The digitalization of credit management…

… is in progress, in accelerated format, undeniably with no possible way back, carried away by a breath that carries away and transports. Which also transforms. Distant is the era of the credit manager who must above all be an expert in Excel and Access, King of database hacks of all kinds, like an alchemist mixing sometimes improbable ingredients, leading to perhaps brilliant results, but always resulting from laborious and time-consuming work, having to be constantly renewed, thus moving it away from the essential, from the very essence of a credit manager communicating on the issues he defends: negotiating internally and in external, solving the often complex problems of strategic clients. Problems which cause friction to the fluidity of the commercial relationship. Fluidity so necessary to maximize sales, customer satisfaction and cash flow.What does digitalization change?

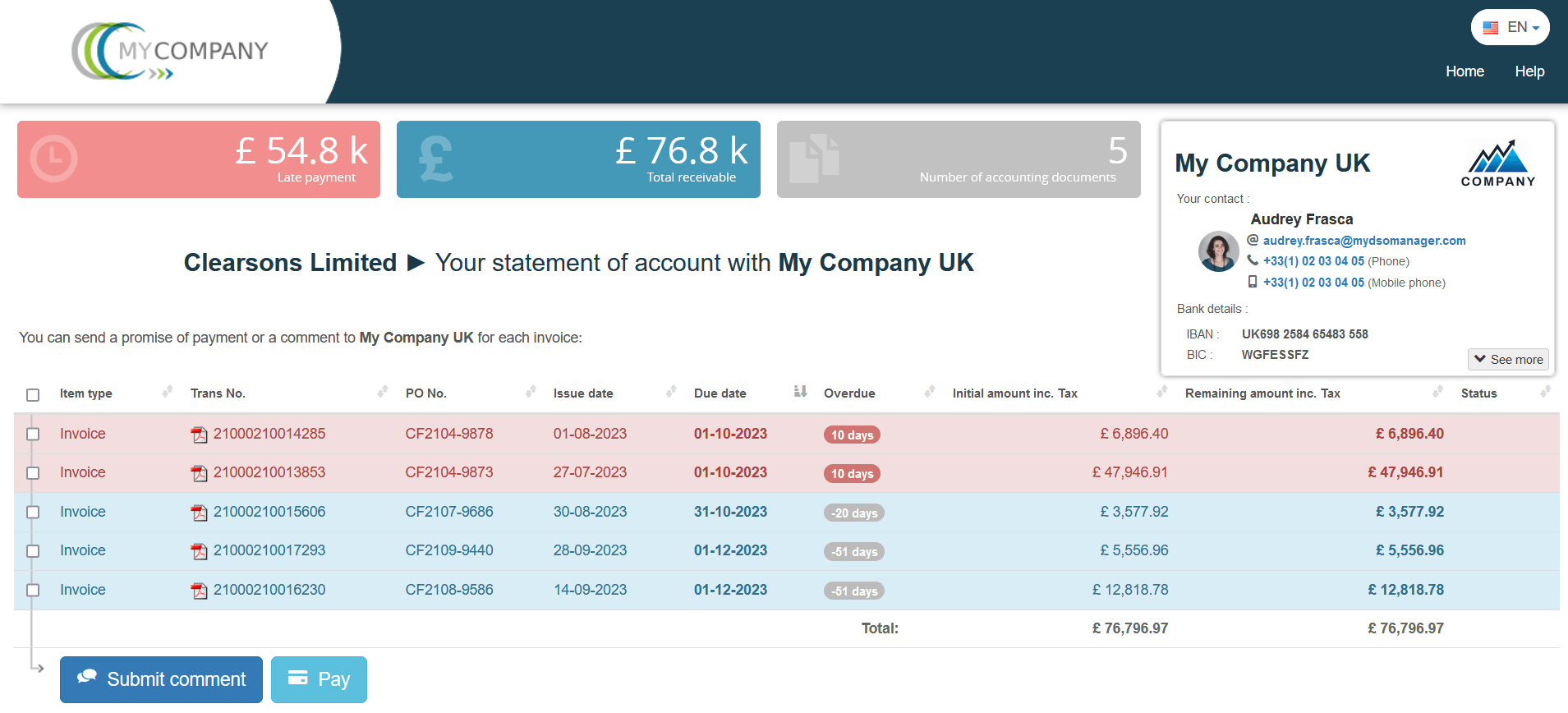

In the first place, access to information. In real time, at any time, to all internal and external stakeholders involved in the commercial relationship: salespeople, sales administration, financial controllers, customers (buyer, accounts payable, etc.), credit managers, collection managers. With, for everyone, the data he or she needs, instantly.Interactive page accessible to each of your customers in My DSO Manager, including key indicators, an account statement with PDFs of invoices, the account recovery manager and the possibility of sending him comments on one or more invoices, buttons payment system allowing debts to be settled by transfer, bank card, etc. :

Secondly, the collaboration. The fluidity of information, that is to say an account statement on an interactive page, with PDFs of invoices, comments from everyone on the situation of a customer or an invoice , performance indicators, allows optimal collaboration, focused on problem solving and decision-making. In an "old-fashioned" mode of operation, 80% of the time is spent collecting and reconciling information. Suffice to say that the protagonists are already exhausted even before having really spoken to the heart of the subject. In this sense, digitalization is an enhancer of skills, which are used for what matters, that is to say the adjustments and human interactions necessary to resolve the problems of the commercial relationship.

