- Organisation: Who manage collection of Accounts Receivable? Is there a credit management or Accounts Receivable collection department? If yes, is it located under the financial or commercial direction?

- Business culture and practices : Who owns the customer relationship? Is it reserved for salespeople or does the collection team have full discretion to contact purchasers directly and apply their collection scenario?

- Processes: What is the quality and relevance of the collection and disputes management process? Is cash collection management is linked to customer risk management (credit analysis, credit limits setup and monitoring, blocking / unblocking of accounts, etc...)?

- IT systems in place: What software is used for credit management and collection? Is it the ERP or accounting software trio, Excel and Outlook, symbols of the Stone Age of credit management, or specialized software for efficiency and performance?

- Customers types: Small businesses or large organizations with very structured purchasing processes, public entities, domestic or export customers, etc. There are many variables that influence collection and the ways of communicating with customers.

Reminder channels — which are essentially substitutes for the lack of communication between company systems — will gradually lose importance in favor of direct interconnections between sellers’ and buyers’ systems. In this context, electronic invoicing acts as a powerful accelerator.

The classic media

- The mail (postmail): A real emblem of debt collection, mail is now used more in the advanced stages of the recovery process, when it becomes necessary to formalize exchanges with acknowledgment of receipt. The disadvantages of mail are numerous:

- Printing, insertion and mailing time. Several days are needed to reach the recipient.

- Opening rate. Many letter never find their recipients and go directly to the garbage.

- The lack of interactivity. Replying to a mail is not instantaneous at a time when ease of communication / reply has become a natural requirement.

- The cost, particularly high if it is a registered letter with acknowledgment of receipt.

- Ecologically negative printing with the use of paper, ink and the physical transport of mail.

- The phone: Another important media, the telephone is the mean to use to clarify problems with his interlocutor and to get promises of payment.

A significative part of the art of trade receivable collection is possible thanks to the phone that allows to develop a personal link with its interlocutors and to set a framework to "guarantee" the future payments. The disadvantages of the phone are:

- It is unsuitable for communicating on account statements with many invoices (several tens or hundreds)

- It takes time and depends on the immediate availability of its interlocutor

- It is very limited in transmitting information, both in quantity and quality (copies of invoices and other documents, etc.).

- The fax: Fax is definitely obsolete but it can still be relevant to contact certain types of buyers. Indeed, the fax has the advantage of being instantaneous and benefits from an acknowledgment of receipt.

A condition of its effectiveness is that it is always used by the customer and that the fax number is the number of the person to be contacted or at least of its department (a fax sent to a standard number for the whole company has small probability to reach the good recipient). - The e-mail: E-mail is the media that benefits of the best rate of reply in cash collection. Advantages of e-mails are numerous:

- It is sent to a custom address. You are almost sure to reach the right recipient(s).

- It is sent instantly.

- It is possible to attach an account statement or an invoice copy as an attachment or through links to your Documents Management System.

- Payment buttons can also be included which facilitate the payment of your customers.

- It is easy and fast to reply to an email, even more if it is interactive

- it can be interactive by providing an access to the customer to its dedicated portal.

On the other hand, it is inadequate to deal with problematic or conflicting situations. The feeling is often exacerbated in the exchanges by emails. In this case, it is necessary to avoid escalation and then take his phone to remove misunderstandings.

On the other hand, it is inadequate to deal with problematic or conflicting situations. The feeling is often exacerbated in the exchanges by emails. In this case, it is necessary to avoid escalation and then take his phone to remove misunderstandings. - Customer visit: A meeting is often an excellent way to solve problems and lay the foundations of a mode of operation allowing to smooth exchanges and payments.

Although it is time-consuming, this solution is relevant with strategic customers or the ones requiring a specific process to align receivable accounting on one side and payable accounting on the other side. It also makes sens to get fresh financial information in order to manage credit risk. However, it is not always feasable due to many constraints (time, distance...).

The new collection media

- SMS: not very suitable between professionals except with small structures, the SMS nevertheless has advantages and is adapted to certain situations. For example, the follow-up to a craftsman who is on his site all day with his phone as the only means of communication but whom you will disturb if you call him. An SMS solves this situation.

Another example a reminder of payment of due date by SMS for an individual person seems very relevant. The SMS is nevertheless unsuitable for most other situations and business relationships. The SMS can also be useful for internal exchanges (requesting the help of a sales representative for example). - Interactive e-mail: This media is proposed by My DSO Manager, an inovative credit and collection software. It is based on e-mail but allows to enhance the interaction thanks to a sharing of the information contained in the software and the possibility for the recipient (s) ) (Client or internal actors) to interact on a dedicated page with the collector. This media is very effective and appreciated because it is simple to use for both the sender and the recipient.

- The Électronic Registered Letter: the LRE is a legal alternative to sending a registered letter with accused classic receipt in paper format. In dematerialized format, it has many advantages in terms of reliability, delivery speed, as well as cost (two to three times cheaper). In addition, it consumes neither paper nor fuel to be delivered.

- Customers types (individuals, big accounts, SME…): The collection strategies and how to do them depend in part on who your customers are.

- Domestic or export business? Sending postmail won't be efficient if your customer is in a far country..

