Customer dispute management is an important aspect of a company's sales process. Indeed, disputes are the result of all the company's existing dysfunctions. They affect cash flow, profitability, and customer satisfaction. They refer to each stage of the "Order to Cash" process.

What is a dispute exactly?

According to credit management terminology, disputes arise due to justified customer dissatisfaction. For a valid reason, the customer does not validate the invoice payment. This concept differs from litigation, which refers to a firm disagreement between the seller and the buyer. It also is different from an unpaid debt that is unjustified and can result in legal action.The main sources of disputes

- Production and/or service delivery raise quality issues.

- The contract or order and what the seller delivered ar different.

- Administrative issues include the absence of purchase order, wording errors, missing documents, supporting documentation, and so on.

- Problems with logistics and delivery.

- Billing errors can include incorrect pricing, early billing, billing to the wrong entity, and so on.

Disputes can have a variety of causes, depending on the business. They represent numerous opportunities to improve the organization and quality processes.

Disputes are the leading cause of late payments; dissatisfied customers refuse to pay the invoices involved. Remember, for a debt to be recoverable, it must be:

- Liquid (cash-valued).

- Due (the due date has arrived).

- Certain (unquestionable).

A dispute makes the debt in question uncertain, preventing effective recovery action. Should you take legal action, the court will first determine whether the debt is certain. If the seller cannot prove this, he will lose his case.

Furthermore, slow resolution of disputes negatively affects customer satisfaction. If there is a significant recurrence, it can cause extensive damage and customer loss.

Disputes can lead to a loss of credibility and customer satisfaction. Even more so should you spend too much time resolving them. However, business also use them to identify internal dysfunctions! Thanks to them, you will be able to improve products and services sold.

-

Disputes management in My DSO Manager

My DSO Manager integrates a collaborative and efficient process for identifying and resolving disputes that, by definition, affect multiple departments within the company. We qualify the invoices in question with a dispute code, such as a price dispute, and a comment that outlines the issue. A resolution manager, similar to a sales representative, receives this information, manages the dispute, and responds to the collector.

You can then manage disputed debts using the disputes report. This indicator allows you to contact the internal actors responsible for the conflict resolution. An organization's ability to quickly resolve disputes and address their underlying causes reflects its quality. All of this is possible thanks to the software.

