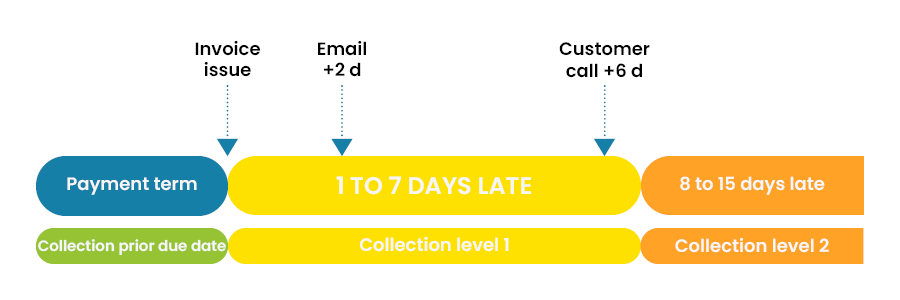

Collection Level 1 is a step in the collection scenario of Trade Receivable. When the buyer does not pay the amount owed to the seller by the due date, it leads to a late payment. This can happen even after the first pre-dunning action sent before the due date.

This stage of the collection process concerns short, overdue invoices. The client did not honor his promise of payment obtained during the first reminder. The invoices remain unpaid for the moment, whereas they are due.

The first step to understanding what the reason for nonpayment is, is to dissociate the minor reasons.

- client forgot to make the payment,

- accountant or director out of office,

- bank transfer made with the wrong bank details,

- The check was sent, but it either got lost in the mail or arrived unsigned,

- A payment was mistakenly made to another supplier.

... which you can resolve quickly, from more serious reasons. Minor ones are subject to precise monitoring by the collector and the good faith of the buyer. Disagreements over bills, your client's financial fragility, or refusal to pay your bills are however, more serious reasons.

A collection action made by phone or by e-mail is key at this stage. If needed, you can also send a letter asking for immediate payment. We advise using letters sent with confirmation of delivery, with a preference for electronic ones over paper.

Read our tutorial about the best media to use in cash collection.

![]() This new recovery action aims to obtain a written promise to pay before the due date of the invoice. In the event that you can't secure one, the alternative objective is to clearly identify the issue. You will then be able to resolve it as quickly as possible and return to the customer.

This new recovery action aims to obtain a written promise to pay before the due date of the invoice. In the event that you can't secure one, the alternative objective is to clearly identify the issue. You will then be able to resolve it as quickly as possible and return to the customer.

Collection level 1

The dunning actions start on or just after the due date of the invoice. The aim is to understand the reasons behind a late payment. It helps to bring the customer to settle the overdue immediately. You can, however, allow a short time period, according to the problem.

![]() The effectiveness of your recovery process depends on multiple factors. They form a judicious combination of phone calls and dunning letters sent by e-mail. You can also send post mail with an acknowledgement of receipt.

The effectiveness of your recovery process depends on multiple factors. They form a judicious combination of phone calls and dunning letters sent by e-mail. You can also send post mail with an acknowledgement of receipt.

![]() Sales managers often say, "Do not send dunning letters" or "Calling clients about overdue invoices will hurt our relationship." You need to be aware that they are in error regarding this subject. Requesting customers to respect their commitments does not affect the business relationship.

Sales managers often say, "Do not send dunning letters" or "Calling clients about overdue invoices will hurt our relationship." You need to be aware that they are in error regarding this subject. Requesting customers to respect their commitments does not affect the business relationship.

On the contrary, excessive tolerance in cash collection quickly leads to an intolerable situation. It shows through an increase in overdues, which affect the cash flow of your business. If this happens, it will indeed impact the relationship with your customer negatively. You may lose your customers if you don't manage your Accounts Receivable properly!

The quality of recovery actions depends on several factors:

- Respect the timing. You must carry out follow-up actions at the right time. They rely on the defined recovery process and discussions with your customers.

- Solicit the right people. At each stage of the recovery, involve the people who can act. Depending on the accounts payable process, these can be different in light of the blocking point. Developing a good knowledge of your clients and their organizations is imperative.

- Communicate the right information. During check-ins, sharing details can help address issues and fill gaps in the business relationship. You can then use this information to take the necessary steps to improve the situation and meet the needs of those involved. PDFs of invoices, up-to-date account status, possibilities to interact with the collection officer, etc. are essential elements for fluid and effective communication.

