More than 140 tools to manage accounts receivable

Credit Management tools helps businesses to improve cash and to avoid unpaid invoices.

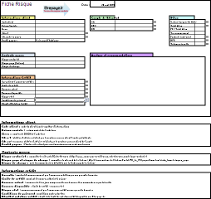

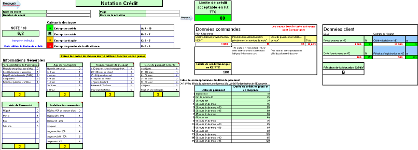

Credit risk profile

The credit analysis

Credit risk synthesis allowing to see all main topics of credit analysis in a snapshot.

Credit risk profile

The credit analysis

Credit risk synthesis allowing to see all main topics of credit analysis in a snapshot.It helps to share credit information between people involved in the credit process (credit manager, CFO...etc.) wihtout struggling with emails.

All information needed is in a simple sheet. Download

Information request form

Get information about your clients

Form template in french including all needed information to collect before opening a customer account.

Download

Information request form

Get information about your clients

Form template in french including all needed information to collect before opening a customer account.

Download

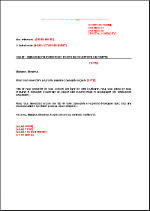

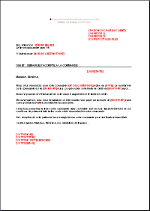

Information request letter

Get information about your clients

Template letter for a request of legal and financial information to a potential new customer.

Download

Information request letter

Get information about your clients

Template letter for a request of legal and financial information to a potential new customer.

Download

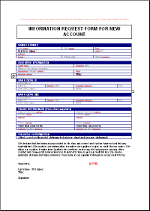

Information request form

Get information about your clients

Form template including all needed information to collect before opening a customer account.

Download

Information request form

Get information about your clients

Form template including all needed information to collect before opening a customer account.

Download

Information request letter

Get information about your clients

Template letter to be sent to another supplier of your client requesting what is his payment behavior with him.

Download

Information request letter

Get information about your clients

Template letter to be sent to another supplier of your client requesting what is his payment behavior with him.

Download

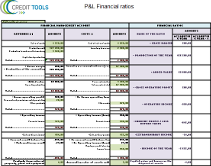

P&L financial ratios

Analyze the Profit and Loss account

This tool calculates the profitability ratios based on the Profit and Loss account.

Download

P&L financial ratios

Analyze the Profit and Loss account

This tool calculates the profitability ratios based on the Profit and Loss account.

Download

Credit notation

Credit Notation

Credit notation tool including 15 criteria to assess creditworthiness of your customers.

Credit notation

Credit Notation

Credit notation tool including 15 criteria to assess creditworthiness of your customers.The tool is using three kind of criteria:

- General information (company legal form, age of company, payment behavior...etc),

- Profit and loss account information (sales, sales history, EBIT, net result),

- Balance sheet information (equity, working capital, cash...etc.).

Easy credit notation

Credit Notation

Credit ranking method to use when you don't have detailed profit and loss accounts and balance sheet of your client.

Easy credit notation

Credit Notation

Credit ranking method to use when you don't have detailed profit and loss accounts and balance sheet of your client.It is based on 8 criteria:

- legal,

- age of the company,

- payment behavior,

- financials,

- business stakes...etc.