- Number of open invoices: Having customer accounts made up of hundreds of invoices with an average value of 50 euros or a few bills of several tens of thousands of euros has a significant impact on the communication medium used. For example, phone can be used only in the second case.

- Organization: If you have to inform several people of each restart done (sales manager, purchaser ... etc), the relaunch by e-mail is more adapted.

- IT systems: What software is used to manage trade receivable? Is it the triptych ERP or accounting software, Excel and Outlook, symbols of the stone age of credit management or specialized software allowing efficiency and performance?

- Portals: Do customer use AP portals?

The quality of communication and exchanges with its customers is essential and as in any professional process, this point must be reflected and industrialized with appropriate tools. It is with the application of collection scenarios that combines the different media according to each collection stage that you will achieve the best performance. The couple interactive e-mail and phone is thus very effective, with an optional electronic registered letter to manage any pre-litigation phase.

-

Collection media in My DSO Manager

It is possible to use many collection media in My DSO Manager and in particular the most effective.

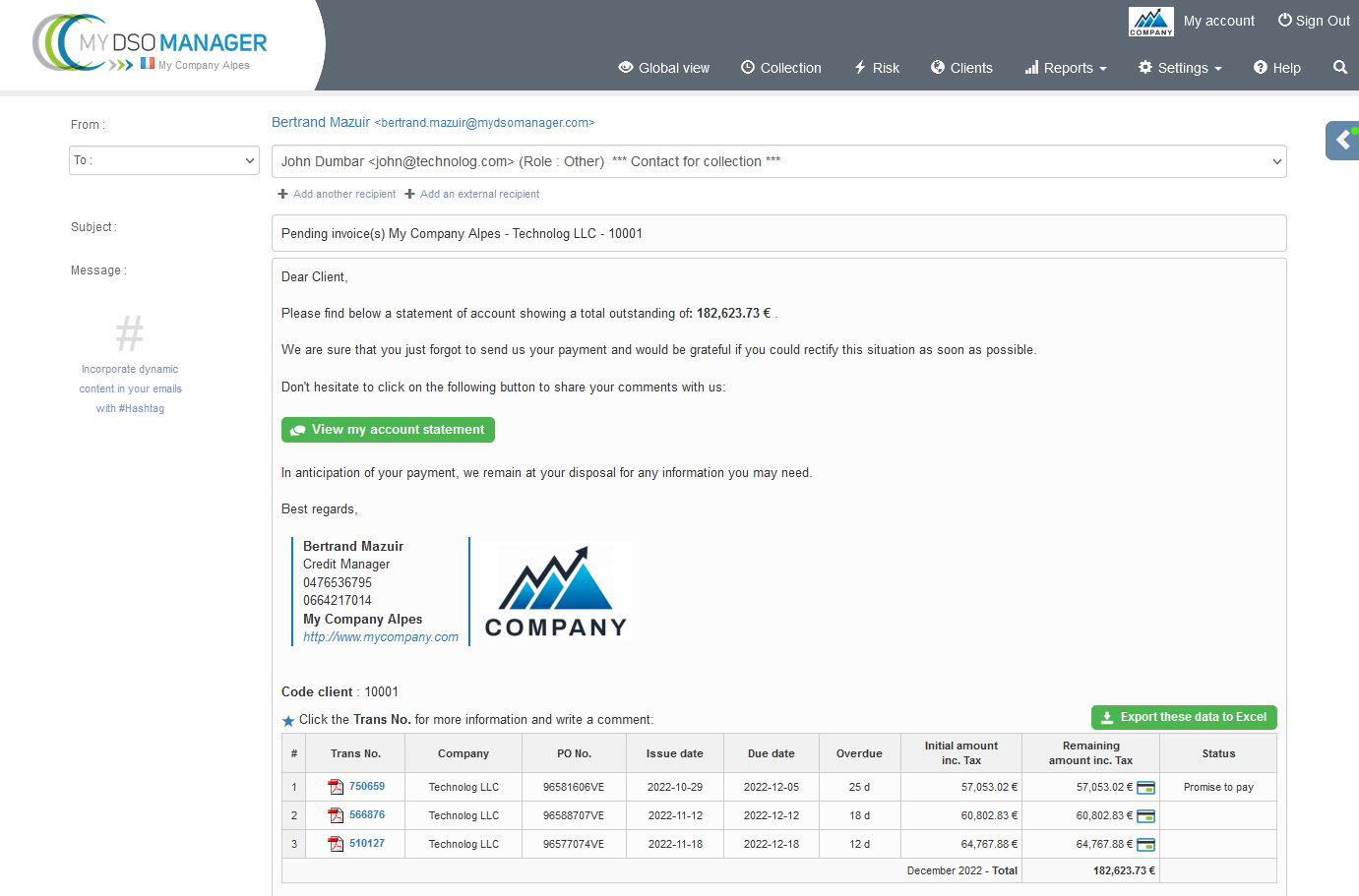

Interactive e-mails are a creation of My DSO Manager to make interactions with customers and internal staff (sales, customer care center ...) more efficient and relevant.

E-mail, interactive e-mail, SMS, electronic letters, postmail, phone allow to chase up customer in a custom and efficient manner.

One thing is the type of media used, another is its quality and the speed to use it. Example of an e-mail from My DSO Manager, automatic, semi-automatic and customizable, including all the necessary information:

See more with the online demo.