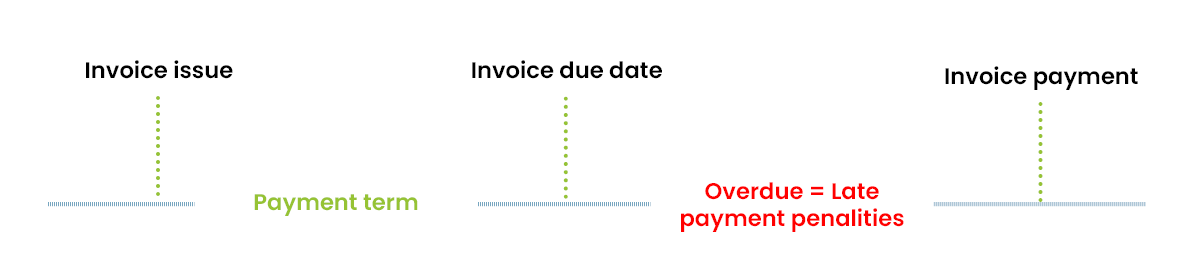

Late payment penalties are payable by the buyer when invoice is not paid while its due date is passed. That means that any late payment versus the due date will usually give rise to an obligation to pay delay penalties.

The supplier is theoretically not supposed to claim them because they should be paid automatically by the buyer who did not respect its commitment to pay on the due date.

In reality, the purchaser pays rarely the penalty by himself and it is often difficult to obtain them even in cases of long delays in payment.

Get into the culture of late payment penalties

Not all companies have included late payment penalties in their sales conditions?In many cases, it is due to a lack in company's commercial culture of the concept of late payment penalties. This lack inhibits the supplier in its claims (fear of harming the business relationship) and does not incite the buyer to comply with the Law on this subject.

However, it has been demonstrated by experience that companies that clearly require the payment of penalties for late payment manage to get them and increase the credibility of their collection strategy with their clients.

Moreover it does not harm in any way the commercial relationship. How a buyer could legitimately criticize its supplier to apply the Law and to require the payment of bills on their due dates?

-

Late payment penalties in My DSO Manager

The late payment penalties are automatically included into My DSO Manager if they are activated in the customer account.

The amount of late penalty is inserted dynamically in recovery documents (e-mails, letters, interactive e-mails) with our #Hashtags. It is calculated based on the rates set in the account's settings. See more with the online demo.

Late payment penalties advantages

- You educate your clients to pay on the due date of your invoices,

- You compensate the financial cost of a late payment,

- You improve the outcome of your business,

- You comply with the law and credit management best practices.

Questions related to late payment penalties

What rate of late payment penalties to use? It depends on the country inflation and interest rates.In United States, The rate is set under the Penalty Interest Rates Act, and is subject to variation.

In France, the law says that the late payment penalties rate must be equal to the European Central Bank's refinancing interest rate applied plus 10 percentage points and in no case be less than 3 times the rate of legal interest.

We recommend to choose a rate between 8% / year and 15% / year .How late payment penalties are calculated? Late payement penalties are calculated on the balance of the receivables due including taxes.

Where do they appear? The late payment penalties must be disclosed in your sales conditions, your business contracts and on your invoices (in the form of a simple standard wording: "the rate of late payment penalties is equal to 12% / year).

Even if they are not specified they must be applied according to European law. .

Should they be billed? It is not necessary to invoice them. However you can do it if you want this amount debits your client's account. In this case, the invoice does not include VAT and is payable immediately.

Download here below the tools to calculate late payment penalties and to get them paid or use for free the online calculation tool.