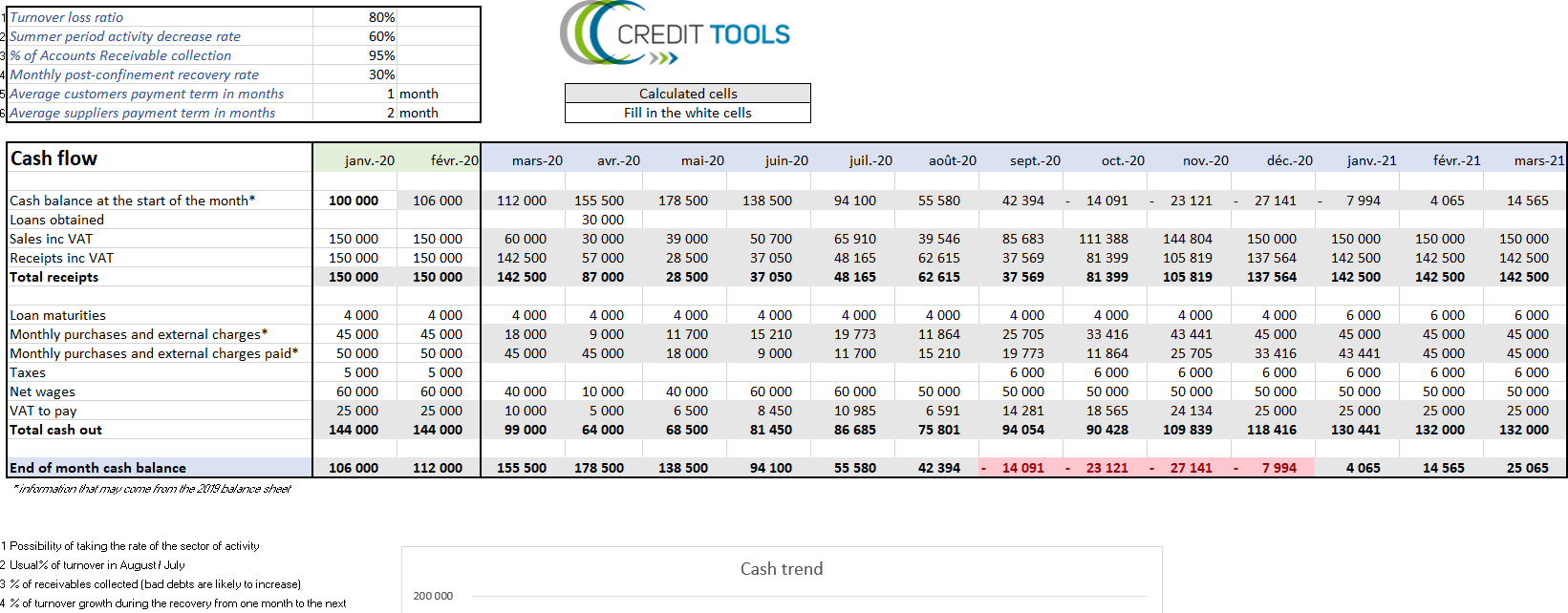

Cash analysis Covid

Credit risk during Covid 19

Excel file allowing the evolution of the cash flow of a company impacted by a major crisis

Download

Cash analysis Covid

Credit risk during Covid 19

Excel file allowing the evolution of the cash flow of a company impacted by a major crisis

Download

Credit limit set up

Set up the credit limit

Credit limit set up tool based on the business need and financial capacities of your customer.

Credit limit set up

Set up the credit limit

Credit limit set up tool based on the business need and financial capacities of your customer.This tool is a big help for credit analysts to ensure credit limits are coherent with customer financial situation. Download

Credit notation + Credit limit set up

Set up the credit limit

Two tools in one with the Credit notation tool linked with the Credit limit set up tool.

Credit notation + Credit limit set up

Set up the credit limit

Two tools in one with the Credit notation tool linked with the Credit limit set up tool.This tool is the most powerful to set up a credit limit according to business need and financial situation of your buyer. Download

Certificate of withdrawal

Set up the payment term

Certificate of withdrawal template in french which confirms to the buyer that a check or a promissory note has been lost and won't be cashed in even if it is found.

Download

Certificate of withdrawal

Set up the payment term

Certificate of withdrawal template in french which confirms to the buyer that a check or a promissory note has been lost and won't be cashed in even if it is found.

Download

Unpaid check letter

Set up the payment term

Dunning letter template in french to send to the buyer after its check came back unpaid.

Download

Unpaid check letter

Set up the payment term

Dunning letter template in french to send to the buyer after its check came back unpaid.

Download

Certificate of withdrawal

Set up the payment term

Certificate of withdrawal template which confirms to the buyer that a check or a promissory note has been lost and won't be cashed in even if it is found.

Download

Certificate of withdrawal

Set up the payment term

Certificate of withdrawal template which confirms to the buyer that a check or a promissory note has been lost and won't be cashed in even if it is found.

Download

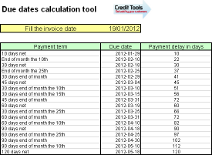

Due dates calculation

Set up the payment term

Easy invoice due date calculation tool.

Due dates calculation

Set up the payment term

Easy invoice due date calculation tool.Fill the invoice date and the tool provides the due dates for each payment term present in the tool. Download

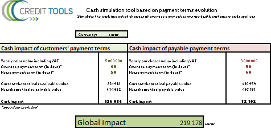

Payment terms cash impact

Set up the payment term

Tool to calculate the changes in your company's cash depending on the evolution of real payment terms of customers and used with suppliers.

Download

Payment terms cash impact

Set up the payment term

Tool to calculate the changes in your company's cash depending on the evolution of real payment terms of customers and used with suppliers.

Download

Unpaid check letter

Set up the payment term

Dunning letter template to send to the buyer after its check came back unpaid.

Download

Unpaid check letter

Set up the payment term

Dunning letter template to send to the buyer after its check came back unpaid.

Download

Down payment request

Down payment and payment in advance

Down-payment request letter template in french which asks to the buyer the payment of an advance as his credit limit cannot be extended.

Down payment request

Down payment and payment in advance

Down-payment request letter template in french which asks to the buyer the payment of an advance as his credit limit cannot be extended.It also informs the client that his order will be proceeded once the payment received. Download

Prepayment request

Down payment and payment in advance

Prepayment request letter template in french to be used when the seller wants to get the full payment of the order before delivery.

Download

Prepayment request

Down payment and payment in advance

Prepayment request letter template in french to be used when the seller wants to get the full payment of the order before delivery.

Download

Advance payment bank guarantee

Down payment and payment in advance

Template of advance payment bank guarantee on demand.

Advance payment bank guarantee

Down payment and payment in advance

Template of advance payment bank guarantee on demand.This kind of guarantee is often requested by the seller in order to make sure he doesn't lose the advance payment in case of dispute. Download

Advance payment bank guarantee on demand

Down payment and payment in advance

Template of advance payment bank guarantee on demand.

Advance payment bank guarantee on demand

Down payment and payment in advance

Template of advance payment bank guarantee on demand.This kind of guarantee is often requested by the seller in order to make sure he doesn't lose the advance payment in case of dispute. Download

Down payment request

Down payment and payment in advance

Down-payment request letter template which asks to the buyer the payment of an advance as his credit limit cannot be extended.

