Ensuring timely payment of invoices is crucial for the success of any business. This is the primary goal of the Credit Management department.

Implementing tailored collection scenarios for each situation yields optimal outcomes, enhancing your company's cash flow and profitability while simultaneously improving customer satisfaction.

Utilizing digital collection software offers numerous benefits and significantly streamlines the execution of established strategies. We live in a fast-paced world of digital customer relations, with advancements in technology, digitization, portals, electronic invoicing, and predictive analytics. As of today, having the right tool is essential for business owners to stay efficient and effective.

Contrary to popular belief, digitalization simplifies access to essential information for both external and internal stakeholders. It enables individuals to concentrate on tasks that bring significant value, such as resolving intricate issues, managing customer relationships, and enhancing salesperson awareness.

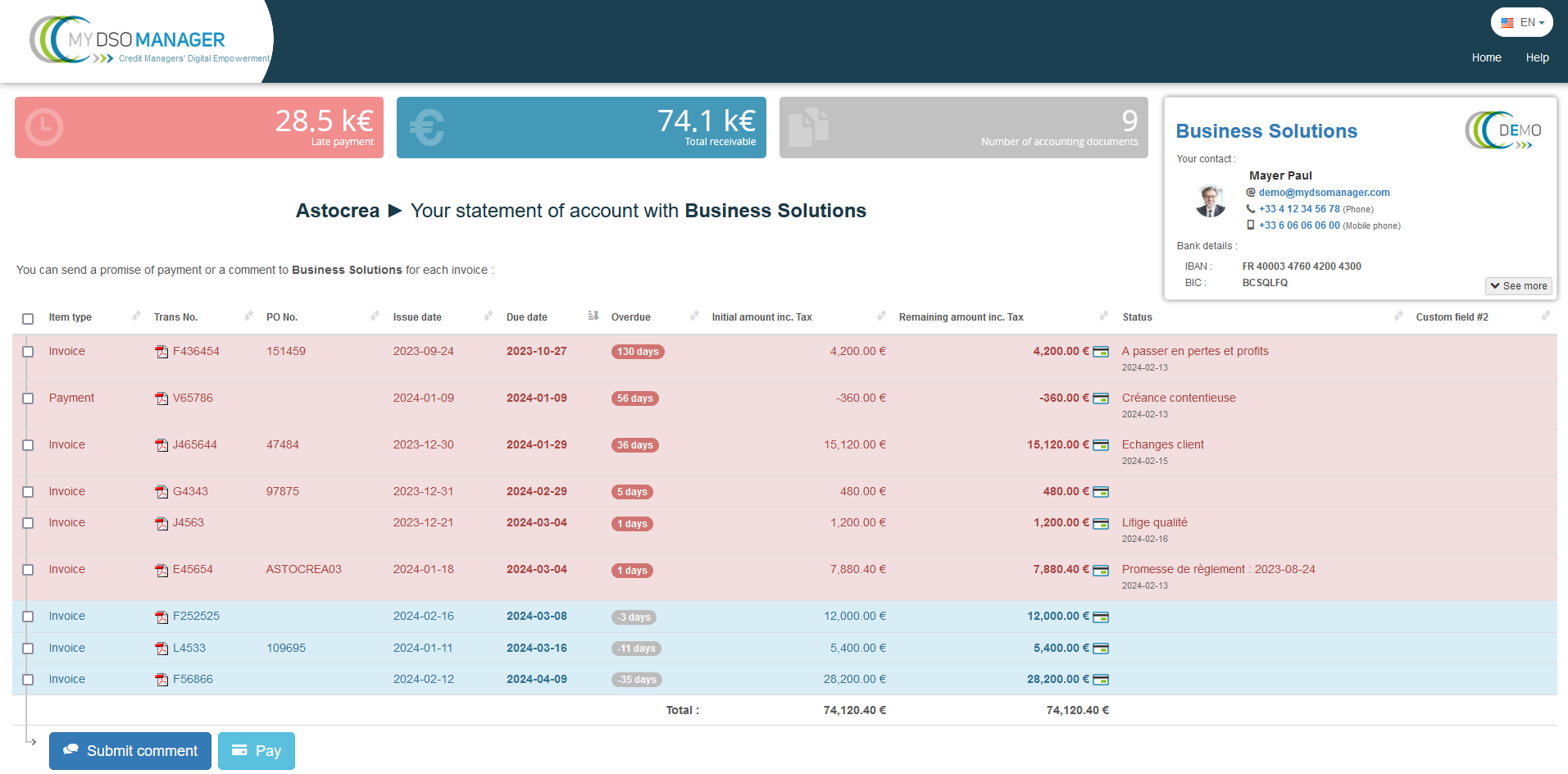

An example of an interactive customer portal included in collection software.

Customers can access the portal through email. It gives accounting providers all the necessary informations and documents to start the recovery process:

- Outstanding receivables and late payments

- Contacts and bank details

- Downloadable statement of account for Excel with the status of each item

- Live interactions with the recovery manager

- Downlard PDF of invoices and other available documents in one click

- Online payment options via SEPA transfer, credit card, etc

How can you enhance cash flow and customer satisfaction?

Ensuring timely payment of invoices is a top priority. The initial dunning action is to be taken before the due date. This is done to remove any obstacles that may hinder payment and to secure a commitment to pay.

This action also helps in promptly identifying any disputes, such as administrative issues, quality concerns about the products or services provided, or price errors, in order to resolve them as quickly as possible.

Collection efforts get more aggressive over time when payment is not made by the promised date. Various communication channels, such as interactive emails, phone calls, and electronic letters with acknowledgement of receipt, are utilized to reach the appropriate individuals. These actions are taken to put pressure on your customer base and increase the likelihood of receiving payment.

