His goal is to accelerate payments coming from customers while avoiding bad debts. This objective concerns all businesses. However, its implementation is highly variable.

The original model, the Anglo-Saxon one, has been adapted and modified according to the commercial culture of each country and each company.

Indeed, many parameters have a direct impact on the organization of credit management department of companies. Here are the main ones:

- Use of credit insurance or not.

- Type of business made by the company (sale of products, services, construction of sets or subsets, projects ... etc.).

- Average transaction amount

- Customer type (personal, public and state enterprises, SMEs - PMI ... etc.).

- Secteur d’activité

- Export or domestic business?

- Payment terms applicable in the country.

- Means of payment used in the country.

- Commercial culture.

- ...etc.

Credit management: what sizing for what purposes?

Depending on the size of the company, the largest group at very small companies, credit management department may include a large team (for example, 20 people per 1 billion of euros of sales), one to four people for a large SME / SMI, or in some cases it does not even exist. This case regards a large majority of very small companies.This does not mean that the function does not exist as such, but it is made by a person whose this is not the main activity.

In any business, whatever its size, credit management missions are essential. They must be designed and organized by top management.

Whatever the organization in place, the objectives of the credit management are:

- Help to do good sales by securing the payment of receivables.

- Establish terms and conditions of sales, standard payment terms (Request of deposit before every order?), and the rules to grant (or not) the credit based on credit analysis.

- Optimize payment terms to improve cash flow and the company's working capital requirement.

- Performing an efficient collection process to get paid at the maturity date of invoices (which reminder actions? When? With what purpose? Using of late payment penalties?).

- Drive the resolution of disputes and contribute to the improvement of internal processes.

- Manage litigation cases.

- Collaborate or perform customer accounts accounting including allocation of payments received and management of provisions for doubtful accounts.

-

My DSO Manager, the online debt recovery software

My DSO Manager offers a set of powerful features to manage accounts receivable and to improve working capital.

It includes innovative functionnalities for credit management and debt collection.

Dunning documents (emails, interactive emails, SMS, mails...) are dynamically generated through #Hashtag and are customizable for each customer for optimum efficiency.

The software can be used very quickly with Smart upload module, automatic import by FTP or our connector (Quickbooks, Salesforce...). See more with the online demo.

The different organizational models

The Anglo-Saxon model

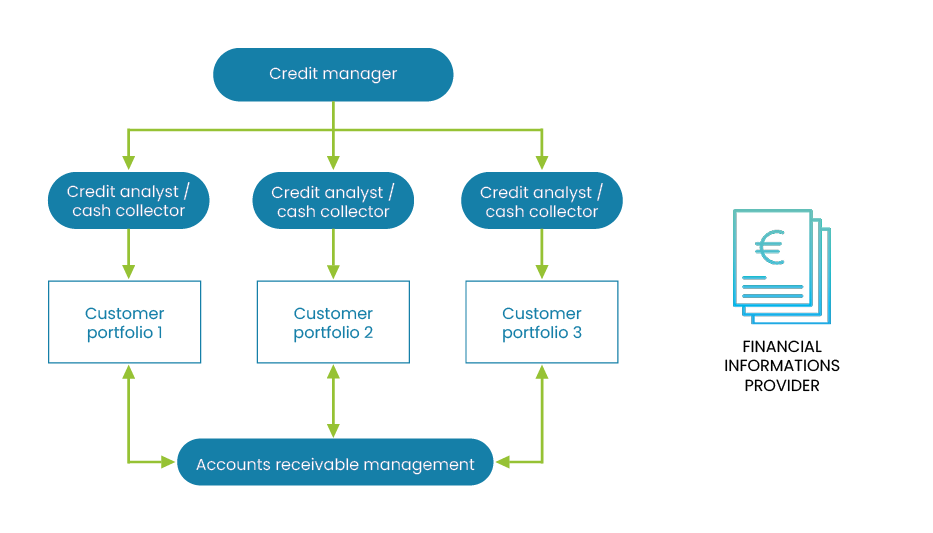

The credit analysis, the payment terms negotiation and the bills collection is performed by a single person responsible for a portfolio of clients on all aspects of credit management.

The validation of credit limits is done on the basis of formal delegations thresholds written in an approval matrix, part of the credit management policy.

For example, a credit analyst (first level) may have a delegation of power up to 50 K €, a credit manager up to 200 K €, the CFO up to € 1 million.

Credit insurance is generally not used or in the form of excess of loss which leaves a great level of autonomy to the company.

The analyst will not hesitate to travel to visit the customer with the sales representative in order to obtain fresh financial information and participate to trade negotiations.

The level of people doing this work is high and complete.