Down payment request

Down payment and payment in advance

Down-payment request letter template which asks to the buyer the payment of an advance as his credit limit cannot be extended.It also informs the client that his order will be proceeded once the payment received. Download

Prepayment request

Down payment and payment in advance

Prepayment request letter template to be used when the seller wants to get the full payment of the order before delivery.

Download

Prepayment request

Down payment and payment in advance

Prepayment request letter template to be used when the seller wants to get the full payment of the order before delivery.

Download

Parent company guarantee

Parent company guarantee

Template of Parent company guarantee in french to be used when a seller wants the official commitment of the mother company of its customer to pay the bills.

Download

Parent company guarantee

Parent company guarantee

Template of Parent company guarantee in french to be used when a seller wants the official commitment of the mother company of its customer to pay the bills.

Download

Parent company guarantee

Parent company guarantee

Template of Parent company guarantee to be used when a seller wants the official commitment of the mother company of its customer to pay the bills.

Download

Parent company guarantee

Parent company guarantee

Template of Parent company guarantee to be used when a seller wants the official commitment of the mother company of its customer to pay the bills.

Download

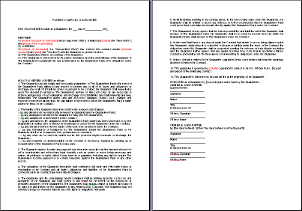

Parent company guarantee on demand

Parent company guarantee

Parent Company Guarantee on demand with all contractual clauses needed included. A template letter of payment request is included in the tool.

Download

Parent company guarantee on demand

Parent company guarantee

Parent Company Guarantee on demand with all contractual clauses needed included. A template letter of payment request is included in the tool.

Download

Bank guarantee on demand

Bank guarantees

Template of a bank guarantee on demand in french in favor of the seller.

Bank guarantee on demand

Bank guarantees

Template of a bank guarantee on demand in french in favor of the seller.This type of guarantee provides a very good level of security to the seller as far as the issuing bank is reliable. Download

Bank guarantee on demand

Bank guarantees

Template of a bank guarantee on demand in favor of the seller.

Bank guarantee on demand

Bank guarantees

Template of a bank guarantee on demand in favor of the seller.This type of guarantee provides a very good level of security to the seller as far as the issuing bank is reliable. Download

Content of a bank guarantee

Bank guarantees

All terms used in a bank guarantee with a definition for each of them.

Content of a bank guarantee

Bank guarantees

All terms used in a bank guarantee with a definition for each of them.This tool helps to better understand a bank guarantee. Download

Forfeiture of the term clause

Contractuals clauses

Forfeiture of the term clause in french mentioning that in case of one installment of a contract unpaid by the buyer all installments will become due.

Download

Forfeiture of the term clause

Contractuals clauses

Forfeiture of the term clause in french mentioning that in case of one installment of a contract unpaid by the buyer all installments will become due.

Download

Property reserve clause

Contractuals clauses

Template of ownership retention clause in french. This contractual clause mentions that the property of the goods sold remains to the seller until invoices are fully paid by the buyer.

Download

Property reserve clause

Contractuals clauses

Template of ownership retention clause in french. This contractual clause mentions that the property of the goods sold remains to the seller until invoices are fully paid by the buyer.

Download

Suspension and termination clauses

Contractuals clauses

Suspension and termination clauses template to be included in contracts in order to be able to stop to deliver if the buyer doesn't pay the bills.

Download

Suspension and termination clauses

Contractuals clauses

Suspension and termination clauses template to be included in contracts in order to be able to stop to deliver if the buyer doesn't pay the bills.

Download

Forfeiture of the term clause

Contractuals clauses

Forfeiture of the term clause mentioning that in case of one installment of a contract unpaid by the buyer all installments will become due.

Download

Forfeiture of the term clause

Contractuals clauses

Forfeiture of the term clause mentioning that in case of one installment of a contract unpaid by the buyer all installments will become due.

Download

Property reserve clause

Contractuals clauses

Template of ownership retention clause. This contractual clause mentions that the property of the goods sold remains to the seller until invoices are fully paid by the buyer.

Download

Property reserve clause

Contractuals clauses

Template of ownership retention clause. This contractual clause mentions that the property of the goods sold remains to the seller until invoices are fully paid by the buyer.

Download

Suspension and termination clauses

Contractuals clauses

Suspension and termination clauses template to be included in contracts in order to be able to stop to deliver if the buyer doesn't pay the bills.

Download

Suspension and termination clauses

Contractuals clauses

Suspension and termination clauses template to be included in contracts in order to be able to stop to deliver if the buyer doesn't pay the bills.

Download

Invoice template

Invoicing rules

Invoice template including all needed type of information.

Download

Invoice template

Invoicing rules

Invoice template including all needed type of information.

Download

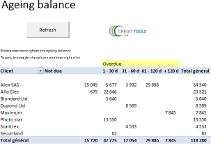

Aging balance

The aging balance

Aging balance

The aging balance

Aging balance on Excel based on the list of accounting documents (invoices, credit notes... etc.) of the customers accounts.

The tool automatically formats a dynamic ageing balance for organizing its cash collection.

Updated 2023

Download Collection letter prior due date

How to collect prior due date?

Collection letter prior due date template in portuguese. Soft letter to be sent before the due date of invoices to ensure that the buyer is going to pay on time and that there is no dispute on the invoices.

Download

Collection letter prior due date

How to collect prior due date?

Collection letter prior due date template in portuguese. Soft letter to be sent before the due date of invoices to ensure that the buyer is going to pay on time and that there is no dispute on the invoices.