In the event that you are unable to receive payment, these reminders can serve as evidence of your good intentions in a potential legal proceeding against your customer. Make no mistake, B-to-B cash collection is incredibly amicable. Ultimately, it's all about effectively coordinating processes and individuals to overcome obstacles that hinder the progress of the business partnership.

![]() The reminders should be presented in a neutral and professional manner, which will enhance the credibility of your company. Ideally, these tasks are performed by a dedicated collection department, which will make sure your customers feel appreciated during the process.

The reminders should be presented in a neutral and professional manner, which will enhance the credibility of your company. Ideally, these tasks are performed by a dedicated collection department, which will make sure your customers feel appreciated during the process.

An ineffective recovery process can be detrimental and fail to maintain a strong business relationship. Just like a chief financial officer (CFO) would advise, it's important to avoid mass reminders such as letters or standard e-mails sent indiscriminately to all customers. Indeed, they won't improve your chances of getting paid, could harm your credibility, and could generate unhappy customers.

-

My DSO Manager, the online cash collection software

Cash collection is one of the key function in My DSO Manager. The Saas software smartly triggers collection actions according to many criteria like collection scenarios assigned, customers' type and history, etc. Collectors can manage their actions to do in a collection agenda.

The tool generates dunning templates for each customer that can be customized in the settings and personalized when you send them.

It also provides cutting-edge features like interactive e-mails and automated actions.

With the collection of customer feedback, invoices now have a status and comment feature, ensuring a thorough record of all customer interactions. Companies of all sizes use My DSO Manager, a SaaS credit management program, in 85 different countries. Experience the full potential of our platform with the online demo.

