AR is also the first or second asset item in value of most corporate balance sheets. It is certainly the one that is potentially the most risky, especially if it is mismanaged.

It is therefore normal that it is one of the main concern of the Chief Financial Officer (CFO), who is guarantor of the economical performance of his company.

If it is up to the credit manager to secure the business, as soon as the commercial negotiation starts, and to speed up the recovery of the receivables, what is the role of the CFO?

Define credit management organization and strategy

First of all, the CFO shall, together with the general management, put credit management under his responsibility. Indeed, the impacts of receivable on cash flow and profitability, that are the main tasks of the CFO, are so high that it is necessarily the responsibility of the CFO to steer credit management team and processes.Second step, he intervenes on the organization of the credit department which depends on several elements:

- Company size.

- Customers types.

- Average value of transactions.

- Sector of activity.

- Commercial culture and habits.

- …etc.

Depending on the specific context of each company, an Anglo-Saxon or Taylorian model will be put in place, with or without the use of external providers such as credit insurance or a debt collection company.

The third essential step is to put in place a credit management strategy consistent with the company's business plan.

The objective is to define the priorities that stem from the main objectives of the company.

Are they to:

- Reduce the DSO to improve cash and investment capacity with:

» Set payment terms reduction as priority in commercial negotiations.

» Financing receivable with discount or factoring.- Encourage the development of turnover by granting favorable terms of payment to customers?

- Preserve profitability with strong credit analysis without accepting to take risk?

The definition of the strategy leads to weight each of these points and to define their implementation.

There are several outputs of this strategy:

- A transverse credit management policy defining the framework in which the credit team operates at each stage of the quote to cash process

- Sales conditions defining :

- Standard payment terms (downpayments, payment delays, payment means requested).

- The discount rate for prepayment, that should be consistent with the weighted average cost of capital and the business strategy..

- The choice of an organization.

- The use or not of credit insurance.

- The use or not of financing tools (factoring with or without recourse, discount of bills of exchange... etc.).

- The implementation of an approval matrix.

- A methodology for collecting receivables and applying penalties for late payment.

What is the day-to-day involvement of the CFO?

However, he is involved in operational management of his n-1 to ensure that he implements the policy defined by top management.

He defines DSO, % of overdue and % bad debts targets in line with the company's business plan.

The CFO is also solicited for all cases that fall outside the usual framework depending on the approval matrix and the business stakes.

For example, an important case requiring exceptional measures (risk, significant deviation from the sales conditions, ... etc.) will be arbitrated by the management on the basis of the credit manager's recommendations.

He will not hesitate to accompany credit manager and sales manager for a visit of a strategic customer.

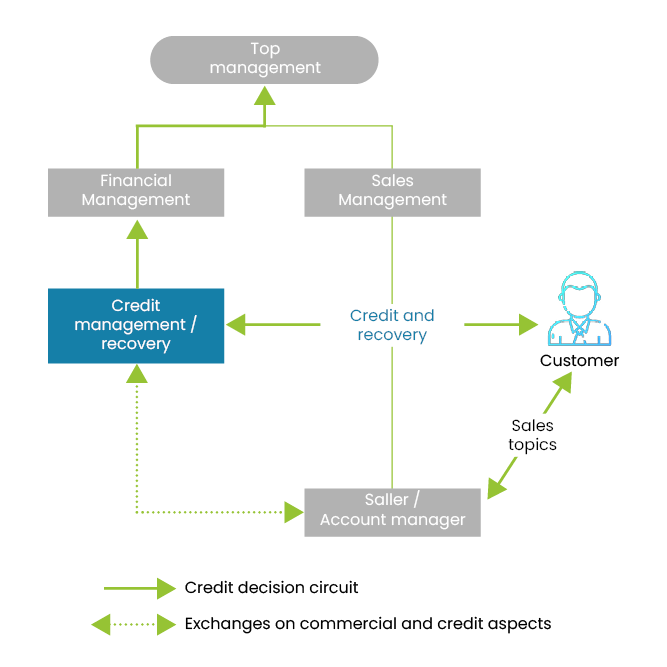

In addition, the functional positioning of the credit manager in the company is very specific, halfway between finance and trade (see article "Credit manager, Anatomy of an unusual species"). His role is to reconcile the two worlds and to ensure that the financial and commercial stakes coexist well in the interest of the company. This role is difficult but essential.

In all other cases, the CFO supports his credit manager so that a fruitful balance is established in the company between commercial and financial stakes.

He facilitates the relationship of the credit manager with the other departments (logistics, sales administration, quality) who are involved in the disputes management expressed by the customers and that are blocking the payment of the invoices.

Conclusion

The role of the CFO is essential in credit management. It establishes a coherent organization and defines the objectives and the means to achieve it. He intervenes and arbitrates on sensitive cases by always being aware of the effects of his decisions on the profitability and working capital requirement of his company.

Like the credit manager at his level, he collaborates closely with the sales department.

As a guarantor of the company's balance sheet and interested both in the company's turnover and its financial performance, he is in an ideal position to take the right initiatives regarding the strategic issues of accounts receivable management.