Download

Collection letter prior due date

How to collect prior due date?

Collection letter prior due date template in french. Soft letter to be sent before the due date of invoices to ensure that the buyer is going to pay on time and that there is no dispute on the invoices.

Download

Collection letter prior due date

How to collect prior due date?

Collection letter prior due date template in french. Soft letter to be sent before the due date of invoices to ensure that the buyer is going to pay on time and that there is no dispute on the invoices.

Download

Collection letter prior due date

How to collect prior due date?

Collection letter prior due date template. Soft letter to be sent before the due date of invoices to ensure that the buyer is going to pay on time and that there is no dispute on the invoices.

Download

Collection letter prior due date

How to collect prior due date?

Collection letter prior due date template. Soft letter to be sent before the due date of invoices to ensure that the buyer is going to pay on time and that there is no dispute on the invoices.

Download

Collection: ask the right questions

How to collect prior due date?

All type of questions to use during collection calls to customers with for each question type the context in which it should be used and the expected result.

Collection: ask the right questions

How to collect prior due date?

All type of questions to use during collection calls to customers with for each question type the context in which it should be used and the expected result.Examples of each type of question. Download

How to do the collection action prior due date

How to collect prior due date?

How to manage the collection call prior due date to the accounts payable department of the buyer?

How to do the collection action prior due date

How to collect prior due date?

How to manage the collection call prior due date to the accounts payable department of the buyer?Structure of a telephone conversation with formulations examples. Download

Reminder letter level 1 classical type

What is the collection level 1?

Dunning letter template level 1 in portuguese informing the customer of the overdue and requesting the payment of due invoices.

Download

Reminder letter level 1 classical type

What is the collection level 1?

Dunning letter template level 1 in portuguese informing the customer of the overdue and requesting the payment of due invoices.

Download

Reminder letter level 1 block account type

What is the collection level 1?

Dunning letter template level 1 in french informing the customer of the overdue and requesting the payment of due invoices otherwise his account will be blocked for new orders and deliveries.

Download

Reminder letter level 1 block account type

What is the collection level 1?

Dunning letter template level 1 in french informing the customer of the overdue and requesting the payment of due invoices otherwise his account will be blocked for new orders and deliveries.

Download

Reminder letter level 1 classical type

What is the collection level 1?

Dunning letter template level 1 in french informing the customer of the overdue and requesting the payment of due invoices.

Download

Reminder letter level 1 classical type

What is the collection level 1?

Dunning letter template level 1 in french informing the customer of the overdue and requesting the payment of due invoices.

Download

Reminder letter level 1 good payer type

What is the collection level 1?

Dunning letter template level 1 in french dedicated to good payers who omit to pay on time. This is a soft reminder for a short overdue.

Download

Reminder letter level 1 good payer type

What is the collection level 1?

Dunning letter template level 1 in french dedicated to good payers who omit to pay on time. This is a soft reminder for a short overdue.

Download

Reminder letter level 1 partnership type

What is the collection level 1?

Dunning letter template level 1 in french dedicated to partners who omit to pay on time. This is a soft reminder.

Download

Reminder letter level 1 partnership type

What is the collection level 1?

Dunning letter template level 1 in french dedicated to partners who omit to pay on time. This is a soft reminder.

Download

Reminder letter level 1 classical type

What is the collection level 1?

Dunning letter template level 1 in spanish informing the customer of the overdue and requesting the payment of due invoices.

Download

Reminder letter level 1 classical type

What is the collection level 1?

Dunning letter template level 1 in spanish informing the customer of the overdue and requesting the payment of due invoices.

Download

How to collect invoices by phone at level 1?

What is the collection level 1?

How to collect invoices by phone at collection level 1?

How to collect invoices by phone at level 1?

What is the collection level 1?

How to collect invoices by phone at collection level 1?Structure of a telephone conversation with formulation examples. Download

Reminder letter level 1

What is the collection level 1?

Dunning letter template level 1 informing the customer of the overdue and requesting the immediate payment of due invoices.

Download

Reminder letter level 1

What is the collection level 1?

Dunning letter template level 1 informing the customer of the overdue and requesting the immediate payment of due invoices.

Download

Reminder letter level 1 block account type

What is the collection level 1?

Dunning letter template level 1 informing the customer of the overdue and requesting the payment of due invoices otherwise his account will be blocked for new orders and deliveries.

Download

Reminder letter level 1 block account type

What is the collection level 1?

Dunning letter template level 1 informing the customer of the overdue and requesting the payment of due invoices otherwise his account will be blocked for new orders and deliveries.

Download

Reminder letter level 1 delay penalties type

What is the collection level 1?

First written reminder requesting an immediate payment including delay penalties.

Download

Reminder letter level 1 delay penalties type

What is the collection level 1?

First written reminder requesting an immediate payment including delay penalties.

Download

Reminder letter level 1 financial closing

What is the collection level 1?

Letter to be sent before financial closing date requesting the payment of due invoices in order to clear the account otherwise auditors may look to the reason of non-payment.

Download

Reminder letter level 1 financial closing

What is the collection level 1?

Letter to be sent before financial closing date requesting the payment of due invoices in order to clear the account otherwise auditors may look to the reason of non-payment.

Download

Reminder letter lever 1 good payer type

What is the collection level 1?

Dunning letter template level 1 dedicated to good payers who omit to pay on time. This is a soft reminder for a short overdue.