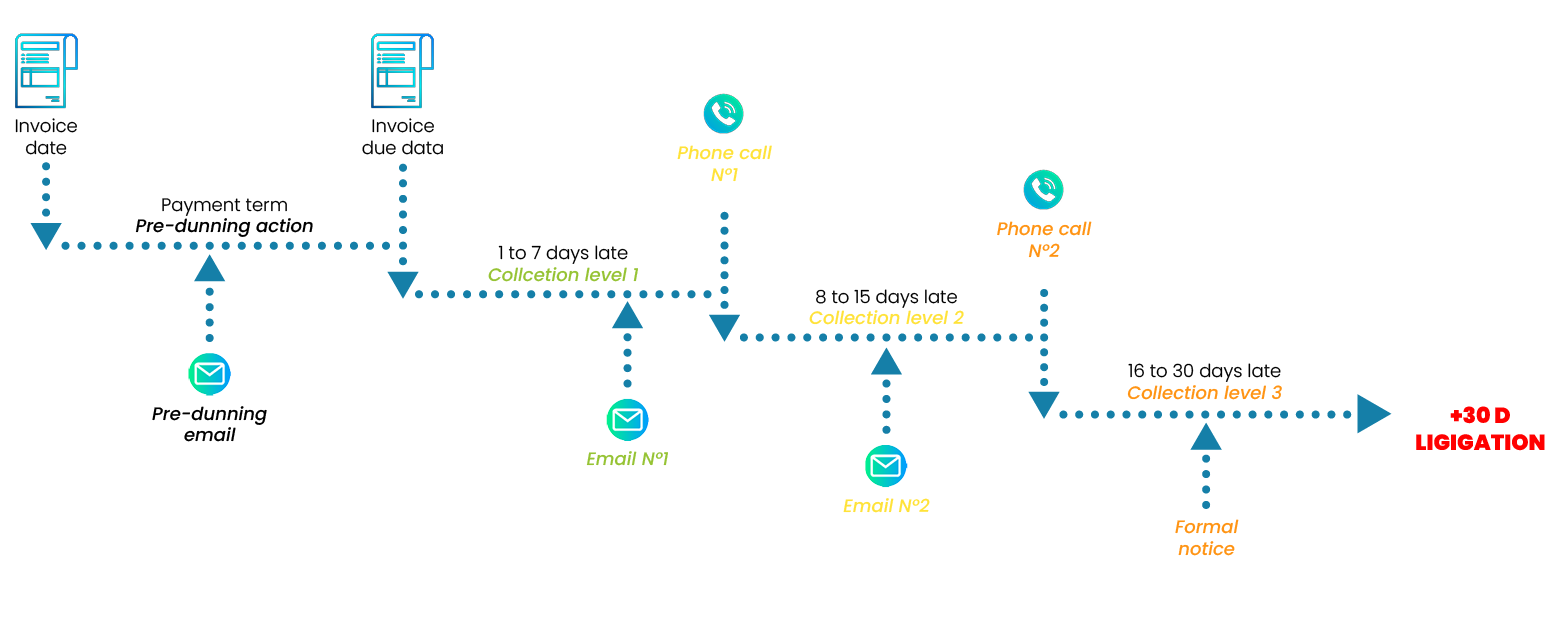

Principes of a collection process

The collection process follows a strict schedule. It establishes a timeframe for a smooth recovery process. It has a start and a finish that occurs when the invoice is paid or, in cases of dispute, after the formal notice is sent.

It involves a series of stages: pre-dunning, level 1, level 2, and level 3, which become increasingly firm and structured over time.

![]() The collection process is a structured framework that allows the collector to exercise some flexibility through their interactions with the client. Nevertheless, every "amicable" recovery process has a conclusion. If there are unpaid account receivables that go beyond level 3 without justification, the amicable action can escalate into a contentious situation.

The collection process is a structured framework that allows the collector to exercise some flexibility through their interactions with the client. Nevertheless, every "amicable" recovery process has a conclusion. If there are unpaid account receivables that go beyond level 3 without justification, the amicable action can escalate into a contentious situation.

The various phases of the recovery scenario

![]() Finding the appropriate customer contacts is crucial for the success of the recovery efforts as well as your business growth. The ideal individuals are those who possess the ability to gather information, address internal issues, and approve payments. There are instances where multiple individuals can serve as the appropriate point of contact during a lengthy invoice validation process.

Finding the appropriate customer contacts is crucial for the success of the recovery efforts as well as your business growth. The ideal individuals are those who possess the ability to gather information, address internal issues, and approve payments. There are instances where multiple individuals can serve as the appropriate point of contact during a lengthy invoice validation process.

