This hybrid nature is not always well understood by the managers of companies, especially SMEs, for whom accounting and trade are two distinct worlds in their organization.

This raises the question of which of the salespersons or accountants must take care of the customer reminders for the payment of the invoices?

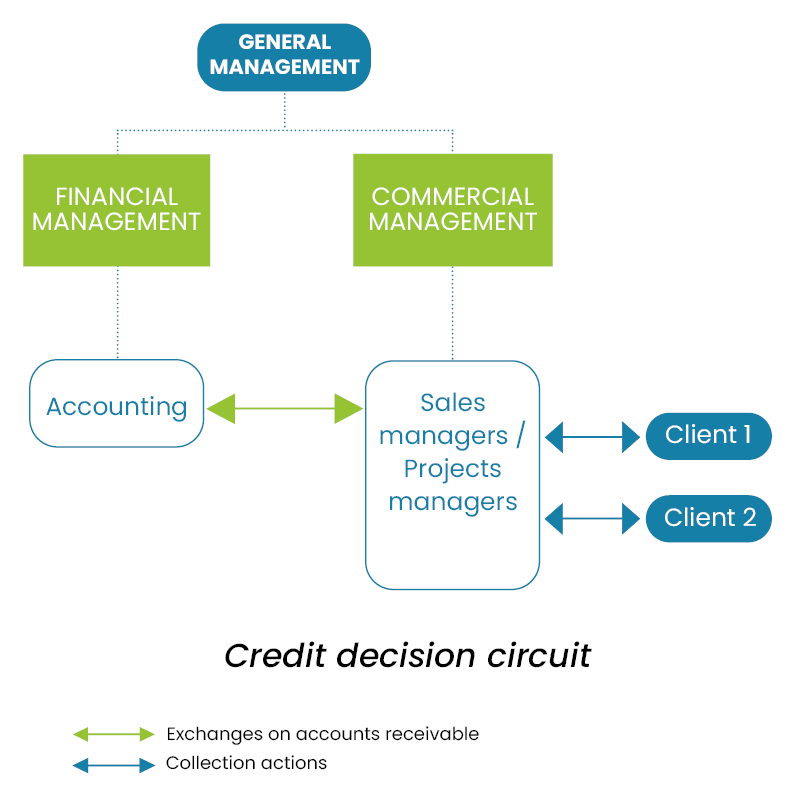

Option 1: sales managers on the front-line

Some choose salesmen and in some cases set up smart bonus schemes to involve them in this activity which is often against their nature.To effectively carry out this work, the salesperson must become a bit accountant and accept the idea of remind his customers about bills payment whatever are the commercial stakes. Good sharing of information and near-daily communication with accounting are also necessary to achieve an acceptable performance.

Typical layout

Indeed, debt collection must follow a logic and a timing that are specific to it and which are difficult to combine with the imperatives imposed by the commercial relationship.

It is particularly difficult for a seller to clearly request payment of a late invoice when he is trying to get a new order. Arbitration is quickly done, recovery becomes secondary and will wait for more favorable times.

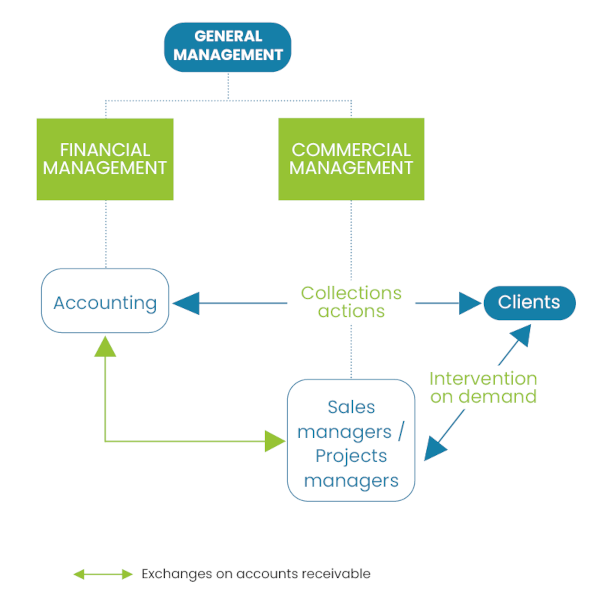

Option 2: management by accounting department

Others prefer to leave this responsibility to the accounting department, which has the advantage of having an accurate knowledge of the accounts receivable situation and who speaks the same language with his accounts payable counterpart.Doing so, the accounting ventures into the unfamiliar field of customer relations, which includes arrangements, peculiarities of all kinds which have nothing to do with the rigorous application of the chart of accounts.

To be effective, the accountant must become a little commercial and accept the finesse and detours that often require this function.

Informing salespeople and involving them when it is relevant is essential to avoid internal tensions that may have a negative impact on interests of the company. The salesperson has other "entries" at the customer and his intervention can be extremely efficient and complementary to those of the accounting.

Typical layout

Indeed, it relieves them of a part of their work that they do not appreciate while keeping them the overall steering.

They are informed of the exchanges especially if there is a problem (litigation, big overduet ...) and intervene wisely. The other advantage is the "accounting / business" teamwork generated by this mode of operation which makes possible to talk to customers in the same way.

-

Debt collection in My DSO Manager

Debt collection management is a key feature in My DSO Manager. The application allows to apply recovery scenarios according to the typology of customers and then to control dunning actions in a dedicated calendar.

The tool dynamically creates reminder templates (e-mails, interactive e-mails, postmail letters, SMS ...) that are configurable in the settings and customizable when sent.

It makes it possible to streamline the communication between the various actors and services of his company around the management of receivables, especially through internal interactive e-mail, the management of different users such as sales representatives who can access the tool and know the situation of their customers Know more with the online demo.

What to choose?

Both models can operate knowing that shared responsibility is at the discretion of each company, its activity, its objectives and its organization. The cursor can be placed on an infinite number of positions. Every company needs to find its model that will be relevant to it.The key to success lies in taking account of this hybrid characteristic of the management of the Accounts Receivable to establish a coherent sharing of responsibilities and a positive collaboration between the two accounting and commercial departments and to provide tools allowing the implementation of this internal communication and management:

- Tools to anticipate and manage the risk of insolvency (financial information, credit insurance, etc.).

- Establishment of sales / contractual conditions which incorporate the basic and legal principles concerning the obligations of the buyer regarding the settlement of receivables (payment terms, late payment penalties...).

- Use of a debt collection and credit management software which makes it possible to carry out the recovery of receivables and to streamline communication between internal actors (accounting, sales, customer care...) and external (clients), in particular concerning the resolution of disputes.

- Solution to handle outstanding payments when the amicable recovery process did not allow to get payment of invoices.