The accounts receivable are a part of current assets and as such is only a temporarily item. A specific item (an invoice or a credit note) appearing in a customer account is not expected to remain outstanding over the period of time of payment term granted to the client.

The aging balance allows to perform an analysis by customer on the amount of open receivables and its impact on cash and working capital requirement.

It is structured around the due date of invoices, which allows to have a quantitative (amount outstanding) but also qualitative (age of invoices versus due dates) view of the accounts receivable.

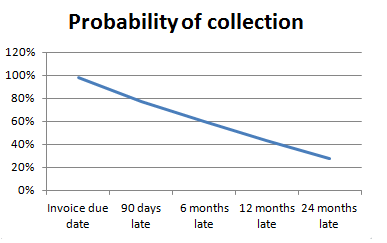

Indeed, the open receivables impact cash flow but can also generate losses because of their age, inversely proportional to the probability of recovery.

One of the great interest of aging balance is to provide a view of receivables by customer and by late payment tranches based on number of days late.

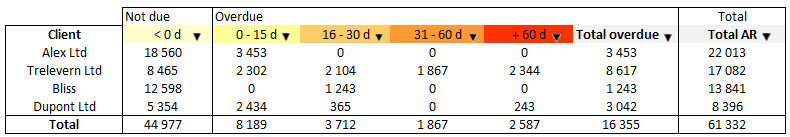

The outstanding receivables is distributed in several columns defined to clear up the user on the criticality of the situation. It is usual to set up 5 columns that correspond to the main stages of friendly collection process and then litigation plus two summary columns:

- A first column for not yet due receivables: we are at the stage of pre-dunning actions.

- A second column for short delays of less than 15 days: collection levels 1 and 2.

- A third column for delays between 16 and 30 days. We are around 30 days overdue and at the end of the friendly collection process.

- A fourth column for delays between 31 and 60 days, which is the beginning of litigation.

- A fifth column for delays of more than 60 days which may have causes like unresolved dispute, payment delays related to a default of the customer or an insolvency (bankruptcy proceedings). The invoices involved will certainly be provisioned into bad debts which will negatively impact the income of the company.

- The sixth column is the total amount of overdue.

- The last column is the total outstanding, for viewing clients with whom the total AR outstanding is most important.

How to drive its recovery with aging balance?

The advantage of this tool is that it allows you to target the largest amounts overdue and the amounts that are due for the longest time.The standard approach is to prioritize its dunning actions on three axes:

- The first is based on decreasing outstanding amounts to perform preventive reminders on at least largest amounts with the aim to get a promise to pay for the due date.

- The second is based on the total amount overdue. A descending sort is performed on this column to highlight the biggest customers overdue. The cash collector chases up the biggest amount then the next ... etc.

- The third focuses on the oldest delays (eg more than 60 days) due to their criticality. The more time passes, lower are the chances of getting paid. A descending sort is performed on this column and the manager tackles the biggest delays longer than 60 days and then down the aging balance.

