- Get a promise of payment for the due date of the invoice by a given mean of payment. You can remind your client about their commitment if they don't make the payment at the promised date. This allows you to require an immediate payment.

- Check that your client has your correct bank account details and address in case they will pay with another payment method.

- Ensure the customer validates the invoices or identifies any problem or dispute blocking the payment. This gives the time to fix the problem identified (error on the invoice, missing material, quality issue ...). You can then finally recieve payment on the due date. This would not have been the case if you had chased up your customer ten days after this date.

- To demonstrate to your customers the seriousness of your Accounts Receivable management. Bad payers can try to gain cash by delaying payments to its suppliers. They will systematically do so with the most lax of them and will pay those who make regular reminders.

-

Maximize the effectiveness of your preventive reminders with My DSO Manager

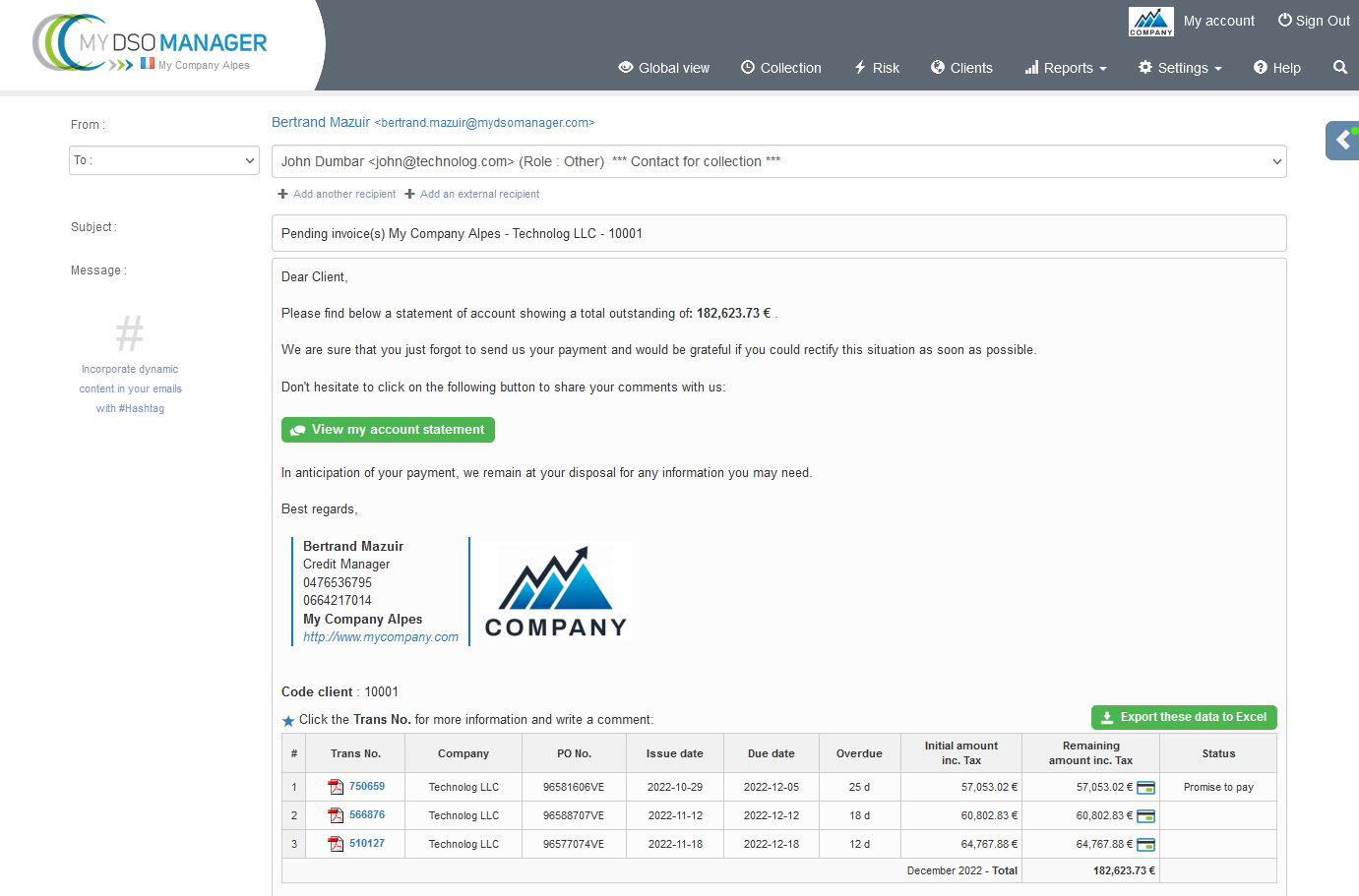

Schedule automatic preventive reminders by interactive email with My DSO Manager.

This makes obtaining a promise of payment or an explanation behind an unpaid invoice both easier and faster. It can be because of a dispute, cash flow problems, and more.

This anticipation enables you to focus on resolving problems and recieve payment as quickly as possible. Meanwhile, you'll be maintaining customer satisfaction thanks to an intelligent collection workflow. Check out our free demo.