![]() Always maintain a polite and professional demeanor when dealing with customers who are late in making payments, and ensure that you remain firm as the duration of the delay increases.

Always maintain a polite and professional demeanor when dealing with customers who are late in making payments, and ensure that you remain firm as the duration of the delay increases.

![]() Maintain a comprehensive record of all your reminders. This will enable you to enhance your effectiveness in the dunning sequence and gently prompt your customer about their prior commitments. In addition, it is necessary to provide evidence of your reminders in the event of legal action being taken against your customer for unpaid invoices.

Maintain a comprehensive record of all your reminders. This will enable you to enhance your effectiveness in the dunning sequence and gently prompt your customer about their prior commitments. In addition, it is necessary to provide evidence of your reminders in the event of legal action being taken against your customer for unpaid invoices.

![]() Phone calls and emails are the most efficient ways to follow up with your customers. Nevertheless, it is essential to have written confirmation (via email or letter) for every agreement or commitment to ensure that both the buyer and seller are on the same page. If he fails to honor his commitment, it is necessary to send dunning letters with proof of receipt to exert pressure on him and formalize the collection process.

Phone calls and emails are the most efficient ways to follow up with your customers. Nevertheless, it is essential to have written confirmation (via email or letter) for every agreement or commitment to ensure that both the buyer and seller are on the same page. If he fails to honor his commitment, it is necessary to send dunning letters with proof of receipt to exert pressure on him and formalize the collection process.

![]() Unpaid bills can stem from more than just the debtor's bad faith, insolvency, and cash flow issues. An important aspect involves addressing various challenges that need to be resolved, such as administrative or quality disputes, communication issues, and more. In this situation, the goal is to efficiently identify and resolve the issue promptly, without needing to request payment again.

Unpaid bills can stem from more than just the debtor's bad faith, insolvency, and cash flow issues. An important aspect involves addressing various challenges that need to be resolved, such as administrative or quality disputes, communication issues, and more. In this situation, the goal is to efficiently identify and resolve the issue promptly, without needing to request payment again.

- How to avoid late payments?

- The keys of cash collection

- Improve your processes with cash collection

Check out the following tutorials as well (not an exhaustive list):

The various categories of payers

Adapting the recovery process to the debtor by assigning a payer profile can be quite beneficial for your business cash flow management. We identify seven primary categories of payers.

-

The negligent payer awaits your reminder for payment.

Just a friendly reminder to complete the task as soon as possible, with a focus on the business aspect. You will need to get it done before the due date.

-

The bad payer is attempting to buy a few weeks (or months) of time by postponing the payment of invoices to gain a few profit margins.

Follow up with him consistently to ensure he fully grasps the importance of your leadership. Urgently dispatch a formal notice, as a mere reminder will only give him the impression that he has ample time to make the payment.

-

The insolvent payer is unable to compensate you for the time because of its cash flow problems.

Be assertive in your recovery and consider implementing a payment schedule with short-term partial payments. The suppliers with the least presence in the collection will be the last to receive payment!

-

The administrative payer oversees numerous large public and private structures. The administrative complexity can overwhelm your collection. The letters sent never seem to reach their destination, etc.

Take the time to familiarize yourself with the internal invoice validation process. Build strong connections with influential individuals who can assist you in overcoming obstacles. They may otherwise hinder the progress of your legislation.

-

The "dispute" payer consistently disputes invoices, whether valid or not, to avoid payment.

Ensure precision in your recovery by promptly providing proof of the payment deadlines for your bills. Then promptly escalate to a faster mode of communication (preferably with proof of receipt). You will then assert your intelligence and avoid deception.

-

The automatic payer, with whom, as a financial expert, you can easily process payments through automatic direct debit in real time.

This one requires no further action apart from sending statements of account prior to the due dates.

-

With a good payer, your payments will effortlessly arrive on or even before the due date of your bills.

This payer has no need for recovery.