Download

Reminder letter lever 1 good payer type

What is the collection level 1?

Dunning letter template level 1 dedicated to good payers who omit to pay on time. This is a soft reminder for a short overdue.

Download

Reminder letter lever 1 partnership type

What is the collection level 1?

Dunning letter template level 1 dedicated to partners who omit to pay on time. This is a soft reminder.

Download

Reminder letter lever 1 partnership type

What is the collection level 1?

Dunning letter template level 1 dedicated to partners who omit to pay on time. This is a soft reminder.

Download

Reminder letter level 2 block account type

What is collection level 2?

Dunning letter template level 2 in french informing the buyer that without immediate payment of due invoices, his account will be blocked for new orders.

Download

Reminder letter level 2 block account type

What is collection level 2?

Dunning letter template level 2 in french informing the buyer that without immediate payment of due invoices, his account will be blocked for new orders.

Download

Reminder letter level 2 partnership type

What is collection level 2?

Dunning letter template level 2 in french dedicated to Partners with which business relations are good without (normally) problems of payment.

Download

Reminder letter level 2 partnership type

What is collection level 2?

Dunning letter template level 2 in french dedicated to Partners with which business relations are good without (normally) problems of payment.

Download

Reminder letter level 2 to the project manager

What is collection level 2?

Dunning letter template level 2 in french to send to the Project manager in order he releases the payment of overdue invoices.

Download

Reminder letter level 2 to the project manager

What is collection level 2?

Dunning letter template level 2 in french to send to the Project manager in order he releases the payment of overdue invoices.

Download

How to collect invoices by phone at level 2?

What is collection level 2?

How to collect invoices by phone at collection level 2?

How to collect invoices by phone at level 2?

What is collection level 2?

How to collect invoices by phone at collection level 2?Structure of a telephone conversation with formulation examples. Download

Reminder letter level 2 block account type

What is collection level 2?

Dunning letter template level 2 informing the buyer that without immediate payment of due invoices, his account will be blocked for new orders.

Download

Reminder letter level 2 block account type

What is collection level 2?

Dunning letter template level 2 informing the buyer that without immediate payment of due invoices, his account will be blocked for new orders.

Download

Reminder letter level 2 partnership type

What is collection level 2?

Dunning letter template level 2 dedicated to Partners with which business relations are good without (normally) problems of payment.

Download

Reminder letter level 2 partnership type

What is collection level 2?

Dunning letter template level 2 dedicated to Partners with which business relations are good without (normally) problems of payment.

Download

Formal notice level 3 classical type

What is the collection level 3?

Formal notice template level 3 in portuguese which informs the debtor that without an immediate payment of invoices including delay penalties the seller will start a legal action against him.

Download

Formal notice level 3 classical type

What is the collection level 3?

Formal notice template level 3 in portuguese which informs the debtor that without an immediate payment of invoices including delay penalties the seller will start a legal action against him.

Download

Formal notice level 3 collection agency type

What is the collection level 3?

Formal notice template level 3 in portuguese.

Formal notice level 3 collection agency type

What is the collection level 3?

Formal notice template level 3 in portuguese.<

This letter is the last reminder before transfering the case to a collection agency for litigation. Download

Formal notice level 3 classical type

What is the collection level 3?

Formal notice template level 3 in french which informs the debtor that without an immediate payment of invoices including delay penalties the seller will start a legal action against him.

Download

Formal notice level 3 classical type

What is the collection level 3?

Formal notice template level 3 in french which informs the debtor that without an immediate payment of invoices including delay penalties the seller will start a legal action against him.

Download

Formal notice level 3 collection agency type

What is the collection level 3?

Formal notice template level 3 in french.

Formal notice level 3 collection agency type

What is the collection level 3?

Formal notice template level 3 in french.This letter is the last reminder before transfering the case to a collection agency for litigation. Download

Formal notice level 3 credit insurance type

What is the collection level 3?

Formal notice template level 3 in french.

Formal notice level 3 credit insurance type

What is the collection level 3?

Formal notice template level 3 in french.This letter is the last reminder before sending the claim to the credit insurer. Download

Formal notice level 3 classical type

What is the collection level 3?

Formal notice template level 3 in spanish which informs the debtor that without an immediate payment of invoices including delay penalties the seller will start a legal action against him.

Download

Formal notice level 3 classical type

What is the collection level 3?

Formal notice template level 3 in spanish which informs the debtor that without an immediate payment of invoices including delay penalties the seller will start a legal action against him.

Download

Formal notice level 3 additional fees type

What is the collection level 3?

Formal notice template level 3 which informs the debtor that without an immediate payment of invoices including delay penalties the buyer will have to pay additional costs due to collection fees.

Download

Formal notice level 3 additional fees type

What is the collection level 3?

Formal notice template level 3 which informs the debtor that without an immediate payment of invoices including delay penalties the buyer will have to pay additional costs due to collection fees.

Download

Formal notice level 3 classical type

What is the collection level 3?

Formal notice template level 3 which informs the debtor that without an immediate payment of invoices including delay penalties the seller will start a legal action against him.

Download

Formal notice level 3 classical type

What is the collection level 3?

Formal notice template level 3 which informs the debtor that without an immediate payment of invoices including delay penalties the seller will start a legal action against him.

Download

Formal notice level 3 collection agency type

What is the collection level 3?

Formal notice template level 3.