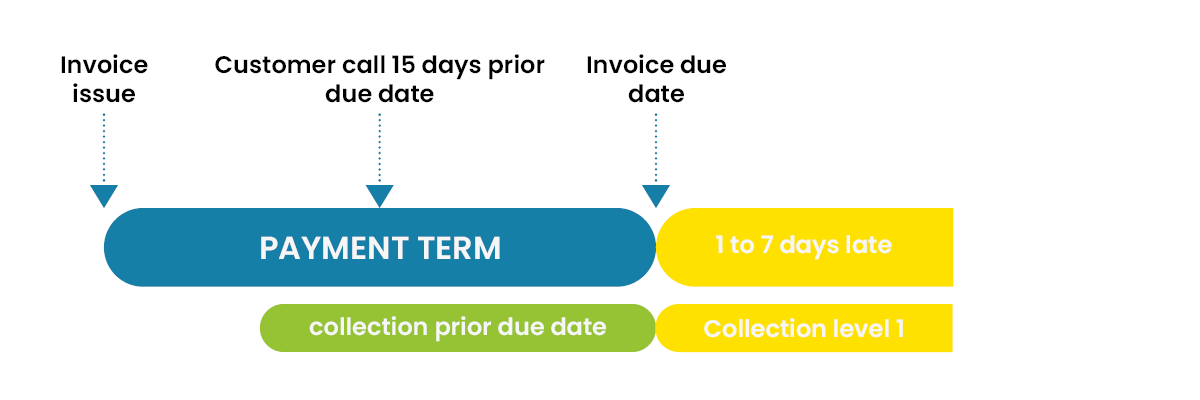

Process of preventive recovery

This action is a commercial and customer satisfaction oriented move. It basically contains questions to ensure that everything is in place for the payment of the invoices. It aims to answer the following questions:- Have you well received the bills?

- Are they all validated for payment? Could you otherwise elaborate on the matter at hand?

- If so, do we agree for a payment on the due date of the invoice?

- etc.

Another advantage, it allows to detect upstream cash issues if any and react quickly to a credit risk identified.

Two follow-up media for that purpose are phone call and e-mail (or interactive e-mail). Clients prefer one or the other, depending on the volume of invoices and the type of client. You can schedule several preventive reminders, such as one by e-mail and the other by phone for example.

Interactive email has many benefits. It contains all the information necessary for your customers' accounts payable to process your request. You can add your clients downloadable account statement and links to PDF invoices. You also have the possibility of allowing them to send questions, comments or bank details. There even are optional payment buttons available.

Furthermore, it is possible to automate its sending to hundreds or thousands of customers, thus increasing its efficiency tenfold. This functionality gives credibility to your approach and the quality of your management. It also strengthens the image of your company which communicates in a modern and digital way with its customers.

Interactive e-mail example