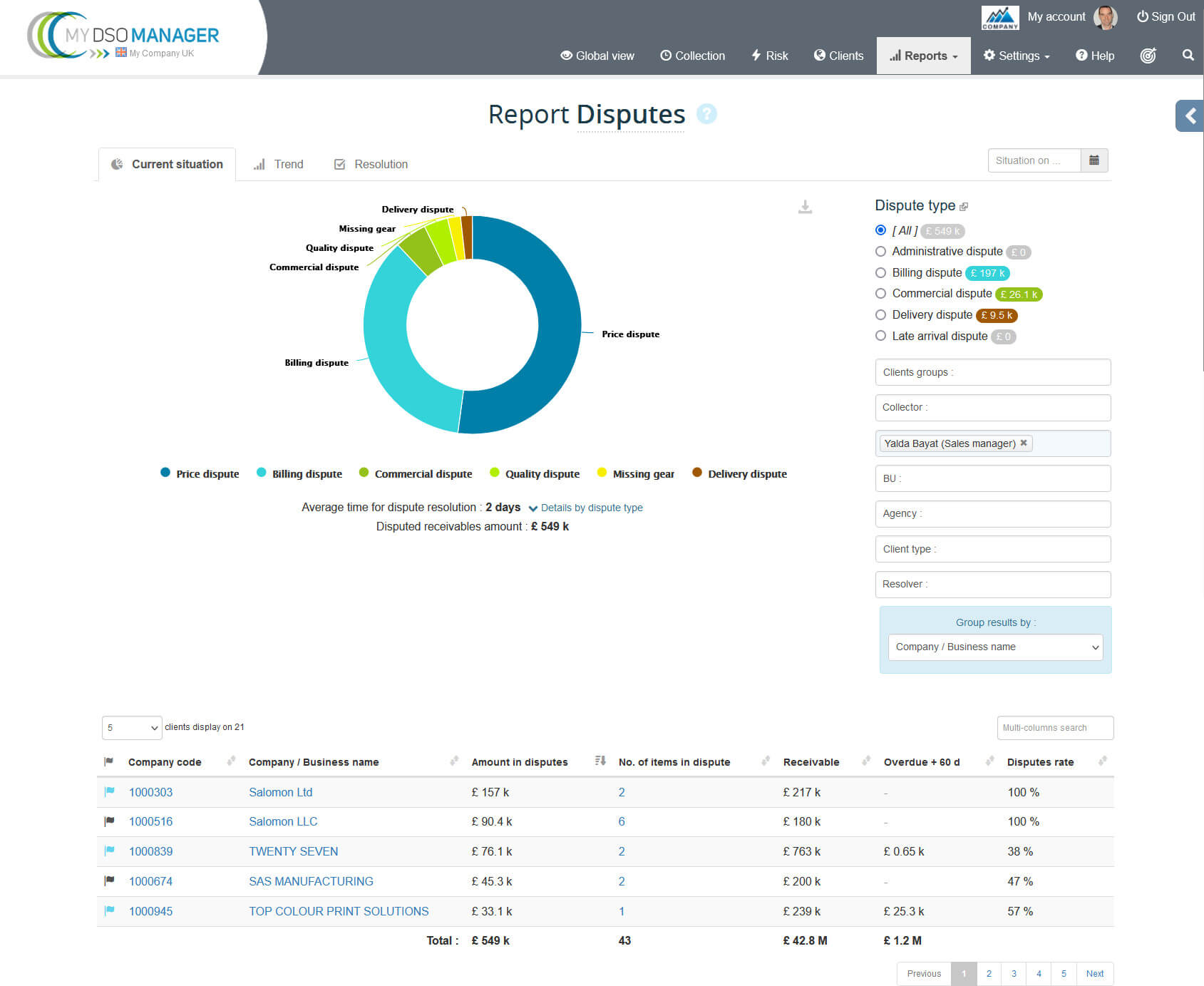

Dispute report from a sales representative, detailing each dispute with each person being able to interact with the collection manager while monitoring performance indicators such as the average dispute resolution time by type and by actor:

Finally, power and glory. Nothing less 😊 Digitalization fills the no man's land between finance and commerce, between a company that sells and those that buy from it:

- Gone are the days when the credit manager is a curiosity in the company, a strange being whose mission is not well understood by either salespeople or financiers.

- Gone are the days when the latter wasted his time making Excel tables hidden behind the screen of his PC.