The Taylorist model

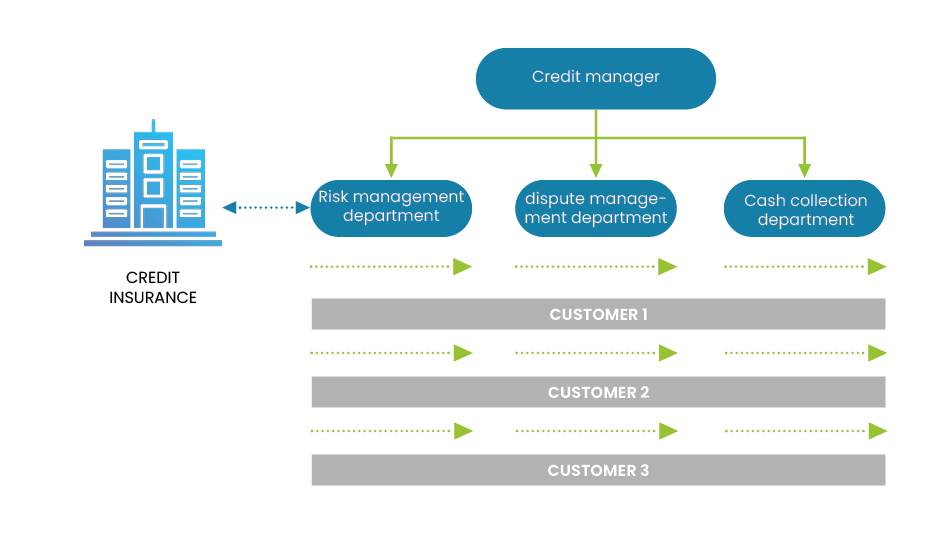

The credit management process is divided into several parts: credit analysis and risk management, cash collection, dispute management, accounts receivable management.Each "job" is done by a specialist who intervenes only on its part. One client is "treated" by different teams according to stage it is in the sales process.

The credit analyst does only the credit assessment, the cash collector does only actions of recovery. The advantage of this system is the specialization of people who reach a high degree of efficiency in their field.

The disadvantages are the counterpart of this benefit:

- Positions less valuable than in the Anglo-Saxon model.

- Redundancy of actions to perform that can generate a certain weariness of the teams.

- Lack of an overall vision of the situation of each customer unless for the credit manager.

Indeed, it is essential that they work together to be effective. For example, the collection strategy applied to a risky customer is not the same as with a standard client. Conversely, a bad payment experience with a buyer may impact negatively its financial evaluation.

The back-office model

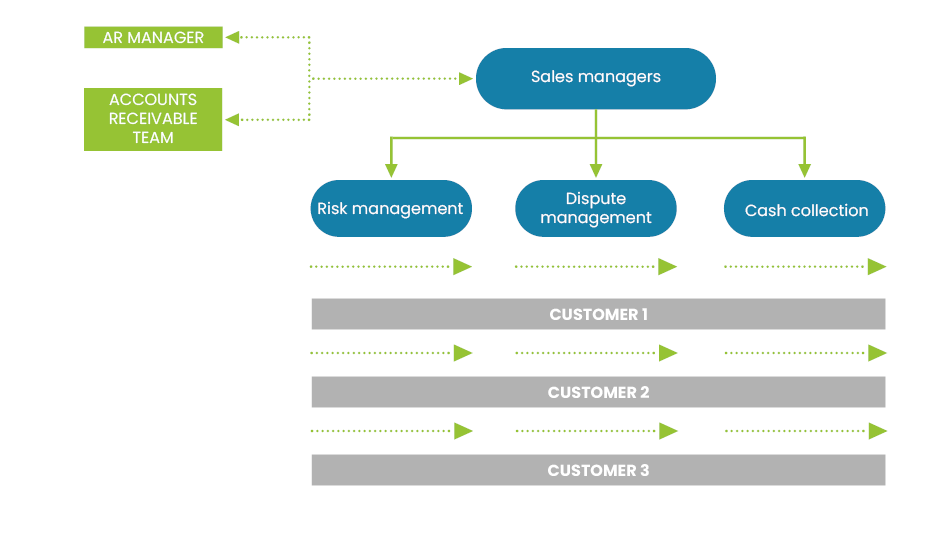

Credit team acts only on the internal management of accounts receivable and is not in direct contact with customers. The negotiation of payment conditions and the cash collection are made by only commercial who monopolize the customer relationship.

The credit management team is involved only in support of sales managers to provide them with the information they need. Being cut off from the customer relationship, it is dependent on information from business managers which may be given according to their interest. This positioning puts credit team in a weak situation and does not allow to reach a good performance.

However, this model can be used when the sales managers have a very high level and can handle all aspects of the business relationship. However, it is less effective and has major disadvantages:

- The sales manager is very often focused on obtaining the order and on the margin improvement. He often considers the cash as a secondary stake.

- The sales manager is not in a position to make an effective debt recovery and at a good level. He doesn't have the skills for it and he is penalized by recurrent situations of conflict of interest. Indeed, it is difficult to request a payment to his client while trying to get a new order.

The customer reminders are done when he has the time and opportunity to do them. First level reminders are usually not directed to the right person. Their efficiency is low. - The credit management department is more an accounting function rather than what it should be. It does not weigh on the business relationship. The financial stakes are neglected.

Conclusion

For good consideration of credit management stakes (no bad debts, cash improvement), I recommend the Anglo-Saxon model, or the Taylorist one. The back office organization, although present by default in many companies, does not allow to assess and mitigate correctly the credit risk and to perform an effective bill collection.Business must work with these processes but they are not the stakeholders and are not in a position to be, whatever their skills.

The use of credit insurance pushes to apply Taylorist organization because credit insurance represents a form of customer risk management delegation that is no longer handled internally but by the insurer.

Be careful in this case because the insurers have their own constraints that may in some cases be opposed to the interests of the seller. It is therefore necessary to keep credit risk competencies internally independently from the credit insurer.

The ideal system of each company depends heavily on the type of business and its customers. Every company has to imagine and implement its model that will safeguard its financial interests while maximizing sales.