Formal notice level 3 collection agency type

What is the collection level 3?

Formal notice template level 3.This letter is the last reminder before transfering the case to a collection agency for litigation. Download

Formal notice level 3 credit insurance type

What is the collection level 3?

Formal notice template level 3.

Formal notice level 3 credit insurance type

What is the collection level 3?

Formal notice template level 3.This letter is the last reminder before sending the claim to the credit insurer. Download

Formal notice level 3 personal type

What is the collection level 3?

Formal notice level 3 template dedicated to sole proprietor owner.

Formal notice level 3 personal type

What is the collection level 3?

Formal notice level 3 template dedicated to sole proprietor owner.This letter is the last reminder before litigation. Download

How to collect invoices by phone at level 3?

What is the collection level 3?

How to collect invoices by phone at collection level 3?

How to collect invoices by phone at level 3?

What is the collection level 3?

How to collect invoices by phone at collection level 3?Structure of a telephone conversation with formulation examples. Download

Contract letter of payment plan confirmation

Negotiate a payment plan

Template of a payment plan contract letter in french. Using this contract is key when you agree with your customer on a payment due to financial difficulties.

Contract letter of payment plan confirmation

Negotiate a payment plan

Template of a payment plan contract letter in french. Using this contract is key when you agree with your customer on a payment due to financial difficulties.It allows to formalize customer commitment. Download

Agreement to compromise debt

Negotiate a payment plan

Payment plan agreement template to use to confirm the agreement made by the seller and the buyer about unpaid invoices.

Agreement to compromise debt

Negotiate a payment plan

Payment plan agreement template to use to confirm the agreement made by the seller and the buyer about unpaid invoices.It can be considered as an acknowledgment of debt which can be used in case of later legal action. Download

Contract letter of payment plan confirmation

Negotiate a payment plan

Template of a payment plan contract letter. Using this contract is key when you agree with your customer on a payment due to financial difficulties.

Contract letter of payment plan confirmation

Negotiate a payment plan

Template of a payment plan contract letter. Using this contract is key when you agree with your customer on a payment due to financial difficulties.It allows to formalize customer commitment. Download

Reminder letter delay penalties type

Late payment penalties

Dunning letter template level 2 in portuguese requesting immediate payment of due invoices plus delay penalties due to late payment, according to sales conditions.

Download

Reminder letter delay penalties type

Late payment penalties

Dunning letter template level 2 in portuguese requesting immediate payment of due invoices plus delay penalties due to late payment, according to sales conditions.

Download

Reminder letter delay penalties type

Late payment penalties

Dunning letter template level 2 in french requesting immediate payment of due invoices plus delay penalties due to late payment, according to sales conditions.

Download

Reminder letter delay penalties type

Late payment penalties

Dunning letter template level 2 in french requesting immediate payment of due invoices plus delay penalties due to late payment, according to sales conditions.

Download

Reminder letter delay penalties type

Late payment penalties

Dunning letter template level 2 in spanish requesting immediate payment of due invoices plus delay penalties due to late payment, according to sales conditions.

Download

Reminder letter delay penalties type

Late payment penalties

Dunning letter template level 2 in spanish requesting immediate payment of due invoices plus delay penalties due to late payment, according to sales conditions.

Download

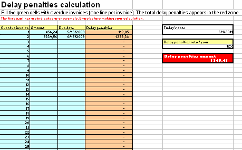

Late payment penalties calculation

Late payment penalties

Easy tool to calculate penalties for late payment according to invoices amount, due date of each invoices and penalty interest rate.

Late payment penalties calculation

Late payment penalties

Easy tool to calculate penalties for late payment according to invoices amount, due date of each invoices and penalty interest rate.This xls tools allows to calculate the amount of late payment penalties in few seconds.

It is possible to do the calcul with invoices not yet paid or with invoices already paid.

It is also possible to include a fix fee per overdue invoice. Download

Reminder letter delay penalties type

Late payment penalties

Dunning letter template level 2 requesting immediate payment of due invoices plus delay penalties due to late payment, according to sales conditions.

Download

Reminder letter delay penalties type

Late payment penalties

Dunning letter template level 2 requesting immediate payment of due invoices plus delay penalties due to late payment, according to sales conditions.

Download

European order for payment form A

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form A

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form B

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form B

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form C

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form C

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form D

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form D

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form E

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form E

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form F

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form F

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form G

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

European order for payment form G

The order for payment

The European Payment Order is a simplified procedure for cross-border monetary claims which are uncontested by the defendant.

Download

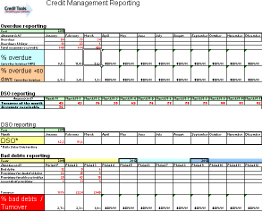

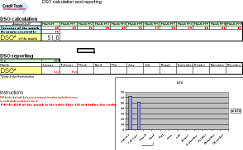

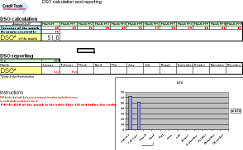

Credit management reporting

DSO calculation

Full Credit Management reporting tool including the DSO reporting, the overdue ratio reporting and the bad debts reporting.

Credit management reporting

DSO calculation

Full Credit Management reporting tool including the DSO reporting, the overdue ratio reporting and the bad debts reporting.This tool helps to have a clear understanding of Credit Management performance and evolution in your company. Download

DSO calculation

DSO calculation

DSO calculation tool which allow to manage the accounts receivable performance from a cash and working capital standpoint.