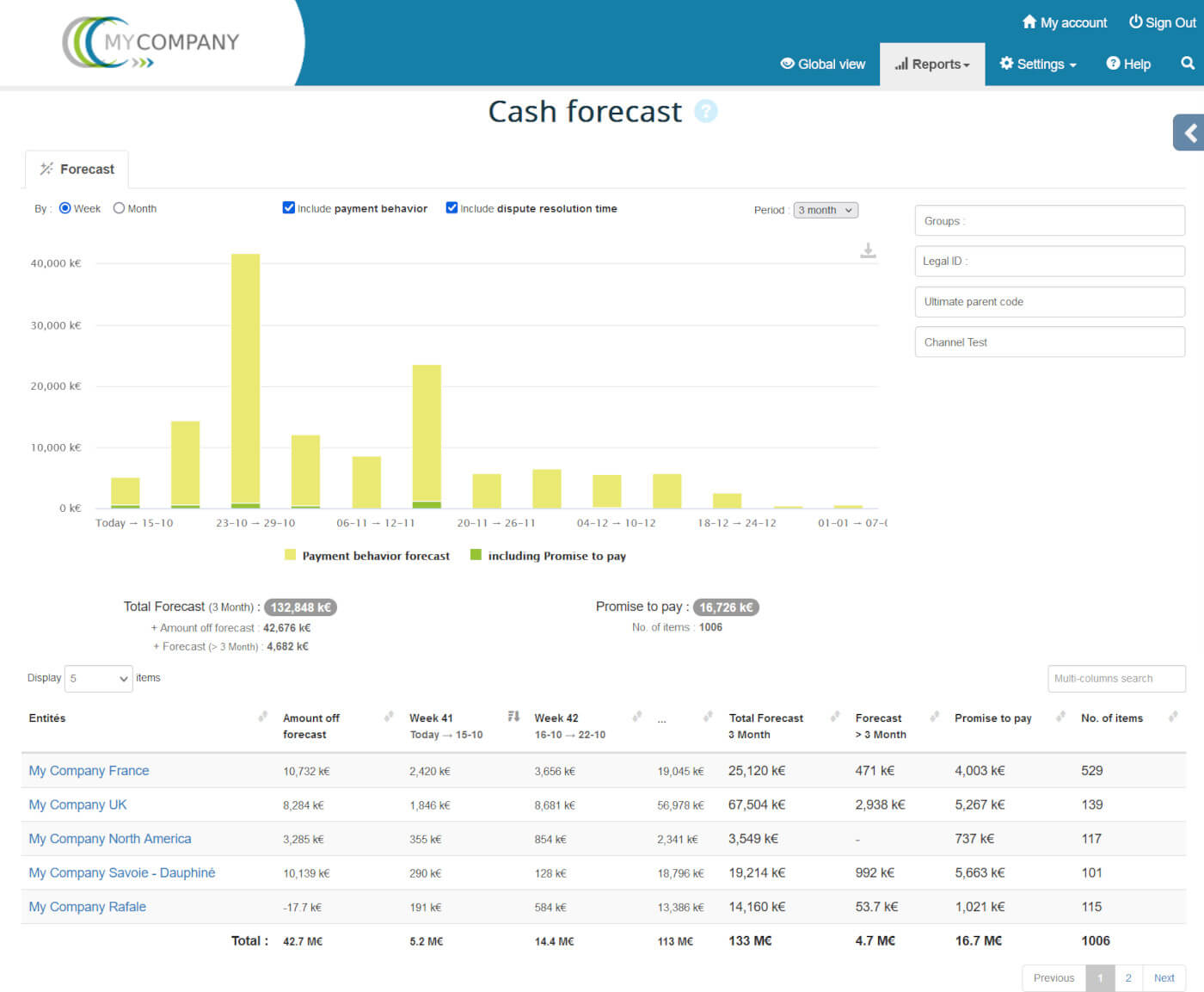

The "Cash Forecast" predictive report from a Corporate platform consolidating in real time the data of a multi-entity, multi-currency and multi-language international group:

Digitalization is therefore an incredible opportunity that changes the very nature of credit management. It allows the valorization of a profession but above all of its principles which are so beneficial to the company as long as they are understood and shared. Like any rapid change, it challenges, sometimes worries. But for all those who want to progress, be more useful and contribute even more to the success of their organization, it represents an opportunity beyond measure.

The slogan of My DSO Manager illustrates the power of the digitalization of credit management and customer account management: Credit Managers' Digital Empowerment. Or digital that strengthens humans. It is in this sense that all digital technologies should be understood.

The My DSO Manager constellation, illustrating the platforms and services interconnected to the solution:

The real digital revolution is here, well beyond just Artificial Intelligence which is only one component, often overestimated due to science fiction referencial. Digitalization is drastically changing the way the credit manager profession is carried out because it provides a projection force unknown until now. The basis remains the same. It is always about managing customer risk, recovering debts, identifying and resolving disputes and improving overdue rates and DSO. But the modalities change so radically that this profoundly modifies both the content and the results. So the objectives become infinitely more ambitious.

So a piece of advice: don’t stay on the sidelines. Embark with us in the exciting digital era of credit management!