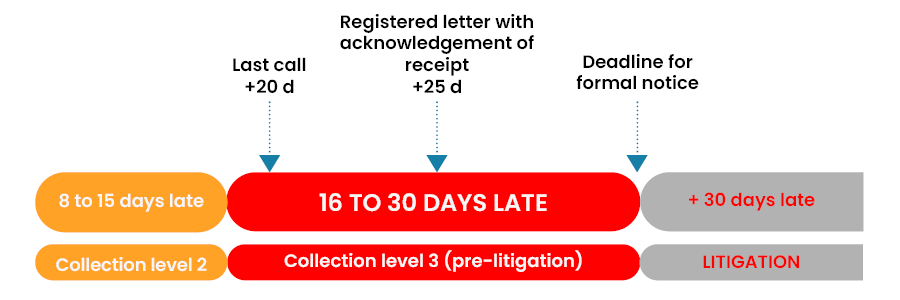

The collection level 3 is the last step of the amicable cash collection process. At this point, we already made numerous efforts to manage old overdue accounts. Credit Managers take this step after the completion all previous steps in the amicable collection scenario.

The focus is now on resolving the outstanding debts in a diplomatic and professionnal manner. You will also ensure that the process respects the rights of both the creditor and the debtor.

Collection level 3 may involve more intensive communication and negotation with the debtor. It also presents the possibility to implement more formal collection measures if necessary. Ultimately, the goal is to successfully recover the overdue funds while maintaining a positive relationship with the debtor. This explains why it takes placeat the end of the collection scenario after the others steps:

This is the last step of the amicable collection process. It ultimately concludes with the issuance of a formal notice to the individual or entity in question. This notice typically outlines the oustanding debt, along with a specific deadline by which the customer must pay you.

This formal communication serves as a final warning before you may take further action to recover the debt. Such actions can be legal proceedings (file a lawsuit) or collection efforts. The deadline provided in the notice is crucial, as it establishes a clear timeline for resolution.

It also emphasizes the seriousness of the situation. Failure to pay by the due date may result in escalated consequences. It underlines the importance for the recipient act, address the issue and fulfill their financial obligation.

![]() Make sure your previous reminders have the right contact informations before going to step 3 and giving formal notice. If you never got an answer to your e-mails and calls, there might be an issue with the management of contacts for collection.

Make sure your previous reminders have the right contact informations before going to step 3 and giving formal notice. If you never got an answer to your e-mails and calls, there might be an issue with the management of contacts for collection.

A pre-litigation stage

Despite numerous reminders made since the issuance of your invoices, your client has still not decided to pay you. You should know that nothing justifies this delay.

Financial costs negatively impact your company's cash flow and profitability, thereby weakening its financial structure.

This situation constitutes a break in the balance of the commercial relationship. It means that one of the protagonists, the buyer, does not fulfill his commitment, which is unacceptable.

What is appropriate in those cases is to increase the pressure on your client. You can send him a letter of formal notice to let him know that you have reached the end of the amicable process. Thus, you safeguard your rights for possible litigation.

![]() This formal letter is a necessary precondition for a litigation action. It has a deadline beyond which you announce your intention to use other means to recover your receivable. It can be through legal action, transfer to a collection agency, reporting the overdue to your credit insurance, etc.

This formal letter is a necessary precondition for a litigation action. It has a deadline beyond which you announce your intention to use other means to recover your receivable. It can be through legal action, transfer to a collection agency, reporting the overdue to your credit insurance, etc.

The sending of the notice gives credibility to your reminder actions with your client, which often unblocks the situation. Preferably, you may send it via an electronic registered letter. This kind of letter is more efficient, immediately received, less expensive, and less polluting.

It constitutes a threat that is effective when your customer does not pay by the ultimate deadline.

![]() Make no mistakes; the objective is always to avoid litigation. This process would consume time, is expensive, and has an uncertain outcome. However, you stand the best chance of receiving payment before reaching this final collection step. It demonstrates your determination to enforce the contract you have concluded with your client.

Make no mistakes; the objective is always to avoid litigation. This process would consume time, is expensive, and has an uncertain outcome. However, you stand the best chance of receiving payment before reaching this final collection step. It demonstrates your determination to enforce the contract you have concluded with your client.

Read our tutorials about the best way to collect bad debts.

Collection level 3 process

At this stage of the recovery process, the essential action lies in sending the formal notice. Nevertheless, you can make a final interactive e-mail or phone call to the buyer. You will inform him that the amicable recovery process is ending because of the unacceptable situation of late payments.

![]() Do not hesitate to send a letter of formal notice (always with an acknowledgment of receipt). By sending this type of mail, you demonstrate your commitment to receiving payment. This letter often induces a psychological effect that unblocks the situation and facilitates payment.

Do not hesitate to send a letter of formal notice (always with an acknowledgment of receipt). By sending this type of mail, you demonstrate your commitment to receiving payment. This letter often induces a psychological effect that unblocks the situation and facilitates payment.

You have to share the decision to send the letter of formal notice within your company. In the accounting department, the commercial leader must speak with one voice to the customer. They will make him understands that he has no alternative but to pay the bills. Management should share and validate this mode of operation in advance through a document defining the credit policy.

If your customer can't pay you because of financial difficulties, you can establish with him a contracted payment plan. You will have good chances of getting your money back without going through the litigation step. You will also maintain good commercial relations with him.

![]() If you don't receive payment before the deadline of your formal notice, you must proceed to the litigation stage.

If you don't receive payment before the deadline of your formal notice, you must proceed to the litigation stage.

Remember that formal notice letters must remain credible. Once you send these letters, there's no need to retract it. If you do not pursue your litigation action and play into the customer's game, then the latter will persists in not paying. This means you take the risk of chasing your debts for a long time.