Download

DSO calculation

DSO calculation

DSO calculation tool which allow to manage the accounts receivable performance from a cash and working capital standpoint.

Download

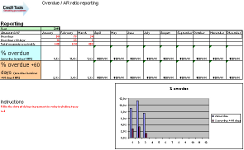

Overdue ratio calculation

Overdue ratio calculation

Reporting and performance follow up tool about the percentage of overdue invoices, that is one of the key performance indicator in Credit Management.

Download

Overdue ratio calculation

Overdue ratio calculation

Reporting and performance follow up tool about the percentage of overdue invoices, that is one of the key performance indicator in Credit Management.

Download

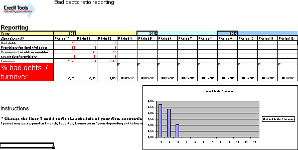

Bad debts ratio calculation

Bad debts ratio calculation

Bad debts ratio reporting tool which allow to check credit management performance regarding losses due to unpaid invoices.

Download

Bad debts ratio calculation

Bad debts ratio calculation

Bad debts ratio reporting tool which allow to check credit management performance regarding losses due to unpaid invoices.

Download

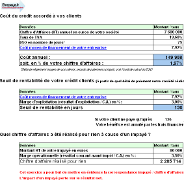

Cost of credit

The best strategy in Credit Management

Calculate with this tools the cost of the credit granted to your customers, the breakeven point of your receivable (from what payment term your company makes losses) and the correspondence between unpaid and turnover (what turnover has been made for nothing because of an unpaid).

Cost of credit

The best strategy in Credit Management

Calculate with this tools the cost of the credit granted to your customers, the breakeven point of your receivable (from what payment term your company makes losses) and the correspondence between unpaid and turnover (what turnover has been made for nothing because of an unpaid).This tools also allows to calculate the average cost of financing of your company. Download

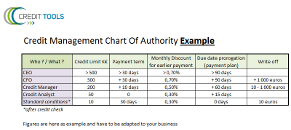

Chart of authority

Credit Management Policy

The chart of authority is an approval matrix defining the approbation level needed to set credit limits and payment conditions.

Chart of authority

Credit Management Policy

The chart of authority is an approval matrix defining the approbation level needed to set credit limits and payment conditions.It is a key tool which has to be part of the credit management policy. Download

Credit management policy

Credit Management Policy

Template of credit management procedure including all steps of the quote to cash process to cover with credit rules:

Credit management policy

Credit Management Policy

Template of credit management procedure including all steps of the quote to cash process to cover with credit rules:- What to do before sending a quotation?

- Risk assessment and mitigation

- Internal Chart of Authority

- Cash collection process and dispute management process

- Litigation recovery

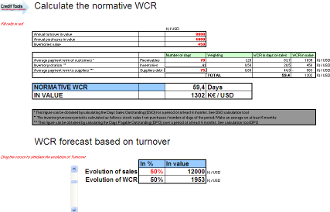

Normative WCR calculation

Normative working capital

Excel tool which allows to calculate the normative WCR and to determine what will be the WCR with the evolution of the turnover of your company.

Download

Normative WCR calculation

Normative working capital

Excel tool which allows to calculate the normative WCR and to determine what will be the WCR with the evolution of the turnover of your company.

Download

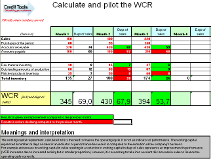

WCR calculation

Drive the working capital

WCR calculation tool based on a monthly basis in order to highlight where gains in WCR can be achieved.

WCR calculation

Drive the working capital

WCR calculation tool based on a monthly basis in order to highlight where gains in WCR can be achieved.WCR is piloted in days of sales for a better performance analysis. Download

DPO calculation

Improve the working capital

DPO calculation tool which allow to manage the DPO which is a key indicator for working capital performance.

Download

DPO calculation

Improve the working capital

DPO calculation tool which allow to manage the DPO which is a key indicator for working capital performance.

Download

DSO calculation

Improve the working capital

DSO calculation tool which allow to manage the accounts receivable performance from a cash and working capital standpoint.

Download

DSO calculation

Improve the working capital

DSO calculation tool which allow to manage the accounts receivable performance from a cash and working capital standpoint.

Download

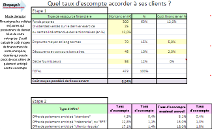

Discount rate calculation

Discount and prepayment

This tool allows to calculate several discount rates based on cost of funding of your business and on the commercial context:

Discount rate calculation

Discount and prepayment

This tool allows to calculate several discount rates based on cost of funding of your business and on the commercial context:- Standard offer (rate below the average funding rate).

- Cash offer (in case your company needs cash).

- Risk offer (in case the customer is insolvent).

Documentary credit template

The documentary credit

Export documentary credit template to use to secure your international business.

Download

Documentary credit template

The documentary credit

Export documentary credit template to use to secure your international business.

Download

Standby letter of credit template

The letter of credit standby

Template of a Standby Letter of Credit which is the most used payment bank guarantee in international business.

Download

Standby letter of credit template

The letter of credit standby

Template of a Standby Letter of Credit which is the most used payment bank guarantee in international business.

Download

Advance payment bank guarantee on demand

Projects management

Template of advance payment bank guarantee on demand in french.