![]() These principles often apply to a high volume of customers and invoices. To apply them, it is therefore essential to use appropriate recovery software. It enables people to carry out actions on their precise dates, with the right people, and with the right information.

These principles often apply to a high volume of customers and invoices. To apply them, it is therefore essential to use appropriate recovery software. It enables people to carry out actions on their precise dates, with the right people, and with the right information.

Collect invoices with administrations and large companies

To succeed in your recovery efforts, it's important to find the right person to approve the payment. However, finding them is not always that easy. Indeed, accounting managers or Chief Financial Officer are easily identifiable as conversant in small and medium businesses. But for larger companies, this search can become more complex.

A major problem in cash collection with large companies and administrations is understanding their organization. Finding someone who can unlock the payment is much more complex. Therefore, you have to investigate to understand the validation process for invoices. Only then will you be able to act where the blockage is; otherwise, reminders will have no effect in the long term.

![]() This principle is even more true as large companies and administrations streamline their accounting services through automated tasks. This works quite well, as long as there is no problem. However, dispute and exception management is often poor, which implies specific recovery actions by the seller.

This principle is even more true as large companies and administrations streamline their accounting services through automated tasks. This works quite well, as long as there is no problem. However, dispute and exception management is often poor, which implies specific recovery actions by the seller.

![]() Today's multiple Accounts Payable portals complicate the task for collection managers. Unless they benefit from interconnected software! For example, Chorus PRO in France helps with the recovery process for debts held by the State.

Today's multiple Accounts Payable portals complicate the task for collection managers. Unless they benefit from interconnected software! For example, Chorus PRO in France helps with the recovery process for debts held by the State.

Both public and private economic actors need to be equally digitalized for a successful commercial relationship in today's world. Without this, the relationship can no longer function effectively.

Tips to prevent the delaying of the payment of an invoice

At this stage of recovery, delays can happen when customers want to gain a few days or weeks of cash thanks to Accounts Payable. This can cause issues with the payment deadlines. Disputes and other administrative problems represent an even greater part of overdue root causes.

Indeed, many of them think that it will not hurt their company, as it is easy to mention a ready-made excuse. Here are the most common ones:

| Customers' tips | Answer to bring |

|

We did not receive the invoice. We would like you to send a duplicate certificate to us. |

Send a duplicate certificate immediately by e-mail. If necessary, you can also send it by postmail. Once done, call the customer as soon as possible for immediate payment confirmation. |

|

We have not received the check mailed two weeks ago. Could you please investigate this matter? |

Start with a quick verification of the absence of a receipt for the check. Then, send a letter of withdrawal and request an immediate payment if you can confirm the absence. We advise you to prefer payments by bank transfer. With this payment method, you won't risk losing your checks anymore! |

|

Our client did not settle with us, so we can't pay you yet. |

This reason is unacceptable! The vicissitudes of your client's business relationship with its own clients should not concern you. Ask your client to respect his commitments as part of the relationship established between him and your business only. Even though your client struggles with their customers, they must still pay on time. |

|

The person authorized to sign checks and wire transfers is out of office. |

Ask for the date of return and remind them as soon as the signatory is back. Then require the next installment to change the means of payment to receive the confirmation before the due date. This will prevent late payments. |

|

We do not agree with the calculation of the due date. |

Agree with the client on the use of a single calculation method to avoid disputes in the future. Obtain a written confirmation to mark the agreement. |

|

Invoice content or billing address errors. |

Immediately redo the invoice with an immediate due date (the same day). Send it by e-mail and ask for immediate payment confirmation. |

|

We have not registered the products or services; could you please send us the delivery note? |

Send the delivery slip immediately by email and demand an immediate settlement. |

|

Our monthly payment campaign is on Thursday, but today is Friday. Please contact us next week for payment. |

Ask for a payment confirmation for next Thursday. Remind your customer that the contractual payment date of your bills is the credit date on your bank account. If they make their payments only once a week or month, they must arrive the day before your bills are due. |

|

We have cash flow problems and need your support. |

You can negotiate a payment plan if your client can prove those difficulties. However, this plan must be as short as possible. This plan should include an immediate partial payment and the requirement to sign a contract or at least confirm it in writing. |