-

Aging balance in My DSO Manager

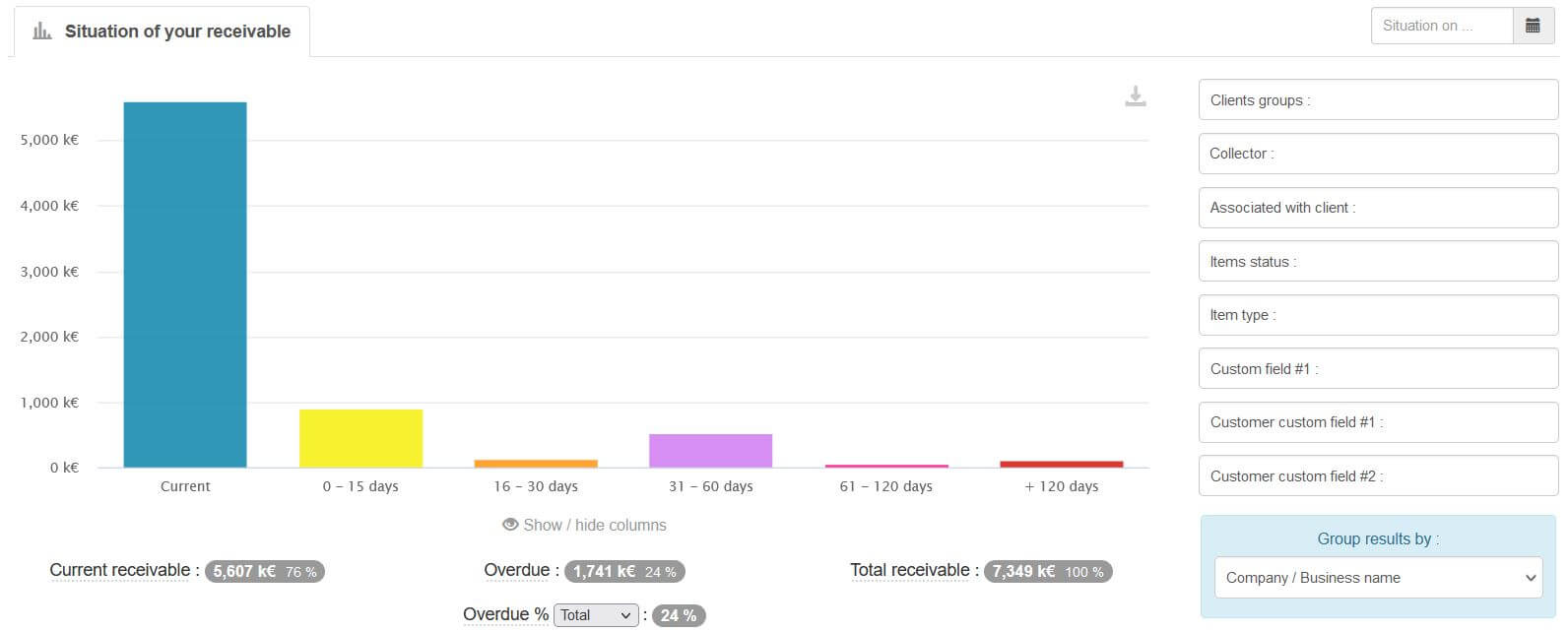

Aging balance is a central tool in MY DSO MANAGER for organizing its cash collection and assess its performance.

Displayed in real time, it makes it possible to identify in a few clicks the customers on which to act in priority. It complements the recovery agenda and all the other reports and indicators of the software.

It covers all receivables or is broken down by customizable analytical fields (customer groups, customer, collector or document segmentations) and by customer See more.

Assess performance with aging balance

The aging balance is a management tool but also a performance assessment tool in cash collection. Indeed, it allows to highlight the % of overdue and to split it per tranche of delay. This is providing a much more detailed analysis.Indeed, a high rate of overdue is a lesser evil if the receivables are past due for a short time. However, if the rate is correct (below 10% for example) but invoices are overdue for a long time (several months) the situation is much more serious.

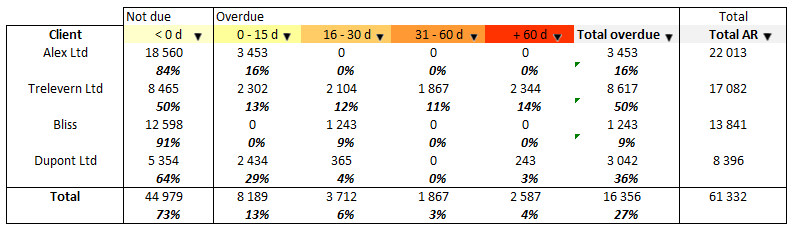

The % of overdue is applied to each of the tranches of the aging balance as follows:

The rate should be lower and lower gradually as the column corresponds to the oldest debts.

In above example, the overall overdue rate is 27%, which is high.

We also see a significant problem with the client Trelevern Ltd, which has a lot of bills late (50% for 8617 euros) including old debts (14% which are more than 120 days late). This is a customer who does not pay for several months. Urgent action needed!

- An explanation: Why this invoice is not paid?

- An action pending or future: What is he doing to solve the problem and bring the customer to pay?

Conclusion

The aging balance is a central tool for the persons involved in the management of trading receivables and debt collection. It allows both to organize and prioritize actions for collection and to monitor performance.It is also useful to determine the amount of bad debts provisions which are partially resulting of the age of the receivables.

Integrated into modern credit management and cash collection software, it is filterable, sortable in real time on numerous criteria (customer or invoice segments, collector, commercial, etc.) to increase its power and the visibility that it procures.