Advance payment bank guarantee on demand

Projects management

Template of advance payment bank guarantee on demand in french.This kind of guarantee is often requested by the seller in order to make sure he doesn't lose the advance payment in case of dispute. Download

Advance payment conditional bank guarantee

Projects management

Template of advance payment conditional bank guarantee.

Advance payment conditional bank guarantee

Projects management

Template of advance payment conditional bank guarantee.The guarantee can play only if conditions described in the guarantee are met. Download

Performance bank guarantee conditional

Projects management

Template of performance conditional bank guarantee. It provides the buyer with a guarantee of good execution as far as he is able to give the proof of the seller default.

Download

Performance bank guarantee conditional

Projects management

Template of performance conditional bank guarantee. It provides the buyer with a guarantee of good execution as far as he is able to give the proof of the seller default.

Download

Performance bank guarantee on demand

Projects management

Template of performance bank guarantee on demand in french. This is more risky for the seller as the buyer doesn't have to prove seller default to use the guarantee.

Download

Performance bank guarantee on demand

Projects management

Template of performance bank guarantee on demand in french. This is more risky for the seller as the buyer doesn't have to prove seller default to use the guarantee.

Download

Retention money bank guarantee on demand

Projects management

Template of retention money bank guarantee on demand in french, often used to avoid partial payment of the buyer during the warranty period.

Download

Retention money bank guarantee on demand

Projects management

Template of retention money bank guarantee on demand in french, often used to avoid partial payment of the buyer during the warranty period.

Download

Retention money conditional bank guarantee

Projects management

Conditional bank guarantee of retention money template in french.

Retention money conditional bank guarantee

Projects management

Conditional bank guarantee of retention money template in french.It is preferable to provide the buyer with a bank guarantee rather than he retains X% of the payment as a waranty. Download

Suspension and termination clauses

Projects management

Suspension and termination clauses template to be included in contracts in order to be able to stop to deliver if the buyer doesn't pay the bills.

Download

Suspension and termination clauses

Projects management

Suspension and termination clauses template to be included in contracts in order to be able to stop to deliver if the buyer doesn't pay the bills.

Download

Retention money bank guarantee on demand

Projects management

Template of retention money bank guarantee on demand.

Retention money bank guarantee on demand

Projects management

Template of retention money bank guarantee on demand.It is often better to provide the buyer with this bank guarantee rather than he holds 5 or 10% of the payment during X years. Download

Advance payment bank guarantee on demand

Projects management

Template of advance payment bank guarantee on demand.

Advance payment bank guarantee on demand

Projects management

Template of advance payment bank guarantee on demand.This kind of guarantee is often requested by the seller in order to make sure he doesn't lose the advance payment in case of dispute. Download

Advance payment conditional bank guarantee

Projects management

Template of advance payment conditional bank guarantee.

Advance payment conditional bank guarantee

Projects management

Template of advance payment conditional bank guarantee.The guarantee can play only if conditions described in the guarantee are met. Download

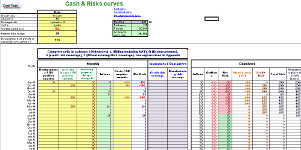

Cash and Risks curves

Projects management

Full tool which allow to calculate month by month the cash curve, the manufacturing risk curve and the credit risk curve on a dedicated project.

Cash and Risks curves

Projects management

Full tool which allow to calculate month by month the cash curve, the manufacturing risk curve and the credit risk curve on a dedicated project.This tool is required to evaluate and simulate these risks before signing a contract. Download

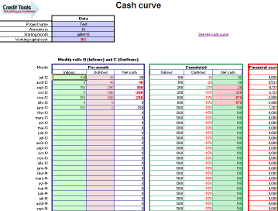

Cash curve

Projects management

Excel tool which allows to calculate month by month the cash flow on a Project or on a business.

Cash curve

Projects management

Excel tool which allows to calculate month by month the cash flow on a Project or on a business.Simply fill columns inflows and outflows and the tool calculates the cash of the month and the cumulated cash on a dedicated graph. Download

Conditional performance bank guarantee

Projects management

Template of performance conditional bank guarantee.

Conditional performance bank guarantee

Projects management

Template of performance conditional bank guarantee.This kind of bank guarantee provides the buyer with a guarantee of successful execution of the seller. Download

Performance bank guarantee on demand

Projects management

Template of performance bank guarantee on demand. This is more risky for the seller as the buyer doesn't have to prove seller default to use the guarantee.

Download

Performance bank guarantee on demand

Projects management

Template of performance bank guarantee on demand. This is more risky for the seller as the buyer doesn't have to prove seller default to use the guarantee.

Download

Retention money bank guarantee on demand

Projects management

Template of retention money bank guarantee on demand, often used to avoid partial payment of the buyer.

Download

Retention money bank guarantee on demand

Projects management

Template of retention money bank guarantee on demand, often used to avoid partial payment of the buyer.

Download

Retention money conditional bank guarantee

Projects management

Conditional bank guarantee of retention money template.

Retention money conditional bank guarantee

Projects management

Conditional bank guarantee of retention money template.It is preferable to provide the buyer with a bank guarantee rather than he retains X% of the payment as a waranty Download

Suspension and termination clauses

Projects management

Suspension and termination clauses template to be included in contracts in order to be able to stop to deliver if the buyer doesn't pay the bills.

Download

Suspension and termination clauses

Projects management

Suspension and termination clauses template to be included in contracts in order to be able to stop to deliver if the buyer doesn't pay the bills.

Download