Disputes and Credit Management

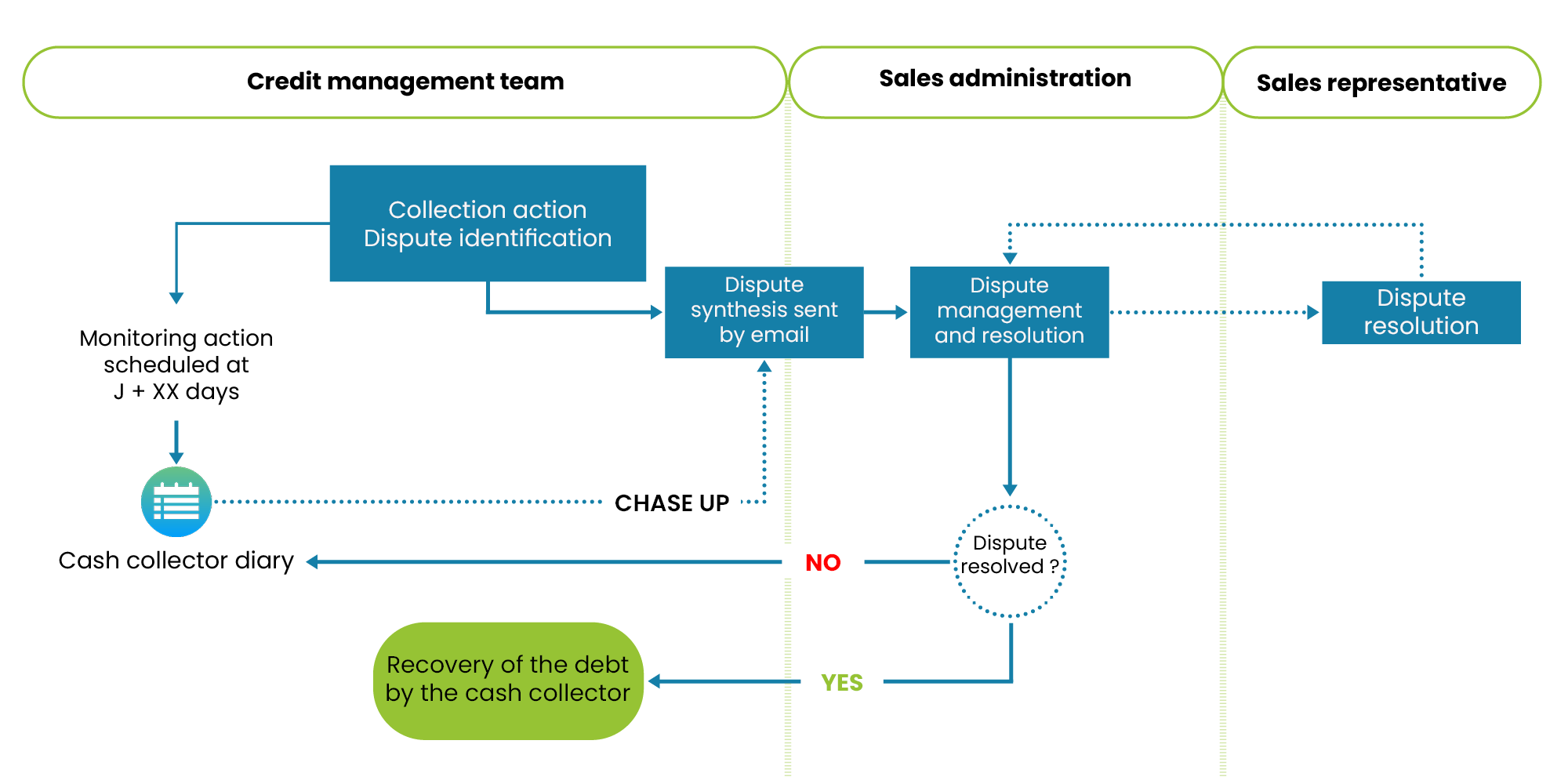

Customer receivables management and cash collection closely relate to identifying and resolving disputes. The collection process, which aims to get bills paid on time, must factor in the problems they cause.

Therefore, we complete the first collection action before the invoice's due date. We do this to guarantee there is no dispute preventing payment. To do so, you can send what we call a collection letter prior due date.

If there is a dispute, preventive recovery actions allows for early detection and implementing resolution strategies. Such strategies expedites the collection process and enable timely payment on the due date. This happens regardless of the resolution of the dispute in the interim.

Disputes management process

The company must establish a dispute resolution process to define the roles and responsibilities of each parties involved. This also ensure that the organization properly handles conflicts.Nothing is worse than putting off resolving disputes until "when we have time." Studies have shown that litigation and failing to address issues raised by customers have an impact on satisfaction.

- If left untreated or improperly treated, the consequences are severe.

- Customer satisfaction is ultimately higher than it would have been if there had been no dispute!

Indeed, by swiftly managing conflicts, the seller shows the buyer how much he values him. He then gains a better competitive edge, and receives payment for his services.

Key factors of success include:

- Transversality refers to the sharing and understanding of the process among the involved departments.

- The management determines which service is responsible for the volume and duration of litigation. This service will encourage stakeholders to resolve disputes quickly. In large corporations, this mission falls under the purview of the Credit Management / Collection Department.

- The ease with which those in charge of collection, administration, sales, and trade exchange information and take actions.

Associating "good methods" with great tools is crucial for managing large volumes of customers, invoices, and disputes.

These tools have the power to change the game ! They provide visibility and can help manage large case volumes efficiently. They also ensure that businesses implement their processes properly with the right tool on hand!

What are the different dispute types?

Various types of disputes can occur in businesses relationships, their treatment may differ depending on their nature.

For instance, sales administration have the ability to resolve disputes over billing errors (bad wording, price error, etc.). Meanwhile sales manager or technician will handle a technical dispute.

To improve dispute resolution, it is necessary to categorize them. For example:

- Quality dispute: includes disagreements over the quality of products and/or services provided.

- Price dispute: the difference between the charge and the client's negotiated price.

- Administrative disputes involve missing or poorly written documents (invoices, purchase orders, packing lists, etc.).

- Event date dispute: for example, the seller issues an invoice but the buyer did not recieve the material.

- Missing goods dispute: discrepancies between billed and delivered quantities.

- Double billing disputes occur when the seller mistakenly bills a delivery twice.

Types of disputes are inherent to each activity and company. Even if some are extremely common, such as price disputes or administrative disputes, they still are unique in some ways.

How to collect disputed invoices

The dispute resolution period halts the Accounts Receivable collection process. That is not to say the collector does nothing! To have the issue resolved, he or she must follow up with the resolver.

Once the buyer and seller resolve the dispute, the collection process will resume with a new due date. This date is then coherent with the resolution date of the dispute.

The first action is Collection Action Level 1, with the goal of obtaining a promise to pay immediately.