an economic context to another. Each company must be able to adapt its offer to it and sometimes depart from the rules of running operations it has set itself.

Operating rules established by the procedure may, in some cases, be overridden, but within a framework defined in advance. Thus, it includes a chart of authority that determines for each decision committing an additional risk to the company the power of validation of each actor. For example, sending a new order to a customer who is in default of payment for more than 30 days may be subject to the validation of the CFO.

It promotes communication and mutual understanding among the different stakeholders. It therefore avoids the "silos" generated by the withdrawal of each service that does not understand the attitude of other services.

Of course, a company must sell and develop its sales, and obviously it must ensure its sustainability by avoiding overdue and bad debts. These issues are not exclusive, quite the contrary. This is what helps in the establishment of a credit procedure.

Which are the rules for which processes?

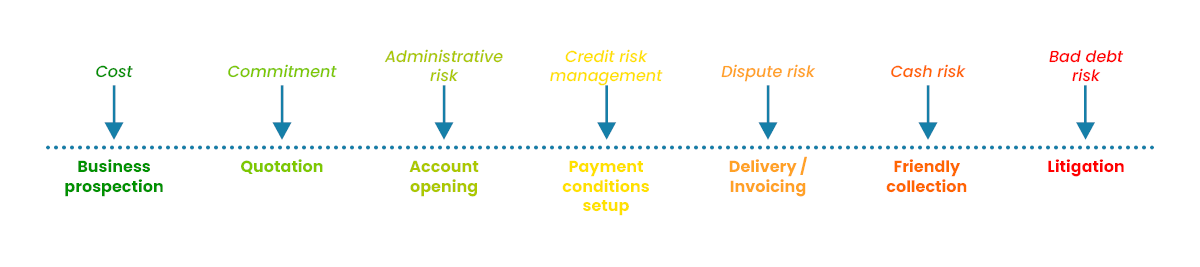

The purpose of the credit management policy is to define rules for all steps that are likely to generate business risk by committing financial resources. This is done in order to manage these risks and to minimize them.If well managed, a risk can become an opportunity. For example, if you have evaluated a customer as insolvent, you can request a payment in advance against an interesting discount. This helps to improve the cash flow of the business while avoiding any credit risk.

Main stages of the sales process

Timing diagram of the sales process:

1) Commercial prospection

Business development incurs costs and should be well oriented to be effective. It is, for example, counterproductive to spend time and money to win an order with an insolvent potential client:- The financial position of the buyer intends more for regression or disappearance through bankruptcy than for becoming a key player in the market.

- Winning a business with this company will result in payment delays or even unpaid invoices and losses,

2) Quotations

These deals can be engaging for the seller, but it is necessary to include commercial conditions (conditions and means of payment, guarantees, etc.) coherent with the context and the creditworthiness of the buyer. Credit risk starts at this stage. It is therefore necessary to define how it is assessed (financial analysis, credit rating, etc.) and how it is managed.3) Customer account opening

The customer opening account must follow certain basic rules to obtain necessary information so that the administrative flow is fluid and do not disrupt the business relationship. Defined rules specify what documents / information must be obtained prior to account opening and who must obtain them.4) Payment terms and credit limit set up

This stage occurs during the trade negotiations and may be before or after the opening of an account. It is here that are approved payment terms (payments, deferred payment, method of payment, invoicing schedule, etc.), and any guarantees (bank guarantees, parent company guarantees, delegation of payment, documentary credit, etc.).This is the heart of the prevention of outstanding risks. These conditions should be an integral part of commercial negotiations and result from the risk analysis that was done previously. The credit management process defines the standard conditions, checks if it is possible to grant them to the client, and manage any deviations from these rules.

5) Delivery and invoicing

This step should not be overlooked, as it is often a source of disputes that generate late payments and have negative impacts on the business relationship. The credit management process specifies the prerequisites for billing in a timely manner and the key steps to check to do a good billing job and not make errors (price, date of invoice, customer name, etc.).

6) Amicable collection

This is an essential phase not to suffer late payment: the cash collection process should be structured and professionalized to be effective. Well done, debt collection lends credibility to the seller, significantly improves cash flow, and contributes positively building a commercial relationship.

The recovery process must be defined as a combined result of recovery actions (phone calls, e-mails, interactive e-mails, intervention of the sales representative ... etc) and agreed upon the credit management department, accounting and sales managers.

It also specifies how are applied late payment penalties to get customers to pay in a timely manner.

7) Litigation

In the event of a failure of amicable collection that ended with the sending a letter of formal notice, collection actions continues but with other means. These are numerous and depend on the organization of each company and its customer types:

- Lawsuits handled by the seller with the contribution of a lawyer (referred provision, assignment in payment),

- Collection agencies,

- Bailiffs,

- Credit insurers.

Conclusion

The credit management policy includes all the steps above, describes how they are implemented and by whom. It must be operational and concrete and therefore be adapted to each company. There should not be two identical procedures, as each business is unique and has its own strategy.

It represents the application in practice of a business strategy and management of customer credit defined by the direction of the company. It allows you to structure the business, improve performance and relationships between the different services that compose it.

In a complex and difficult economic context, the implementation of such rules gives direction to the company and its employees and helps protect the company as much as possible from overdue payments and losses, which are responsible of a business failures on four and many broken dreams of entrepreneurs.

Well established and applied, it will help to improve the cash flow and working capital needs of the company and to preserve its future, and foster its development.